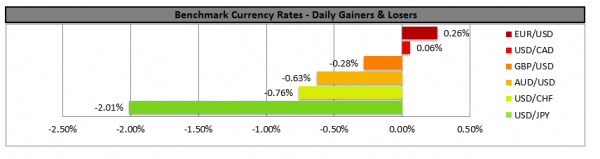

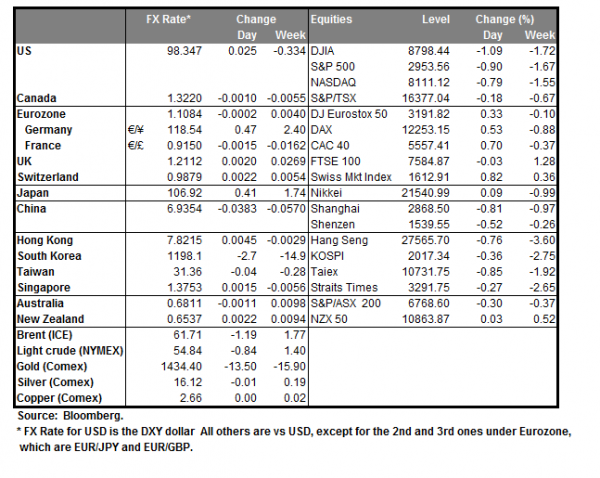

US President Trump tweeted yesterday that he will impose new tariffs of 10% on 300 Billion USD worth of Chinese imports by September 1st. The main reason cited for the move is the slow pace of progress made (if any) in the US-Sino negotiations. It should be noted that the new round of negotiations in Shanghai has ended yesterday without any signs of progress on the horizon. The announcement of the US President’s intentions sent stock markets and bond yields tumbling, while at the same time strengthened the case for the Fed to proceed with more rate cuts. It would be indicative of the situation that the US President also stated that he wasn’t concerned about the market’s reaction, yet at the same time left a window open for negotiations to bear fruit. We could see the situation escalate further, as the US President seems to be determined on the issue and as China may issue a harsh response to the threat. We expect that commodity currencies which rely on trade with China, may suffer the most while at the same time safe havens may continue to benefit.

Market focus shifts to the US employment report

The US employment report for July is to be released today at 12:30 (GMT). The Non-Farm payrolls figure is forecasted to drop and reach +164k, if compared to June’s reading, while the unemployment rate and average earnings growth rate to remain unchanged respectively at 3.7% and +3.1% yoy. Should the actual rates and figures meet their respective forecasts, it could indirectly confirm the tightness of the US labor market. It should be noted that the forecasted drop of the Non-Farm Payrolls figure could be blurring the rosy picture somewhat and could gain more attention as the other two main indicators are expected to remain unchanged. On the flip side, a number of analysts stated that a correction lower of the NFP figure could be expected after the surprise surge in June’s report. We expect higher than usual volatility for USD pairs during the time of the release. EUR/USD rose yesterday correcting Wednesday’s drop partially by breaking the 1.1050 (S1) resistance line (now turned to support). Once again, we could see volatility extending for the pair, as important fundamental uncertainty persists. Should the pair’s long positions be favored by the market, we could see the pair breaking the 1.1100 (R1) resistance line and aim for the 1.1140 (R2) resistance level. Should the pair come under the selling interest of the market, we could see the pair, breaking the 1.1050 (S1) support line and aim for the 1.1000 (S2) support level.

Other economic highlights, today and early tomorrow

Today during the European session, we get UK’s construction PMI for July as well as Eurozone’s PPI and retail sales growth rates, both for June. Besides the US employment report for July, in today’s American session, we get the US Trade balance for June, the US factory order for June, the Michigan consumer sentiment final reading for July and the baker Hughes oil rig count. From Canada, we get the trade balance for June. During Monday’s Asian session, we get Japan’s services PMI for July.

Support: 1.1050 (S1), 1.1000 (S2), 1.0945 (S3)

Resistance: 1.1100 (R1), 1.1140 (R2), 1.1190 (R3)

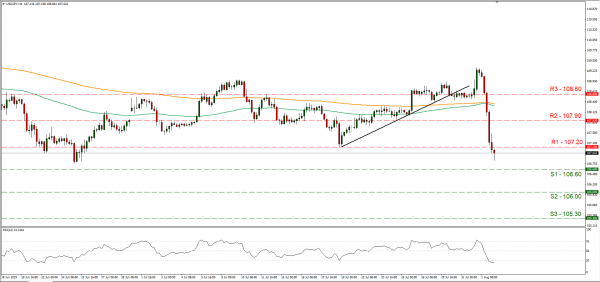

Support: 106.60 (S1), 106.00 (S2), 105.30 (S3)

Resistance: 107.20 (R1), 107.90 (R2), 108.60 (R3)