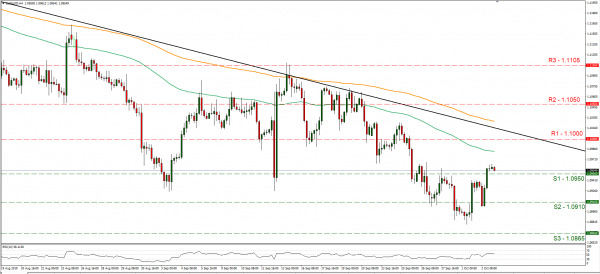

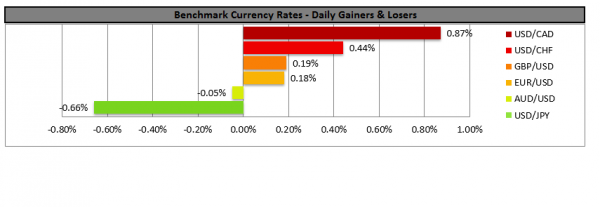

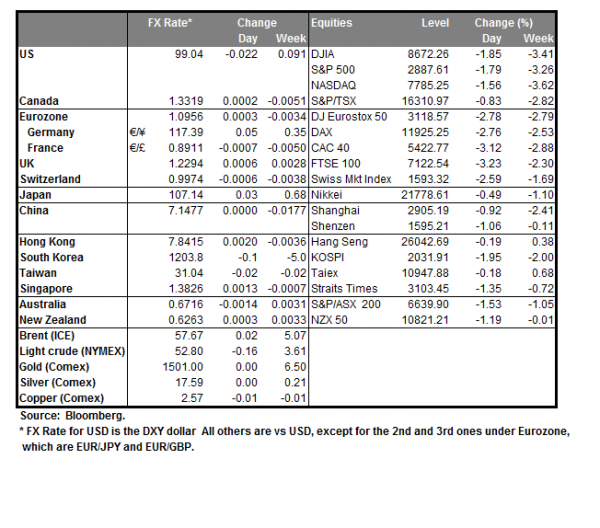

The USD weakened further yesterday, as worries about a possible slowdown in the US economy intensified. The release of employment data lower than expected, indirectly confirmed worries sparked after a surprise drop in the US manufacturing sector as released on Tuesday. Analysts tend to note that the reversal of the US financial releases being better than expected, may have created a gap between market expectations and the reality, causing the drop. It should be noted that the USD weakened even against the EUR, which had a number of soft data released in the past few days. The situation intensifies, as the US won approval on Wednesday to levy tariffs on $7.5 billion worth of European goods over illegal subsidies handed to Airbus, threatening to trigger a transatlantic trade war. We expect the USD to remain data driven in the next days and should releases continue to miss their targets, we could see it weakening further. EUR/USD rallied yesterday, breaking the 1.0910 (S2) and the 1.0950 (S3) resistance lines, now turned to support. Despite the pair stabilising somewhat during today’s Asian session, we could see some further bullish tendencies as US financial releases today are forecasted to have adverse results for the USD. On the flip side it should be noted that the pair, remains below the downward trendline incepted since the 26th of June. Should the USD side of the pair continue to weaken, we could see EUR/USD rising even further testing if not breaking the 1.1000 (R1) and aim for higher grounds. Should the pair come under the selling interest of the market, we could see the pair breaking the 1.0950 (S1) line and aim for the 1.0910 (S2) support level.

Pound strengthens on Brexit developments

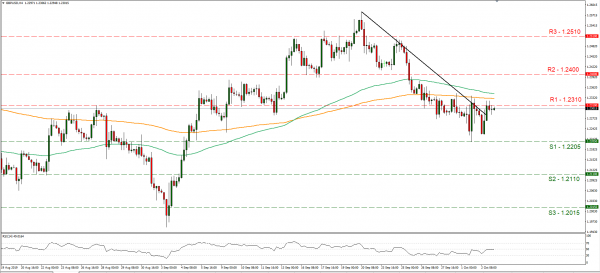

The pound strengthened somewhat yesterday as UK’s PM laid out his Brexit plans to the EU. According to media, for the disputed Irish border issue Johnson proposed creating an all-island regulatory zone in Ireland to cover all goods. The offer was somewhat coolly received by the EU, as EU Commission President Juncker stated that UK’s proposals have some positive advancements yet there are still some problematic points. It should be noted that the UK position of a total abolishment of the Irish backstop seems to be weakening as the wording has changed. We could see the pound getting some further support should there be further positive headlines about Brexit. GBP/USD rose yesterday, testing the 1.2310 (R1) resistance line. As the pair broke the downward trendline incepted since the 20th of September, we switch our bearish outlook for the pair, in favor of a sideways motion scenario. Should the bulls take over the pair’s direction, we could see the pair breaking the 1.2310 (R1) resistance line and aim for the 1.2400 (R2) resistance barrier. Should the bears dictate the pair’s direction, we could see cable aiming if not breaking the 1.2205 (S1) support line and if broken aim for lower grounds.

Other economic highlights today and early tomorrow

Today during the European session, we get Turkey’s CPI rate for September, UK’s services and composite PMI’s also for September and Eurozone’s PPI rate for August. In the American session, we get the US factory orders growth rate for August and at the same time, the ISM non-manufacturing PMI reading for September. In tomorrow’s Asian session, we get Australia’s retail sales growth rate for August. As for speakers please note that ECB’s De Guindos, Chicago Fed President Charles Evans, Cleveland Fed President Loretta Mester, Dallas Fed President Robert Kaplan, Fed’s Richard Clarida and RBA’s Luci Ellis are scheduled to speak. Also bear in mind that RBA’s stability report is due out tomorrow during the Asian session and that China and Germany have public holidays today.

Support: 1.0950 (S1), 1.0910 (S2), 1.0865 (S3)

Resistance: 1.1000 (R1), 1.1050 (R2), 1.1105 (R3)

Support: 1.2205 (S1), 1.2110 (S2), 1.2015 (S3)

Resistance: 1.2310 (S1), 1.2400 (S2), 1.2510 (S3)