The Australian dollar rose slightly after the RBA released minutes for the meeting held on August 6. In the minutes, the officials expressed concerns about the global economy, particularly among its major trading partners like China. The officials also praised the weaker Australian dollar, which they believe is positive as it boosts exports. Domestically, they said that the economy had made some improvements as a result of the resources sector and increased consumption. On the housing side, they said that there was some evidence that housing conditions were improving in Sydney and Melbourne, where prices have increased slightly. Finally, the members said that the low interest rates could remain for a considerable amount of time.

Yesterday, US stocks ended the day in the green as the risks of a recession subsided. These risks started to emerge last week after a rally in the bond market led to the inversion of the yield curve. The Dow and the Nasdaq ended the day up by 250 and 105 points respectively. Futures indicate that these gains will be sustained today. There was also gains in Asia-Pacific, where the Shanghai, Nikkei, and Australia ASX 200 rose by 4, 83, and 60 points respectively.

The Japanese yen was relatively unchanged after reports showed that Japan had approved the sale of high-tech materials to South Korea. This was the second time the country had approved of these shipments. The shipment came a day ahead of a meeting between representatives from the two countries that will be held in Beijing. The two Asian powers have been rocked in a mini-trade war that saw Japan restrict the sale of materials that are essential in the manufacturing industry.

The biggest focus among traders today will be the financial release of key retailers in the US. Their results could be excellent indicators of the health of the American consumers. Some of the companies that will release their earnings are TJX Companies, Home Depot, Kohls, Urban Outfitters, and La-Z-Boy.

EUR/USD

The EUR/USD pair moved slightly higher in the Asian session, reaching a high of 1.1086. This was slightly higher than yesterday’s low of 1.1075. On the hourly chart below, the pair’s price is slightly above the 23.6% Fibonacci Retracement level. The price is also along the 14-day and 28-day moving averages. The price has also been moving on a downward trend. This means that the pair could continue moving lower, to test the important support of 1.1025 in the next few weeks.

AUD/USD

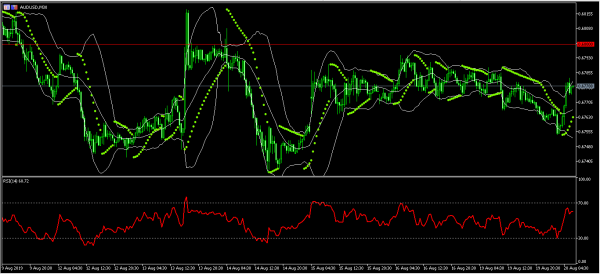

The AUD/USD pair moved slightly upwards earlier today after the RBA released its monetary policy minutes. The pair is now trading at 0.6778, which is slightly lower than the intraday high of 0.0.6782. On the 30-minute chart below, the price is along the upper line of the Bollinger Bands while the RSI has soared to the current level of 60. The dots on the Parabolic SAR are below the current price. As such, the pair could continue moving higher, to test the important resistance level of 0.6800.

AUD/NZD

The AUD/NZD pair has been on an upward trend since August 2 when it was trading at 1.0260. Since then, the pair has moved up and is currently trading at 1.0558. On the four-hour chart, this price is slightly below the important resistance level of 1.0588 and is also slightly above the 14-day and 28-day moving averages while the RSI has been slightly below the overbought level of 70. There is a likelihood that the upward trend will continue.