The Australian dollar rose earlier today after the Bureau of Statistics released the retail sales for August. The numbers showed that turnover increased by a seasonally-adjusted rate of 0.4%. This was higher than in July where retail sales remained unchanged. The increase in prices was attributed to a slow rise in food, clothing, footwear, and personal accessories. This was offset by a decline in cafes, restaurants, and takeaways. Meanwhile, the central bank released its Financial Stability Report. As with the monetary policy statement released earlier this week, the bank said that the Australian economy had started to make a turnaround after the previous rate cuts.

US stocks rose yesterday as traders waited for the official jobs numbers today. This week, the Dow index has declined by more than 800 points. Analysts expect that the economy added 140k jobs after adding just 130k in August. The unemployment rate is expected to remain unchanged at 3.7% while the private nonfarm payrolls are expected to increase by 133k. Meanwhile, the trade deficit is expected to have increased to $54.50 billion in August from the previous $54 billion.

The Canadian dollar weakened against the USD ahead of the trade and PMI numbers. In July, the country’s exports increased to $49.76 billion while imports increased by $50 billion. This left a trade deficit of more than $1.12 billion. Today, data is expected to show that the trade surplus dropped to $1 billion. Traders will also receive the Ivey PMI data today. In the previous month, the Ivey PMI rose to 60.6.

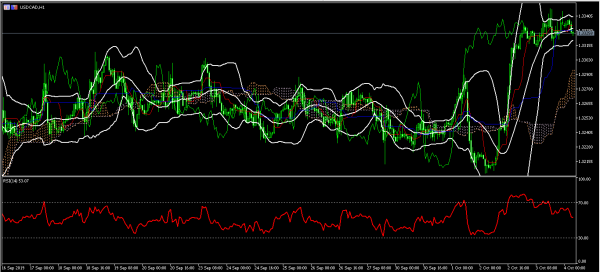

USD/CAD

On Wednesday, the USD/CAD pair jumped from a low of 1.3050 to a high of 1.3320. The pair continued to move up yesterday and reached a high of 1.3348. Today, the pair remains close to yesterday’s high. On the hourly chart, the price remains slightly below the middle line of the Bollinger Bands. The price remains above the Ichimoku Cloud while the RSI has been moving lower. It’s likely that the pair will remain at the current levels ahead of US NFP data.

EUR/USD

The EUR/USD pair rose slightly in overnight trading. The pair is now trading at 1.0980, which is slightly below the important trendline shown in yellow below. The RSI has been on an upward trend and has reached the level of 60. The price is slightly above the 14-day and 28-day moving average. The pair could test the resistance level of 1.1000 before the US NFP data.

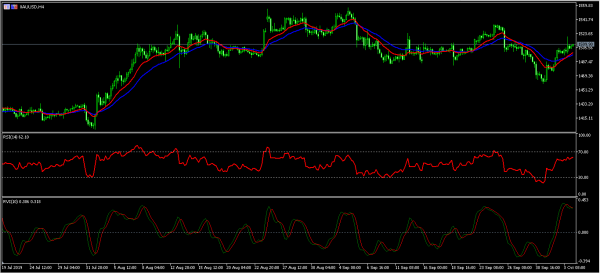

XAU/USD

The XAU/USD pair rose slightly as traders started to worry about a global slowdown and the risks of a recession. The pair reached a high of 1520.27 yesterday. As of this writing, the pair is trading at 1509.75, which is above the 14-day and 28-day moving averages while the RSI has been moving higher. The relative vigor index has made a bearish crossover. This implies that the pair could move slightly lower today.