Asian stocks declined as the trade war between the United States and China intensified. On Friday, China announced that it will retaliate against tariffs set to be put on goods from 1 September 2019. The country will increase tariffs on American goods worth more than $75 billion. Trump was swift in his response. After meeting with his economic team, the President said that the earlier 25% tariffs on Chinese goods will go up to 30%. The 10% tariffs that were to go into effect from September were increased to 15%. Trump also ‘ordered’ American companies to start rethinking their relationship with China, the biggest market in the world.

The USD/JPY pair dropped sharply to a low of 104.45 and then pared back those losses. The pair was reacting to the escalating trade war between the US and China. It was also reacting to the landmark trade deal that was announced between Japan and the United States. In a set of tweets, Donald Trump said that the US and Japan had reached a deal that is expected to be signed in September. The new deal will cool a dispute between the two allies. Part of the deal was about the agricultural sector, where Japan agreed to buy all the surplus corn that the US has. Trump is concerned about losing the support from farmers, who helped propel him to presidency.

Sterling moved slightly upwards after the challenge of Brexit continued. The issue was discussed by Boris Johnson and other European leaders at the G20 meeting in France. In a statement, Johnson said that a deal can be reached easily if the EU leaders agreed to remove the backstop clause. The EU has insisted that the backstop is essential to ensure that there are good relations between North Ireland and the Republic of Ireland. The EU has asked the UK to offer an alternative. In a statement, Johnson said that the UK would not pay the GBP 39 billion divorce bill in full in the event of a no-deal Brexit on October 31.

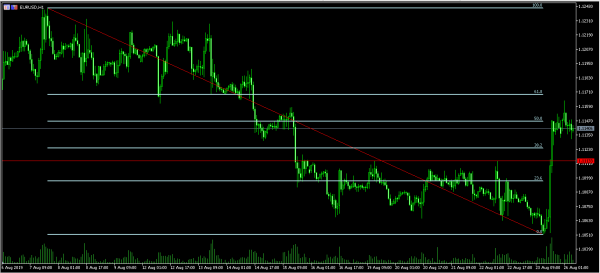

EUR/USD

On Friday, the EUR/USD pair rose sharply as the trade war reached a new level. The pair rose from a low of 1.1050 and reached a high of 1.1165. The pair is now trading at 1.1140, which is slightly below the 50% Fibonacci Retracement level. The pair appears to be forming a head and shoulder pattern, and is currently at the second shoulder. This means that the pair could continue moving lower. If it does, it will likely retest the important support of 1.1110 as shown below.

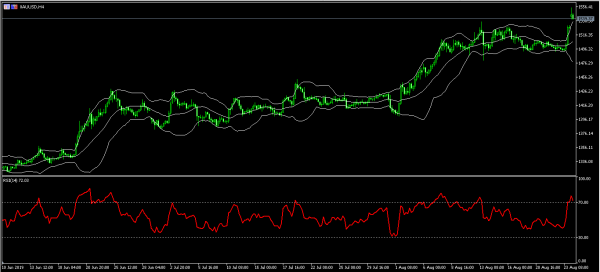

XAU/USD

The price of gold rose sharply in the Asian session. The XAU/USD pair reached a high of 1554.23 as investors continued the rush to safe havens. This followed a difficult few days in which the risk of a recession has increased. On the hourly chart, as a result of the gap, the price is trading above the upper line of the Bollinger Bands while the RSI is firmly above the overbought level of 70. At this point, there is a likelihood that the pair will continue moving higher, with the next point to watch being 1,600.

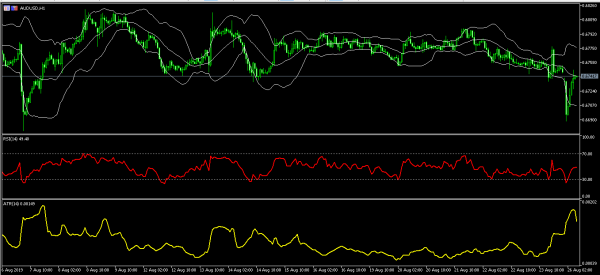

AUD/USD

On Friday, the AUD/USD pair dropped sharply to a low of 0.6687 after the trade war escalated. Today, the pair reversed these losses and reached a high of 0.6750. On the hourly chart, this price is along the middle line of the Bollinger Bands while the RSI has moved from the oversold level of 30 to the current 50. The average true range, which is a measure of volatility increased too. The pair will likely remain being volatile as the market react to the issues on Brexit.