For the 24 hours to 23:00 GMT, the GBP rose 1.78% against the USD and closed at 1.2430, as UK and Ireland’s leaders hinted at the possibility of Britain’s orderly exit from the European Union.

On the data front, UK’s gross domestic product (GDP) fell 0.1% on a monthly basis in August, following a rise of 0.3% in the previous month. Market participants had envisaged the GDP to record a flat reading. Moreover, Britain’s goods trade deficit widened to £9.81 billion in August, defying market expectations for a surplus of £10.0 billion. The nation had posted a revised deficit of £9.62 billion in the prior month.

Additionally, UK’s manufacturing production declined 1.7% on a yearly basis in August, surpassing market expectations for a drop of 0.7%. In the prior month, manufacturing production had registered a revised fall of 0.9%. Also, the nation’s industrial production eased more-than-expected by 1.8% on a yearly basis in August, compared to a revised decrease of 1.1% in the previous month. Markets had anticipated industrial production to record a decline of 0.9%.

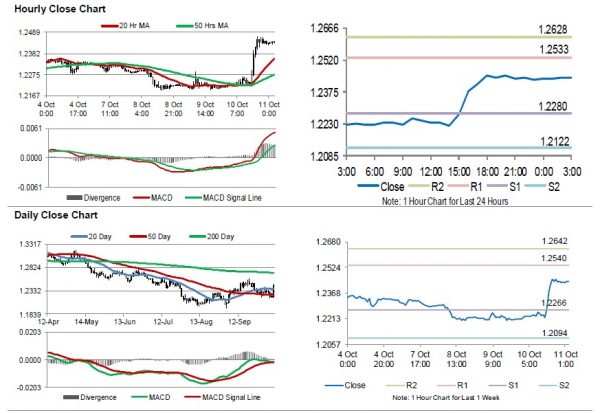

In the Asian session, at GMT0300, the pair is trading at 1.2439, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2280, and a fall through could take it to the next support level of 1.2122. The pair is expected to find its first resistance at 1.2533, and a rise through could take it to the next resistance level of 1.2628.

Looking ahead, investors will keep an eye on UK’s consumer price index, the ILO unemployment rate, retail price index and producer price index, all slated to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.