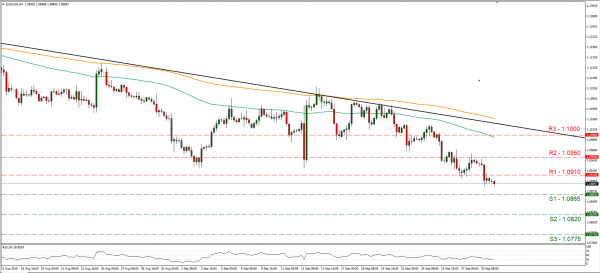

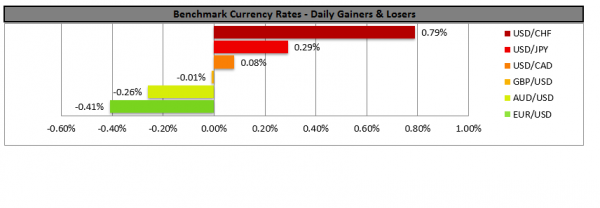

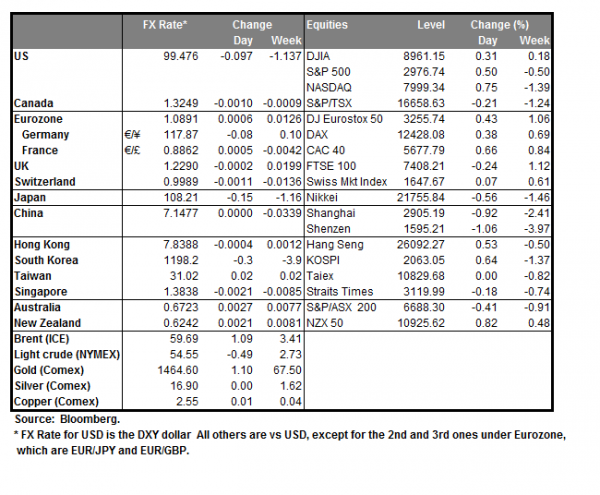

The USD gained against a number of other currencies yesterday and during today’s Asian session. Manufacturing data due out today, could provide further support should they show that economic activity has returned to growth once again, after August’s contraction, for the first time in three years. Analysts tend to note that the USD may regain some confidence should the new reading actually show growth once again. On the flip side the common currency weakened as also (after the French HICP) Germany’s HICP rate missed its target, indicating a retreat of inflationary pressures in Eurozone’s largest economy. It should be noted that the greenback has strengthened the most against the EUR in over two years with EUR/USD showing a record low for the period. Also, JPY remained weak as the Tankan indicator showed that business confidence was at low levels for the third quarter of 2019 (lowest in six years). The pound remains Brexit troubled and the financials may not be so favourable either. We could see the USD remaining supported should the markets be impressed by today’s US financial releases and disappointed by the performances of other currencies. EUR/USD continued to drop yesterday, breaking the 1.0910 (R1) support line, now turned to resistance. We maintain a bearish outlook for the pair remains under a downward trendline which actually steepened in the past 10 days. Should the bears maintain control over the pair’s direction, we could see EUR/USD price action breaking the 1.0865 (S1) support line and aim for the 1.0820 (S2) support level. Should the bulls take over, we could see the pair breaking the 1.0910 (R1) resistance line and aim for the 1.0950 (R2) resistance level. Please be advised that the RSI indicator in the 4-hour chart has broken below the reading of 30, confirming the bearish sentiment for the pair, yet at the same time may imply that the pair’s short position may be getting somewhat overcrowded.

RBA cuts rates and the Aussie weakens

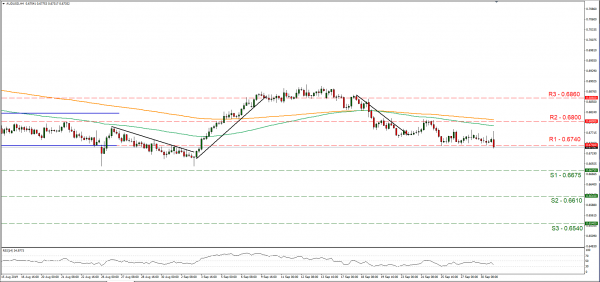

As was expected RBA decided to cut rates by 25 basis points and lower them to the level of +0.75%. The bank stated it is reasonable to expect extended period of low rates and that it will ease further if needed. Also, it stated that the Australian economy grew at a slower than expected pace, yet appears to have reached a “gentle turning point”. The bank notes that the economy has still spare capacity, yet the inflation pressures are likely to be subdued for some time, while the AUD is at lower levels of recent times. AUD/USD gained upon release of the decision, yet quickly relented any gains made and moved towards lower grounds. We expect the AUD to remain data and China driven and its outlook may weaken further after RBA’s release. AUD/USD maintained a sideways motion yesterday yet dropped after the release of RBA’s interest rate decision, breaking the 0.6740 (R1) support line, now turned to resistance. We expect the pair to maintain a bearish direction for the short term, after the release of RBA’s interest rate decision as the market digests the news. Should the pair remain under the selling interest of the market we could see it aiming if not breaking the 0.6675 (S1) support line, aiming for lower grounds. Should the pair’s long positions be favored, we could see it breaking the 0.6740 (R1) resistance line and aim if not break the 0.6800 (R2) resistance level.

Other economic highlights today and early tomorrow

In today’s European session, we get Germany’s final manufacturing PMI for September, UK’s nationwide HPI and manufacturing PMI for September, Eurozone’s preliminary CPI rate for September. In the American session, we get Canada’s GDP rate for July and from the US the ISM manufacturing PMI for September as well as the API weekly crude oil inventories figure later on. China is on holiday for the rest of the week.

Support: 0.6675 (S1), 0.6610 (S2), 0.6540 (S3)

Resistance: 0.6740 (R1), 0.6800 (R2), 0.6860 (R3)

Support: 1.0865 (S1), 1.0820 (S2), 1.0775 (S3)

Resistance: 1.0910 (S1), 1.0950 (S2), 1.1000 (S3)