The dollar strengthened while stocks declined after the Federal Reserve made its interest rates decision. As expected, the bank slashed interest rates by 25 basis points to a range of between 1.75% and 2%. This was the second straight month of rate cuts by the Fed. Officials signaled that they would stop there, despite uncertainty over trade and pressure from the White House. Analysts are expecting more cuts by the end of 2020. Fed officials left the language from its previous policy meeting relatively unchanged. This statement drew immediate attack from Trump, who called Jay Powell a ‘terrible communicator who had no guts and vision’.

The NZD pair declined in the Asian session after the country’s statistics office released its reading of the Q2 economic data. Numbers showed that the economy rose by a YoY rate of 2.1%, which was lower than the previous 2.5%. The consensus estimates were 2.0%. On a QoQ basis, the economy expanded by 0.5%, which was slightly lower than the previous 0.6%. This data showed that the New Zealand economic growth had remained sub-trend in the first half of the year. The growth in the second quarter was mostly driven by the services sector, which accounts for about two-thirds of the economy. Eight of the eleven industries in the service sector showed growth in the quarter.

The Australian dollar declined after the country released its GDP data. In August, the country’s unemployment rate increased to 5.3% from the previous 5.2%. The participation rate increased slightly from 66.1% to 66.2%. In the month, the economy’s employment change was 34.7k, which was lower than 41.1k. While some of these numbers beat the consensus estimates, they show that the economy is relatively weak. This data came a few days after RBA minutes showed that officials were likely to slash rates again.

Later today, traders will receive the interest rates decision from the Swiss National Bank (SNB). The bank is expected to leave rates unchanged at -0.75%. The Indonesian central bank is expected to slash rates by 25 basis points while the Norwegian central bank is expected to raise interest rates by 25-basis points to 1.50%. From the United Kingdom, traders will receive retail sales data. Retail sales are expected to decline to 2.9% from the previous 3.3%. The core retail sales are expected to decline from 2.9% to 2.6%. The BOE will also deliver its decision. From the United States, traders will receive the Philadelphia Fed manufacturing index, which is expected to decline from 16.8 to 11.0.

The Japanese yen strengthened after the Bank of Japan (BOJ) delivered its interest rates decision. As was widely expected, the bank left interest rates at minus 0.10%. The rates have been unchanged at the current levels since the 2008/9 crisis. In the accompanying statement, the BOJ said that it will likely lower rates in the October meeting. The statement said:

The BOJ judges that it is becoming necessary to pay closer attention to the possibility that the momentum towards achieving its price target will be lost. Taking this situation into account, the BOJ will re-examine economic and price developments at its next policy meeting, when it updates the outlook for economic activity and prices.

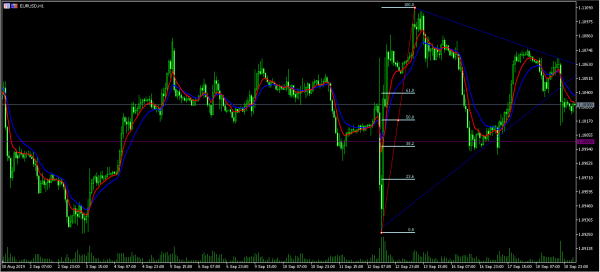

EUR/USD

The EUR/USD pair declined sharply yesterday after the Fed delivered its interest rates decision. The pair reached a low of 1.1013 from the previous high of 1.1070. The pair is now trading at 1.1030. This price is below the lower line of the symmetrical triangle that had formed before. The price is also between the 50% and 61.8% Fibonacci Retracement level. The price is also slightly lower than the 14-day and 7-day moving average. Today, the pair will likely continue moving lower to test the important support of 1.1000.

AUD/USD

The AUD/USD pair declined sharply after the Fed decision and after the jobs numbers from the country. The pair is now trading at 0.9763, which is the lowest level since September 4. On the hourly chart below, the pair is trading at the 50% Fibonacci Retracement level. It is also trading below the 7-day and 14-day moving averages while the RSI has continued to remain at the oversold level of 30. The pair appears to be in a strong downward trend, which is also confirmed by the ADX indicator which is above 30.

NZD/USD

The NZD/USD pair continued the declines started early this month when the pair reached the important resistance of 0.6445. Today’s low was the lowest level the pair has been since September 3. On the hourly chart, this price is below the 14-day and 28-day moving average while the RSI has declined to almost the oversold level of 30. The pair will likely continue moving lower to a low of 0.6280.