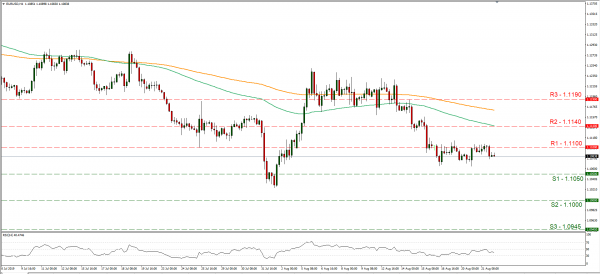

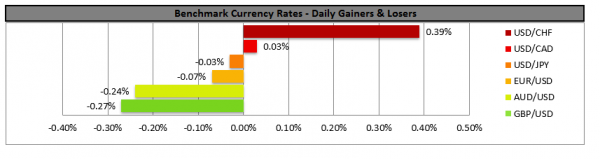

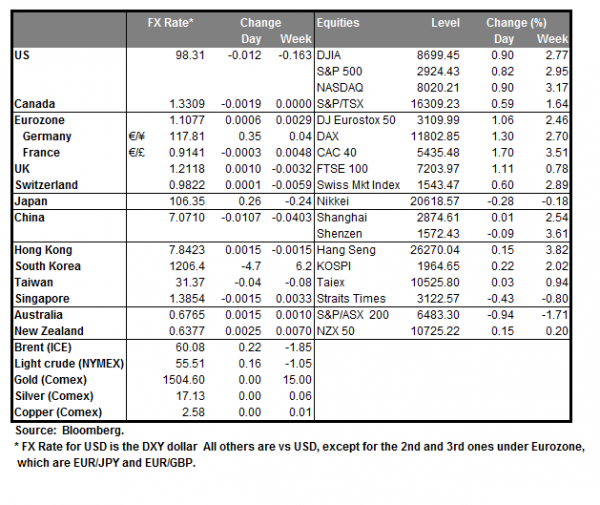

The USD gained some ground against other currencies yesterday as the Fed’s minutes calmed aggressive expectations for future rate cuts. The minutes showed that the Fed was deeply divided as to whether cut rates or not however there seemed to be an inclination for a once off cut. It should be noted that additional rate cuts are still priced in by the market, which awaits tomorrow’s speech by J. Powell, the Fed’s Chairman, at the Jackson Hole symposium. The Fed Chairman’s speech is expected with special interest as last week’s Treasury yield inversion underscored the possibility of a possible recession of the US economy. We expect volatility to continue for the greenback as the Jackson Hole is about to begin today and we could see headlines starting to reel in about monetary policy, at the side-lines of the event. EUR/USD dropped somewhat yesterday, distancing itself from the 1.1100 (R1) resistance line, yet losses remained limited for the pair. Our base scenario is for the pair to remain on a sideways motion today as it did in the past few days, yet at the same time we maintain worries for the pair to drop as the EUR side of the pair could weaken due to today’s financial releases. Should the pair’s long positions be favoured by the market, we could see the pair breaking the 1.1100 (R1) resistance and aim for the 1.1140 (R2) resistance level. Should the pair come under the market’s selling interest, we could see it breaking the 1.1050 (S1) support line and aim for the 1.1000 (S2) support level.

Oil prices weaken despite drawdown

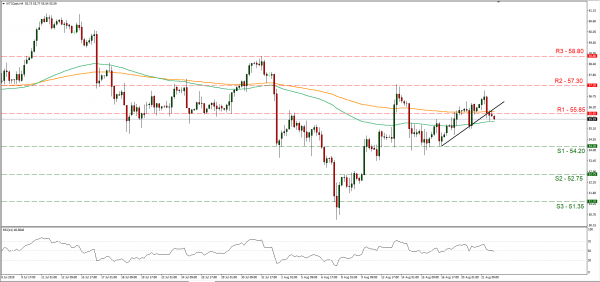

Oil prices weakened yesterday and during today’s Asian session, despite US government data showed a wider drawdown in US oil inventories, than what the market expected. Crude oil stocks decreased 2.7 million barrels, a wider drawdown than the 1.9 million barrels that analysts had forecast. It should be noted though that the increase in demand for fuel seems to remain at low levels cooling expectations for the US oil market to remain tight, as per analysts. Also, analysts tend to note that despite the focus of the oil market still being on the US-Iran tensions, uncertainty about the global economy still tames oil prices. WTI prices dropped yesterday and during today’s Asian session, we they broke below the 55.85 (R1) support line, now turned to resistance. As the commodity’s prices also broke the upward trendline incepted since the 16th of August, we switch our bullish outlook for WTI prices, in favour of a sideways movement. Please bear in mind that we could see oil prices dropping further should worries about a global economic slowdown increase, as it may have an adverse effect on the commodity’s demand. Should the bears dictate WTI prices we could see them breaking the 54.20 (S1) support line and aim for the 52.75 (S2) support barrier. Should the bulls take over, we could see the commodity’s prices breaking the 55.85 (R1) resistance line and aim for the 57.30 (R2) resistance hurdle.

Other economic highlights today and early tomorrow

On a busy Thursday, we get the European preliminary PMI’s for August and ECB is to publish its account of the last policy meeting in the European session. During the American session, we get Canada’s wholesale sales growth rate for June, the US Markit preliminary PMI’s for August and Eurozone’s preliminary consumer confidence indicator for August. Be advised that the Jackson Hole symposium is to begin albeit the main event, J. Powell’s speech is tomorrow. During tomorrow’s Asian session, we get New Zealand’s retail sales growth rate for Q2 and Japan’s inflation rates for July.

Support: 1.1050 (S1), 1.1000 (S2), 1.0945 (S3)

Resistance: 1.1100 (R1), 1.1140 (R2), 1.1190 (R3)

Support: 54.20 (S1), 52.75 (S2), 51.35 (S3)

Resistance: 55.85 (R1), 57.30 (R2), 58.80 (R3)