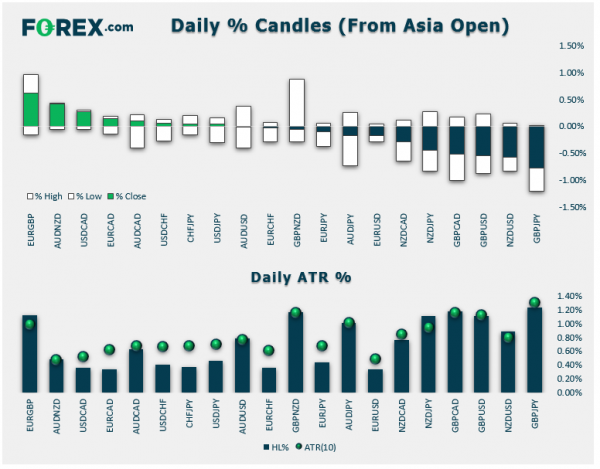

- FX: The Japanese yen and US dollar were the strongest major currencies, while the British pound and New Zealand dollar brought up the rear. Many US and Canadian traders were out on holiday, leading to a quiet session once European markets closed for the day.

- Turkey’s lira dropped to a four-month closing low against the US dollar as the Trump Administration reportedly readies sanctions on key Turkish officials.

- Commodities: Oil shed more than -2% on the day while gold ticked higher in the context of its longer-term bullish flag.

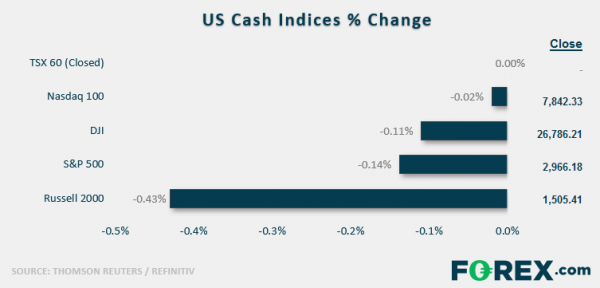

- US indices closed a choppy, illiquid session marginally lower, with a report that China wants further talks before signing last week’s “Phase One” trade deal. Earnings season kicks off in earnest tomorrow with highly-anticipated reports from JP Morgan, Wells Fargo, Citigroup, and Goldman Sachs among others – see more here!

- Financials (XLF) were the strongest major sector on the day while Materials (XLB) brought up the rear.

- Stocks on the move:

- Nike (NKE) tacked on 1% on the day to hit a fresh record high near $95 following an upgrade at BAML.

- Recent IPO Crowdstrike (CRWD) shed -10% on a downgrade at Citigroup.

- Speaking of recent IPOs, SmileDirectClub dumped another -13% today and is currently trading down nearly -60% from its IPO price of $23 last month.

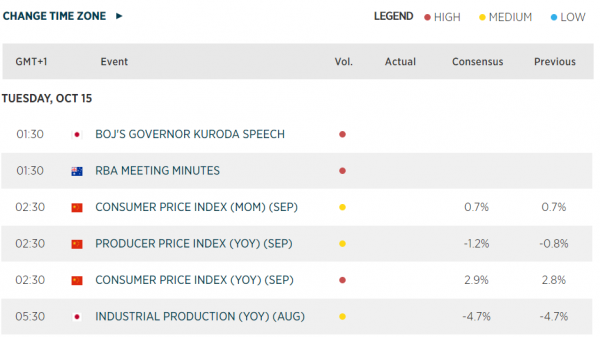

- Check out the major macroeconomic events and trends we’ll be watching in the week to come!