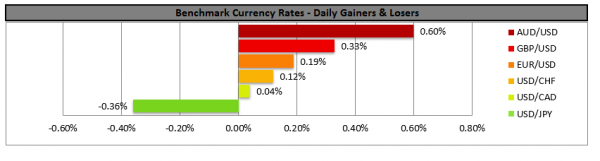

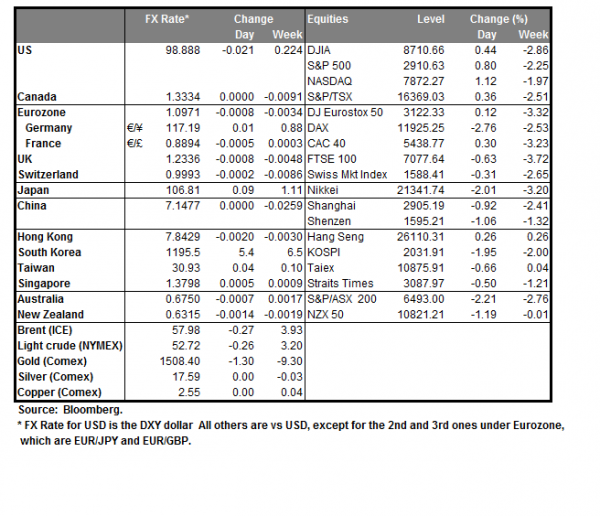

Today at 12:30 (GMT), the US Employment report for September with its Non-Farm Payrolls Figure is due out. The release tends to attract most of the market’s attention, as after a week of weak US readings, investors tend to concentrate on the report for more clues. The unemployment rate is expected to remain unchanged at 3.7% which is considered low for US standards, average earnings growth rate is forecasted to also remain unchanged at +3.2% yoy and the Non-Farm Payrolls figure to rise and reach +145k, if compared to Augusts reading of 130k. Should the actual rates and figures meet their respective forecasts, we could see the USD getting some support as the US labour market seems to be tightening somewhat further. Please be advised that we tend to view risks associated with the particular release, tilted to the downside as the US ISM PMI readings for September came out far lower than expected, indicating a slowing of economic activity in the US which may have had an adverse effect on the labour market. EUR/USD remained supported yesterday at some point during the American session aiming clearly for he 1.1000 (R1) resistance line yet correcting somewhat lower later. Despite the pair still being below the downward trendline incepted since the 25th of June, it experienced some bullish pressures since the 1st of the month. Should the pair find fresh buying orders along its path, we could see it breaking the 1.1000 (R1) resistance line, the prementioned downward trendline and aim for the 1.1050 (R2) resistance level. Should the pair come under the selling interest of the market, we could see it breaking the 1.0950 (S1) support line and aim for the 1.0910 (S2) support level.

Fed turns dovish again?

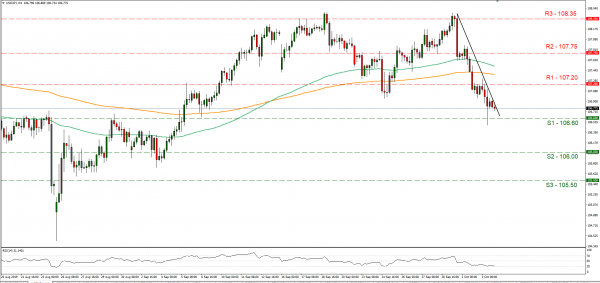

Comments made by a number of Fed officials seem to be tilted more on the dovish side. As media report, Fed’s Clarida stated yesterday that Fed will act as appropriate to sustain low unemployment, while Chicago Fed President Evans stated that he is supportive of further adjustments if needed and Dallas Fed President Kaplan stated that he too is openminded about rate cuts. On the flip side Cleveland Fed President Loretta Mester, seemed to oppose the idea that the labour market could strengthen much further than now. The market seems to have priced in another rate cut by the Fed in October, indicative of a more dovish inclination by the market. After the current week’s soft US data, investors are also focusing on Fed Chair Powell’s speech today (18:00,GMT) for any further clues on monetary policy. Should the Fed’s Chairman adopt a tone more tilted to the dovish side we could see the USD weakening, otherwise USD could get some support. USD/JPY maintained a bearish direction yesterday testing the 106.60 (S1) support line. For our bearish outlook to change for the pair, we would require a clear breaking of the downward trendline incepted since the 1st of the month. Should the bulls dictate the pair’s direction we could see the pair’s price action breaking the prementioned trendline and aim if not break the 107.20 (R1) resistance line. Should the bears maintain control over the pair, we could see it breaking the 106.60 (S1) support line aiming for lower grounds.

Other economic highlights today and early tomorrow

Besides the US employment report for September in the American session today, we get the US trade balance figure for August, Canada’s trade data for August and Ivey PMI for September and last but not least the US Baker Hughes active oil rig count. As for speakers, ECB’s De Guindos, Boston Fed President Rosengren, Atlanta Fed President Bostic, Minneapolis Fed President Kashkari, Fed Chairman Jerome Powell, Fed’s Brainard, Fed’s Quarles and Kansas Fed President George are scheduled to speak.

Support: 1.0950 (S1), 1.0910 (S2), 1.0865 (S3)

Resistance: 1.1000 (R1), 1.1050 (R2), 1.1105 (R3)

Support: 106.60 (S1), 106.00 (S2), 105.50 (S3)

Resistance: 107.20 (R1), 107.75 (R2), 108.35 (R3)