The US dollar declined after the ISM reported the worst PMI number in more than ten years. In September, the ISM manufacturing PMI declined to 47.8 from the previous 49.1. Data from Markit showed that manufacturing PMI rose to 51.1 from the previous 50.3. The number from ISM showed that the manufacturing sector was having serious problems. While tariffs are to blame, Donald Trump pointed the finger at Jerome Powell and the Fed for the slowdown. Meanwhile, the JP Morgan global manufacturing PMI rose slightly to 49.7 from 49.5 in August. This marked the fifth consecutive month below the crucial 50 mark.

The price of Bitcoin was relatively unchanged after the Wall Street Journal reported that Visa and Mastercard were reconsidering their involvement in Facebook’s Libra project. The companies have been irked by the continued criticism of Libra by European and American officials. Just last month, the Finance Minister for France said that Libra was not welcome in Europe. US politicians, especially Democrats, have warned that the currency will give Facebook a lot of power.

Later today, traders will receive the construction PMI from the United Kingdom. This will come a day after the European Union made a major concession on Brexit. The EU said that it would consider limiting the Irish backstop. This happened as Boris Johnson prepared a far-reaching and comprehensive proposal. ADP will also release its employment numbers. Traders expect data to show that the economy added 140k jobs in September. This will be lower than the 195k jobs added in August. The EIA will also release the crude oil inventory numbers. Analysts are looking for the inventories to increase by 1.56 million barrels.

EUR/USD

The EUR/USD pair rose slightly to a high of 1.0937 from yesterday’s low of 1.0878. This price is slightly above the important resistance level shown in yellow below. The price is slightly above the 28-day and 14-day moving averages. The price is along the 23.6% Fibonacci Retracement level. The RSI has moved to almost the overbought level of 70. The likely scenarios are that the pair will move up to the 38.2% Fibonacci retracement level or decline to the previous low of 1.0878.

USD/JPY

The USD/JPY pair declined sharply from a high of 108.46 to the 50% Fibonacci Retracement level of 107.70. On the hourly chart, this price is below the 14-day and 28-day moving averages while the RSI has dropped closer to the oversold level of 30. The average true range, which is a good measure of volatility continued to rise. The pair might continue moving lower to test the important support of 107.00.

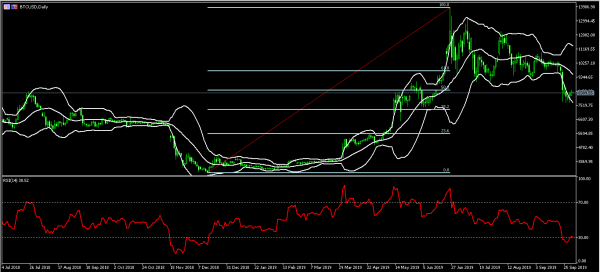

BTC/USD

The BTC/USD pair was relatively unchanged after WSJ reported that Visa and Mastercard were reconsidering their involvement in Libra. The pair is trading at 8311, which is along the 50% Fibonacci Retracement level. The price was along the lower line of the Bollinger Bands while the RSI remained below the oversold level of 30. The pair will likely test the 38.2% Fibonacci level of 7200.