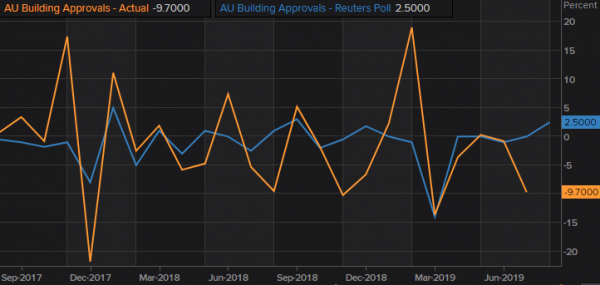

Aus building approvals first up

Due for release at 11.30am AEST, markets catch Aussie Building Approvals – a measure of change in the number of new building approvals issued period to period. August’s print which is expected to come in at 2.1% m/m, would represent a decent jump on July’s -9.7% – partially helped by the cyclical uptick we tend to see in the Australian housing market around spring season, especially if looking at trend across time in the data points. AUDUSD was down ~12pips during the prior July print, though, the magnitude of any reaction could be a different story this time around given the highly anticipated “live” status of today’s RBA October meeting. Nonetheless, markets will look to take stock of the print at the very least in corroborating RBA comments that there are strong signs of “stabilisation in the Aussie housing market”.

Walking into the RBA’s October meeting

AUDUSD onlookers will be closely watching today’s highly anticipated 2.30pm AEST RBA October meeting, expected to deliver a 25bps rate cut. Overnight, markets saw the implied probabilities of a 25bps rate cut marginally edge up from ~75% to 81%. Given the number of persistent downside risks weighing on the global and domestic economy, coupled with the RBA’s broad lower-for-longer stance that’s prepared to ease rates in order to prop up growth, inflation and employment, there’s strong rationale in favour of the RBA undertaking its 48th rate cut since 1990. Though, to caveat that, it could be interesting to think about whether markets might be under-pricing a surprise October hold, especially when taking into account Lowe’s more-balanced-than-expected Armidale Business Chamber speech, and the RBA’s “take stock of the evidence” approach that suggests it not’s necessarily outrageous if one more month were to go by in order to observe the recovery in key domestic outcomes. Either way, it could be a closer call than you think.

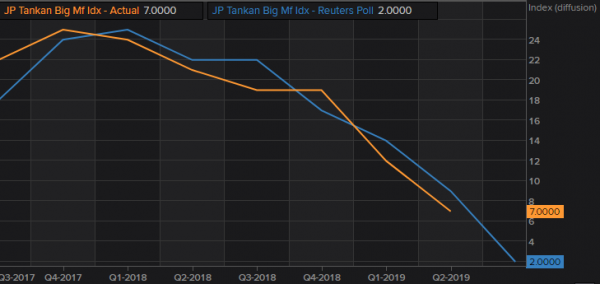

Tankan on JPY

Elsewhere, Japan receives important Tankan surveys considered a leading gauge of Japanese manufacturing growth, which in turn, helps determine the economic state of the Japanese economy. While these measures are numerous and spread themselves across 10 different types of surveys – the focus will largely be on Tankan Big Manufacturing Index. The quarterly Tankan Big Mf Index looks at large enterprises and is forecast to print at 2 for Q3. Even though it’s positive, markets are likely to maintain focus on how the data has continued to trend lower since early 2018, especially in the face of persistent geopolitical risks and trade disruptions. Maintain USDJPY bearish bias.