- “Risk-on” mood returns on US-China trade talk hopes

- US August jobs report in the spotlight on Friday

- Gold suffers biggest daily loss in almost three years

A positive vibe is sweeping across financial markets this morning as renewed hopes for progress in US- China trade negotiations uplift global sentiment and boost investor confidence.

News that Beijing and Washington officials will be holding high level trade talks in early October is certainly raising hopes over the two largest economies in the world finding a middle ground on trade. This optimism is being reflected in Asian markets on Friday with regional shares set to conclude the week on a positive note.

Although the risk-on mood induced by renewed trade hopes will be welcomed by global equity markets in the near term, gains are set to be limited by investor skepticism down the line. Lessons from the past have certainly illustrated the unpredictability of the Trump administration when it comes to trade developments. While trade negotiations are far better than none at all, it would be unwise to be unprepared for another disappointment given the history of past negotiations.

US jobs report to test Fed cut expectations

Friday’s major risk event and potential market shaker will be the US non-farm payroll report for August which will influence expectations over how deep the Federal Reserve will cut interest rates next.

Overall, data from the United States has painted a mixed picture this week with the US manufacturing PMI contracting for the first time in three years to 49.1% in August. However, US private payrolls increased in August at their fastest pace in four months at 195k while the US services industry rebounded last month as private employers boosted hiring.

The non-farm payroll report for August is projected to show an increase of 160k jobs created and the unemployment rate holding steady at 3.7%. Should the US jobs report meet or exceed market forecasts, this should cool speculation over deep Fed rate cuts, ultimately supporting the Dollar.

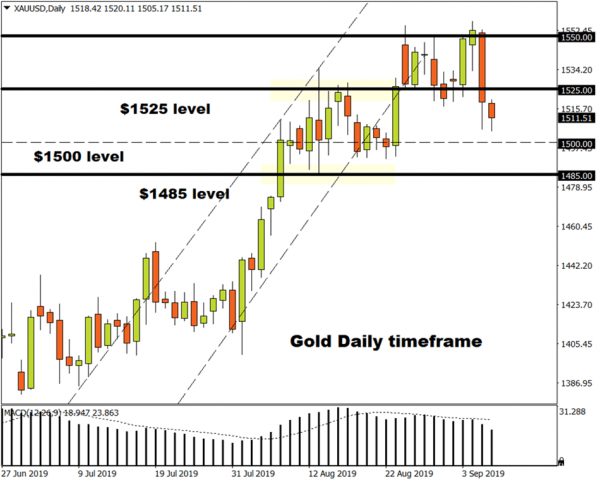

Commodity spotlight – Gold

It has not been the best of trading weeks for Gold which suffered its biggest daily loss in almost three years yesterday, shedding over $40 in valuation as risk-on repelled investors from safe haven assets and boosted appetite for riskier investments.

While the precious metal is positioned to weaken further in the near term amid the improving market sentiment, the downside will be limited by core market themes. For as long as global growth concerns, uncertainty over trade and low interest rates across the globe remain key market themes, the outlook for Gold remains bright and encouraging. Where the precious metal concludes this week will be influenced by the US jobs data released on Friday afternoon. A solid jobs reports could hurt Gold bulls as investors re-evaluate how deep the Federal Reserve will cut interest rates beyond September.

Focusing on the technical picture, Gold is under pressure on the daily charts. Sustained weakness below $1525 should encourage a decline towards $1500 in the near term.