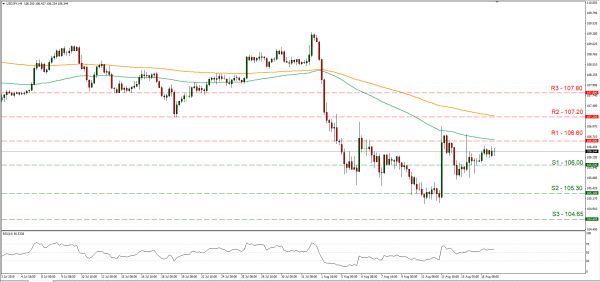

Analysts tend to note lately that safe-haven currencies may be coming under pressure as markets expect central banks to release new stimulus. Such stimulus could provide a boost for the slowing global economy and ease investor’s fears somewhat. Specifically, PBOC’s decisions over the weekend as well as expectations for some fiscal stimulus in Germany feed expectations for an improvement. On the flip side the US-Sino relationships are still being eyed by the markets as the main determinant. The issue of Huawei being allowed to provide supplies for American companies, seems to be in the eye of the hurricane. It should be noted that over the weekend there were articles which noted the intentions of the US government to impose tariffs on cars and most importantly European cars, which could weaken further the Eurozone. Should trade tensions be strained further we could see safe havens picking up in value, otherwise, we could see them weakening somewhat. USDJPY maintained a sideways motion between the 106.00 (S1) support line and the 106.60 (R1) resistance line on Friday and during today’s Asian session. We could see the pair maintaining its direction, yet volatility could occur as analysed above de to fundamental news about the markets. Should the bears dictate the pair’s direction, we could see it breaking the 106.00 (S1) support line, aiming for the 105.30 (S2) support level. Should the bulls take over, we could see the pair breaking the 106.60 (R1) resistance line and aim for the 107.20 (R2) resistance level.

Sanctions dominate oil market.

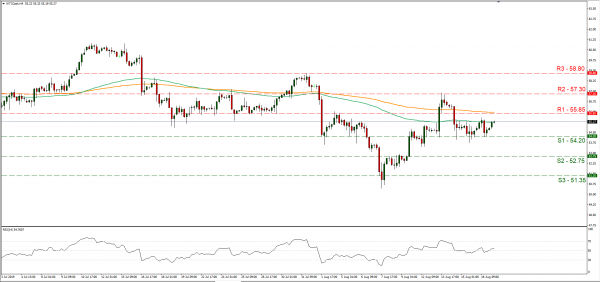

Media report that the Chinese national petroleum Corp. has halted August loadings of Venezuelan oil, worried by the latest US sanctions on the Latin American country It should be noted that tensions in the oil market, may rise further as Gibraltar has decided to release an Iranian oil tanker, despite the US accusing it of breaking US sanctions about Iranian oil. Despite the ship being free to sail, the US may try to block it sparking new tensions in the oil market. Should tensions rise further, we could see oil prices rise as the supply line of the black gold becomes more fragile. WTI prices distanced themselves from the 54.20 (S1) support line during today’s Asian session. Should the commodity’s long positions continue to be favoured by the market, we could see an upward trendline being formed and WTI breaking the 55.85 (R1) resistance line and aim for the 57.30 (R2) resistance barrier. Should WTI come under the selling interest of the market, we could see it breaking the 54.20 (S1) support line and aim for the 52.75 (S2) support level.

Other economic highlights today and early tomorrow

On a rather slow Monday, please note the release of Eurozone’s final CPI rate for July and during tomorrow’s Asian session the release of RBA’s meeting minutes could create some volatility for the Aussie.

As for the rest of the week:

On Wednesday, we get from Canada July’s inflation rates and from the US the existing home sales and most importantly Fed’s meeting minutes of the last FOMC meeting where a rate cut was decided. On a busy Thursday, we get Australia’s, Japan’s and Eurozone’s PMIs for August, as well as the US market PMI for August and Eurozone’s consumer confidence for August. On Friday, we get from Japan the CPI rates for July as well as Canada’s retail sales growth rates for June and the US New home sales figure for July. Also bear in mind that the Jackson Hole symposium will be taking place this week as well as the G7 meeting at the end of it and both events could create volatility in the market.

Support: 54.20 (S1), 52.75 (S2), 51.35 (S3)

Resistance: 55.85 (R1), 57.30 (R2), 58.80 (R3)

Support: 106.00 (S1), 105.30 (S2), 104.65 (S3)

Resistance: 106.60 (R1), 107.20 (R2), 107.90 (R3)