US stocks soared yesterday after China signaled that it won’t retaliate against the US. The country’s Ministry of Commerce said that it wished to resolve its trade dispute with the US with a “calm” attitude. The Ministry also said that it was opposed to the ongoing trade war with the US. It asked the US to cancel the additional tariffs to prevent any escalation. Shortly afterwards, Trump signaled that talks will resume on a “different level” but he did not explain. All this is happening two days before the tariffs on Chinese goods are set to go into effect.

The Japanese yen weakened against the USD after the country released a series of mixed economic data. In July, the jobs to application ratio dropped to 1.59 from the previous 1.61. This number measures the ratio between job applications and the vacancies that have been announced. In Tokyo, the core CPI dropped to 0.7% from the previous 0.9%. The headline CPI dropped from 0.9% to 0.6%. Retail sales dropped by -2.0%, from the previous gain of 0.5%. On a positive note, the unemployment rate dropped to 2.2% from the previous 2.3% while the industrial production rose by 1.3%. This was better than the previous decline of -3.3%. These numbers came at a time when Japan and South Korea are going through a trade conflict that threatens the two economies. In an interview, the head of the Asian Trade Center said that:

I think that this Japan-Korea incident is a symptom of what happens when a system starts to collapse. You have trade disputes that escalate and there’s no hand brake anymore, so they roll over into security disputes — and then again, there’s no hand brake, so they can continue to percolate and there’s no obvious way to end them.

In Australia, building approvals in July dropped by -9.7%, which was worse than the previous drop of -0.8%. This is a sign that the housing sector in the country is still going through a major challenge. Later today, the market will receive the nationwide house price index for the UK. The index is expected to drop slightly from 0.3% to 0.1%. From Germany, investors will receive the retail sales and from France, they are expected to receive the harmonized index of consumer prices. From the EU, investors will receive the preliminary CPI data for August. This is expected to show that consumer prices remained unchanged in August at 1.0%. From the US they will receive the personal income and spending data. Meanwhile, Canada will release the second reading of the second quarter GDP.

EUR/USD

The EUR/USD pair dropped sharply in overnight trading as some optimism on trade returned. The pair is now trading at 1.1043, which is slightly lower than 1.1050, which was the lowest level on Friday. On the hourly chart, this price is along the lower line of the Bollinger Bands while the RSI has dropped to the oversold level of 30. The momentum indicator has remained being subdued. The pair will likely continue moving lower and possibly test the important support of 1.1000 in the next few days.

USD/JPY

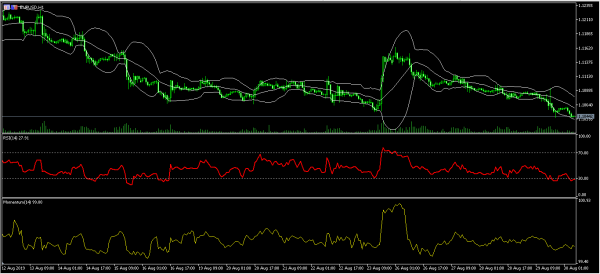

The USD/JPY pair rose after mixed economic data from Japan. It also rose as the trade war fears eased. This week, the pair has risen from a low of 104.45 to a high of 106.68. On the hourly chart, the price is trading along with the 14-day moving average and slightly below the 28-day moving averages. The RSI has moved slightly lower from a high of 78 to the current 58. The accumulation/distribution indicator has been on an upward trend. The pair will likely continue moving higher although this could change if the US implements tariffs on Monday.

XBR/USD

The XBR/USD pair rose sharply after positive statements on trade. The pair is now trading at 60.40, which is higher than where it started the week at 57.75. On the hourly chart, the pair is trading above the 14-day and 28-day moving averages. The RSI has remained slightly below the overbought level of 70 while the ADX has fallen to 14. This is a sign that while the upward trend could continue, there is a high possibility of a reversal.