US futures and European markets are looking to rebound after a major bloodshed yesterday. Thanks to the German factory orders data which has printed very strong reading today. It came in at 2.5% while the forecast was 0.5%. But I am not so confident if this positive mood will last for long. Moreover, it is very normal for stocks to have a little bit of bounce back after a major shock, like the one we had yesterday.

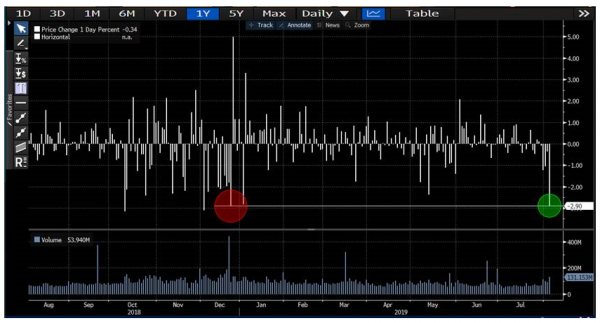

The devil is always in the detail and the below chart shows that the Dow Jones index has maintained its four consecutive days of losses. The index suffered the biggest loss of 2019 and the second biggest intra-day drop off 1032 points yesterday. All of the 30 stocks closed in negative territory but out of these 30 stocks, only 3 stocks made new 52 week low. Having said this, nearly 73% of Dow Jones index stocks are sitting at their new 4-week low and 10% at 24-week low and only 3% at 52 week low. Clearly, there is a trend and this isn’t doing any favour for bulls. The reason for this is that 53% of the Dow Jones stocks are trading below their 200-day moving average and this confirms the very fact the bears have completely lost control of this.

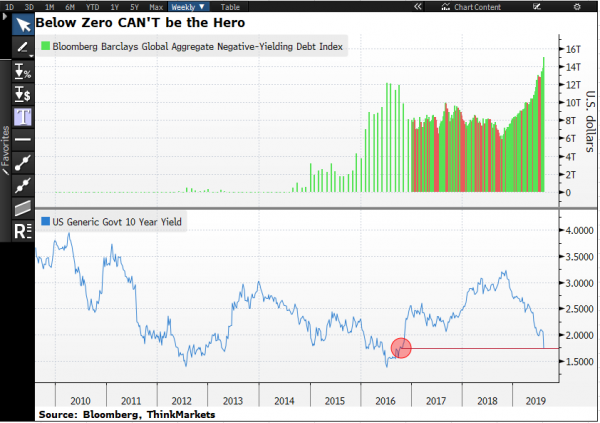

One element which markets haven’t paid much attention is the size of the negative-yielding debt. over the past few years, it has skyrocketed and this is an alarming sign because when this Armageddon falls there is no escape. the global supply of bonds with negative yields has head 15,000,000,000,000 US dollars for the first time ever.

Of course, the reason behind this that investors deem these derivatives as a safe haven play and the current trade war between the US and China has made many investors to park their funds. I do believe that the size of this negative-yielding debt is going to continue to rise because now The US and China have locked themselves in a new war, a currency war. This is because the US President Donald Trump as labelled China as a currency manipulator.