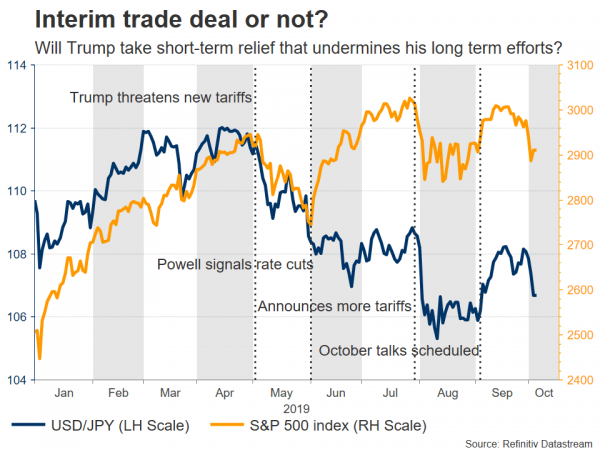

Without a doubt, the main event next week will be the US-China trade talks, which commence on Thursday. Several key economic data are also on the menu, but those will only be a sideshow. Rather, what will make or break market sentiment is whether the two superpowers reach an ‘interim’ trade deal that deescalates tensions a little. It’s a very close call, but Trump may have more incentives not to strike a small deal, and keep ‘maximum pressure’ on Beijing instead.

Deal or no deal? Risk sentiment hangs in the balance

Top American and Chinese officials will meet on Thursday for yet another round of negotiations. The stakes are high, because unless some deal is reached, the US is set to increase its tariffs against China on October 15. Specifically, investors are hopeful that the two sides can strike an ‘interim’ deal on some smaller issues, like China buying US agricultural products in exchange for Trump postponing his tariff hikes, which would deescalate tensions a little.

There are good arguments why such a deal might be made. Looking at it from Trump’s eyes, the US manufacturing sector is already on its knees and the weakness is also starting to infect the much larger services sector, so he would likely prefer to avoid more escalation if the US economy is going to remain solid until next year’s election. Staying in the political realm, one of Trump’s biggest constituencies – farmers – are among the groups most impacted, so a small deal that guarantees agricultural purchases would also score political points for him.

From China’s point of view, economic growth is also slowing despite substantial stimulus injections, and further tariffs would make matters worse. Indeed, considering how leveraged China’s economy already is, the reintroduction of stimulus measures is a double-edged sword, as it may compound vulnerabilities in the system and amplify any future shock. Hence, Beijing may be happy with a small deal that averts more tariffs too, as that would also provide valuable time to see whether Trump is reelected.

Now having said that, there are also serious arguments against an interim deal. First and foremost, it would completely negate the ‘maximum pressure’ approach that Trump has utilized against China so far. There’s no doubt that veteran US negotiators like Lighthizer know that reducing pressure on Beijing by making a small deal would almost certainly reduce the odds for striking a ‘real’ deal anytime soon. So will Trump take short-term economic relief that could undermine his longer-term negotiating efforts?

It’s a very close call, but the answer may be no. Trump has shown that he doesn’t like to relent pressure, so he may simply prefer to simply allow the Fed to cut rates for now to support the economy. His rhetoric against China has also showed no sign of cooling down. Of course, there is high uncertainty involved with this call, and everything could boil down to how much China is prepared to buy, for how long, and what it asks in return. In this sense, China could demand that the US also rolls back some existing tariffs, not just postpone future ones, which may not sit well with Trump.

A failure to reach a limited deal would further undermine market sentiment, likely sending stocks lower alongside the dollar, as the implied chances for more Fed rate cuts in the coming months soar. The defensive yen and gold could be the biggest beneficiaries in this scenario. The opposite reactions would likely take place if a deal is struck.

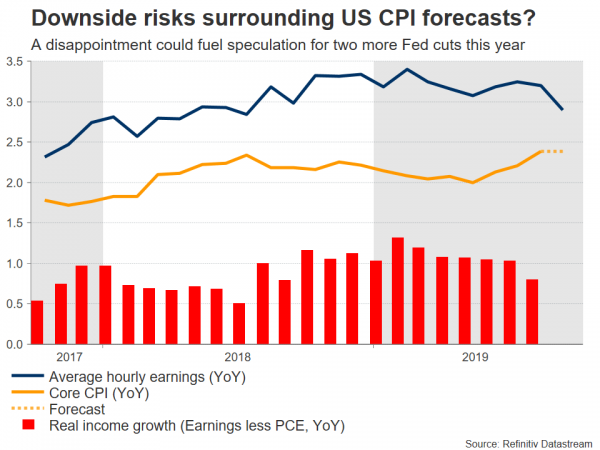

US inflation data could seal the deal for an October rate cut

On the data front, all eyes will be on the US CPI readings for September, due on Thursday. Both the headline and the core CPI rates are expected steady at 1.7% and 2.4% respectively.

That said, the nation’s Markit services PMI for the month indicated that “service providers continued to offer discounts and reduce their output charges” as a result of softer demand, which implies that the risks surrounding these CPI forecasts may be tilted to the downside.

In case of a disappointment, the implied probability for another Fed rate cut in October – currently at 80% – could jump closer to 100% and markets may also price in a greater likelihood for more action in December, weighing on the dollar. That said, the bigger driver for the currency will be what happens with trade, considering that the Fed has been clear it is cutting rates not as a response to any major domestic weakness, but rather as insurance that the trade war doesn’t catch up with the US.

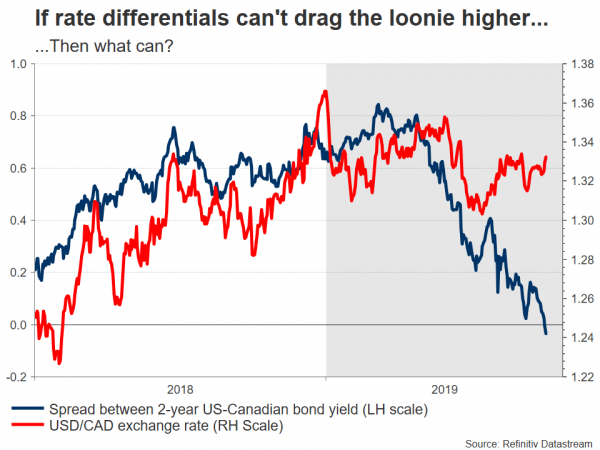

Canadian jobs figures next piece in the BoC easing puzzle

Across the border in Canada, employment data for September will be in focus on Friday. The Bank of Canada (BoC) remained neutral at its latest meeting, highlighting that while trade conflicts are fueling uncertainty, the domestic economy is still solid.

Investors are more or less on board with this, assigning a mere 40% chance for the BoC to cut rates before year-end. Yet, it’s difficult to believe that the BoC will remain an island of neutrality in a sea of central bank stimulus. At some point, a weakening US and global economy is bound to have spillover effects on Canada, which is highly reliant on commodity exports, especially oil. Indeed, the latest collapse in oil prices argues for slower economic growth by itself.

As for the loonie, if the BoC staying neutral all these months as other central banks cut rates wasn’t enough to propel the currency higher, it’s difficult to see what will.

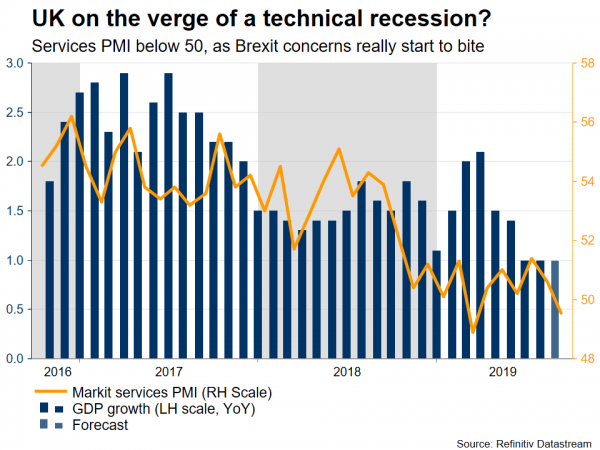

UK GDP data eyed, but Brexit remains the main variable

In Britain, GDP data for August are out on Thursday, but as has been the case in recent years, the pound is likely to focus on politics. On that front, recent reports suggest the EU responded to the UK’s proposals, saying that while the British plan is a step forward, further concessions are needed before formal negotiations can take place. Hence, everything is still up in the air, and much will depend on whether PM Johnson is willing to amend his position again.

Turning to the pound, the risks seem skewed to the downside overall. Even if Boris softens his stance further, it is questionable whether he would go far enough to satisfy the EU, and if he does, then his die-hard Brexiteers may not follow him. Meanwhile, the British economy is struggling, with the latest services PMI survey pointing out that “the UK is facing a heightened risk of a recession”. This implies that the Bank of England may also adopt a dovish stance soon, opening the door for rate cuts.