The Canadian dollar hit a four month high versus the US dollar on Wednesday after comments from Bank of Canada (BoC) Governor Stephen Poloz made it clear the central bank is considering an interest rate hike. Canadian monetary policy makers have issued hawkish statements since June 11. The market has gone from not pricing a rate move in 2017, to a 70 percent chance of a rate hike in July. The Loonie has surged as the BoC is joining a chorus of central banks that have changed the tune of their rhetoric following the lead of the U.S. Federal Reserve who has already hiked twice in 2017 with a possible another rate raise before the end of the year and a reduction of the massive balance sheet also in the works.

The BoC did not engage in a quantitive easing program although it did consider all options including negative rates but after the proactive rate cuts of 2015 the Federal government launched a fiscal stimulus program. At this time the central bank and the government are saying their actions are paying off. Concerns for rising household debt levels have prompted rating agencies to downgrade Canadian banks for their exposure to an overpriced real estate market. The central bank is now in a position to gradually start tightening. The fact that there is no QE to taper or negative rates to undo before the effects of the first rate hike puts the BoC ahead of the pack of policy makes around the globe.

Earlier today another BoC Deputy Governor Lynn Patterson added to the comments made by her peer Carolyn Wilkins and Governor Poloz by saying that the negative impact of the oil shock of 2014 is not longer dragging the economy down.

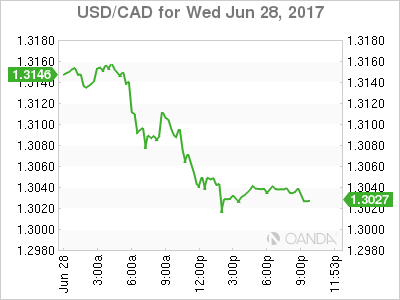

The USD/CAD lost 0.942 percent in the last 24 hours. The currency pair is trading at 1.3032 after hawkish comments from the BoC Governor have put a rate hike on the table in the near future. The market is now speculating about a July 12 meeting policy decision, although it might be too early after the BoC changed its tune from neutral to hawk in June.

The US healthcare reform has proven too controversial and has depleted the political capital of the Trump administration. This means that the pro-growth policies promised just after the elections are unlikely to be brought forth this year. The market had already priced in infrastructure spending and tax reform back in December. Right now economic fundamentals and the Federal Reserve are keeping the USD afloat. The failure to launch of relevant policies and the Russia probe are in headlines constantly. The Fed and mixed economic results have offset some of the negative pressure.

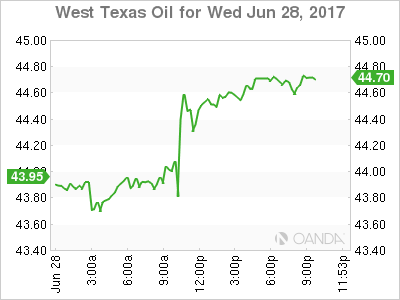

Energy prices gained 1.148 percent on Wednesday. The price of West Texas Intermediate is trading at $44.59 after the release of the US weekly crude inventories saw a small rise of 118,000 barrels instead of the forecasted drawdown of 2.5 million barrels. Oil production was down week over week as the storm in the Gulf of Mexico has affected supply in the US. The API report came in with higher buildups so the energy traders were already pessimistic by the time the Energy Information Administration (EIA) report showed a lower buildup in crude and a surprise drawdown in gasoline stocks.

US oil rigs have increased in number this year at the same time the Organization of the Petroleum Exporting Countries (OPEC) has agreed to extend the production oil cut agreement in a move that aims to stabilize oil prices going forward. OPEC members will meet with other major producers in Russia to discuss the next steps to boost energy prices.

Market events to watch this week:

Thursday, June 29

8:30 am USD Final GDP q/q

8:30 am USD Unemployment Claims

Friday, June 30

4:30 am GBP Current Account

8:30 am CAD GDP m/m