The Canadian dollar gained 0.20 percent on Thursday thanks to a rise in oil prices and despite an improvement to the final GDP reading for the first quarter in the US. Oil rose 0.40 percent after the a slowdown in US production has energy rising in the last 6 sessions.

The main factor driving the strength of the loonie has been the shifting winds of central bank rhetoric. The Bank of Canada (BoC) Deputy Governor Carolyn Wilkins on a routing speech put the end of easing firmly on the table. She was followed by Govneor Stephen Poloz a day later to reiterate the message. The head of the BoC has hammered the message this week, as he attends the European Central Bank (ECB) Forum in Portugal, that the rate cuts have done their job, but tried to not too much emphasis on a rate hike with the upcoming July monetary policy meeting.

The Canadian central bank is part of a group of central banks that have shifted their verbal intervention of late. The Fed issued a warning to markets in March ahead of that month’s Federal Open Market Committee (FOMC) meeting though Fed member comments that the market was not pricing in a rate hike, which eventually happened. After a patient Fed for most of 2014, 2015 and 2016 it was a surprise to see a proactive central bank that has now 2 rate hikes in 2017 and continues to signal a third one as well as starting to reduce its balance sheet.

The Bank of Canada is a special case as the European Central Bank (ECB) and the Bank of England (BoE) have quantitive easing programs that will have to be gradually wound down whereas Stephen Poloz can jump on the rate hike bandwagon with relative speed. The BoC governor also does not have to worry about a vote as there is no monetary policy committee.

The timing of the first rate hike will be challenging. The three factors driving the loonie will have to be taken into consideration. Oil prices have been stable but the showdown between the US shale producers and the OPEC output deal nations is not addressing the tepid demand for energy around the world. Nafta renegotiations starting in August could change the economic landscape for Canada and that is something the central bank will have to address. The third factor is the Fed itself. The American economy has been softer in 2017 raising questions about what impact a third rate hike and a lower Fed balance sheet could have in the second half of the year.

The USD/CAD fell 0.208 percent in the last 24 hours. The currency is trading at 1.3002 as the loonie has broken below the 1.30 price level briefly. The Canadian dollar has been boosted by repeated comments from senior policy makers from the Bank of Canada (BoC) that have hinted at a rate hike coming sooner rather than later. Before June 11 the market was not expecting a rate move by the BoC, with the first quarter dependant on economic fundamentals. Now after the comments from two deputy Governors and the Governor himself there is now a higher than 60 percent chance the rate move could come in the July meeting.

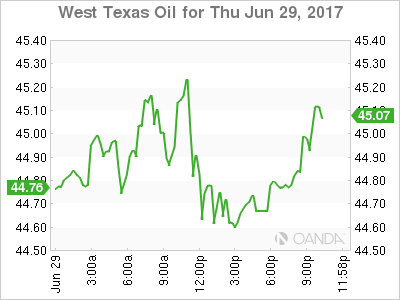

Oil gained 0.404 percent on Thursday. The West Texas Intermediate is trading at $44.69. The change in fortune in oil prices came during the past two weekly crude inventory releases in the US. The expected large buildups have failed to materialize and US production has been hit by a storm in the Gulf of Mexico. Organization of the Petroleum Exporting Countries (OPEC) members Nigeria, Iran and Libya have increased their production but other members have complied with cuts and are still profitable although they face various challenges if they want to keep cutting to help prices rise, only to see US, Brazil and Canada producers take advantage as they are not bound by any deal to limit their output.

Market events to watch this week:

Friday, June 30

4:30 am GBP Current Account

8:30 am CAD GDP m/m