The August jobs report is expected to be strong, economists target employment to increase by 160,000, but temporary jobs for the US census could skew the headline number by roughly 40,000 jobs. Investors might put a lot of weight into this non-farm payroll report as deterioration in the labor market is what might be required for the Fed to commit to an easing cycle.

- US jobs to rise by 160,000

- US wages to gain 0.3%

- US Unemployment to remain steady at 3.7%

The most recent labor statistics paint a mixed picture, which explains why the consensus range is a wide 110,000 to 232,000 jobs created. This week’s ADP employment change reading showed 195,000 jobs created, the highest reading since April. While the ISM manufacturing and services reports showed significant declines with their employment components. Challenger job cuts rose sharply while Jolts job openings were strong in early August.

Much of Wall Street has been concerned with the lingering effects that the trade war is having with business investment. We could see greater than expected weakness with the August numbers as that was a major turning point in the trade war. The August report could show even further reduced hours and a bigger shift to temporary staff. The timing of this week’s progress in trade talks however could outshine any abysmal reading.

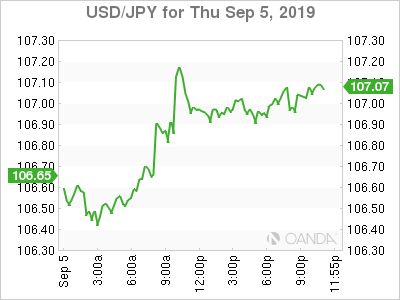

USD/JPY Bullish Breakout could be temporary

The dollar-yen daily chart shows that the recent bearish channel has seen price strongly respect the lower band and the recent rally is tentatively finding resistance from the 107.20 region. If we see a strong labor report with a rebound with average weekly hours worked and steady wages, bulls could look to make a run for the 108.00 handle. If we only see a strong headline jobs number but the rest of the statistics are messy, we could see a violent spike higher followed by a strong reversal. A big miss could see weakness target the 106.00 handle, but we could see some buyers emerge.

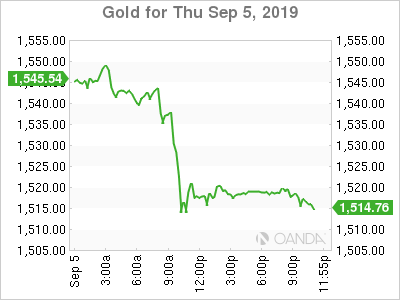

Gold

Despite Thursday’s shellacking, the biggest slide in 14 months, gold’s safe-haven appeal will likely remain strong as the US enters a slower growth period. The bullish trade was overcrowded and the current pullback could see some investors look to buy any major dip towards the $1,470 region. If the employment report comes out with a strong headline but softer wages and hours worked we could see some choppiness that will eventually see gold regain its firm footing.

Friday, September 6th

2:00am ET EUR Germany Industrial Production m/m

2:00am ET NOK Norway Industrial Production data

3:30am ET GBP Halifax House Prices m/m

5:00am ET EUR Q2 Final GDP q/q

8:30am ET USD Non-Farm Payroll Report, Unemployment Rate and Wage Data

8:30am ET CAD Employment Change and Unemployment Rate

10:00am ET CAD IVEY PMI