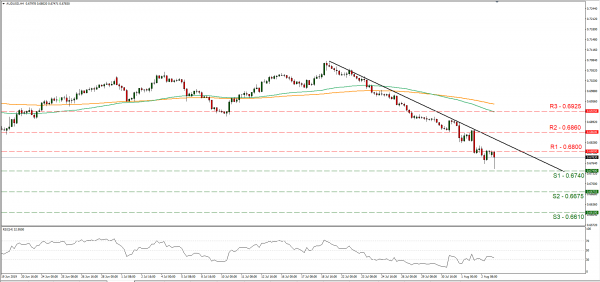

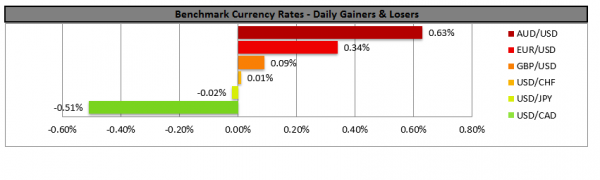

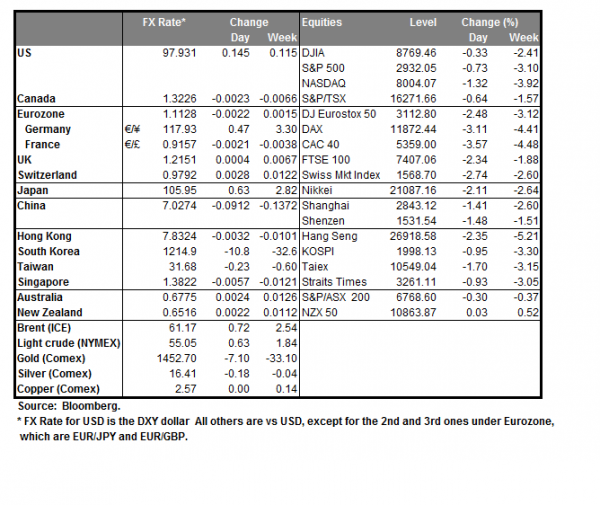

Tomorrow during the Asian session (04:30, GMT) RBA will be releasing its interest rate. Currently AUD-OIS imply a probability for the bank to remain on hold at +1.00% of 92.86%. Given the past meetings which resulted in two corresponding rate cuts, and should the bank remain on hold, we could see the markets attention moving to the accompanying statement. Given that the CPI rate (Q2: +1.6% yoy) remains well below the bank’s target range (+2-3% yoy) and there continues to be a wide uncertainty regarding the US-Sino trade relationship, we could see the bank maintaining a dovish stance. Should the dovish stance be actually present as mentioned, we could see the AUD slipping further. AUD/USD continued to have bearish tendencies against the USD on Friday, as it remained below the 0.6800 (R1) resistance line and during today’s Asian session aimed for the 0.6740 (S1) support line. We continue to maintain a bearish outlook for the pair, as the downward trendline incepted since the 19th of July remains intact. Should the bears maintain control over the pair, we see the case for it to break the 0.6740 (S1) support line and aim for the 0.6675 (S2) support level. Should the bulls take over, we could see the pair breaking the 0.6800 (R1) resistance line and aim for the 0.6860 (R2) resistance level.

Yen continues to strengthen against USD

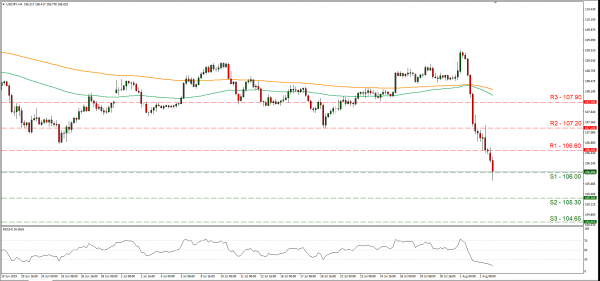

JPY continued to strengthen against the USD as the uncertainty surrounding the US-Sino trade relationships has deepened. Analysts tend to note that the impact of the US-Sino trade relationships turns out to be very big It should be noted also that the situation escalated further as the Chinese side vowed to fight back at US President Trump’s tariffs. On the other side of the pair the release of the US employment report for July sent out some mixed signals and according to analysts cemented expectations for a rate cut in the October meeting of the Fed. Also please bear in mind that the Japanese -S.Korean spat could have some side-effects for the JPY. We could see the pair maintaining its current bearish trendline, should uncertainty deepen further. USD/JPY continued its drop on Friday and during today’s Asian session, breaking the 106.60 (S1) support line. We maintain a bearish outlook for the pair, however please note that the RSI indicator in the 4-hour chart, is well below the reading of 30, implying a rather overcrowded short position for the pair. Should the pair remain under the selling interest of the market, we could see the pair, breaking the 106.00 (S1) support line and aim for the 105.30 (S2) support hurdle. Should the pair’s long positions be favored by the market, we could see the pair breaking above the 106.60 (R1) resistance line once again aiming for the 107.20 (R2) resistance barrier.

Other economic highlights, today and early tomorrow

Today during the European session, we get Turkey’s CPI rate for July and UK’s Services PMI for the same month. Also bear in mind that the final reading of Eurozone’s Composite PMI for July is out. In the American session, we get from the US the ISM Non-Mfg PMI for July. In tomorrow’s Asian session, besides RBA’s interest rate decision, we get New Zealand’s employment data for Q2.

As for the rest of the week:

On Tuesday, Germany’s factory orders growth rate for June is due out. On Wednesday, we get from New Zealand RBNZ’s interest rate decision, Germany’s industrial production for June and Canada’s Ivey PMI for July. On Thursday, we get China’s Trading Data for July. On Friday, we get from Japan the GDP for Q2, China’s inflation data for July, UK’s GDP for Q2, UK’s Manufacturing Production for July, US PPI rate for July and Canada’s employment data for July.

Support: 0.6740 (S1), 0.6675 (S2), 0.6610 (S3)

Resistance: 0.6800 (R1), 0.6860 (R2), 0.6925 (R3)

Support: 106.00 (S1), 105.30 (S2), 104.65 (S3)

Resistance: 106.60 (R1), 107.20 (R2), 107.90 (R3)