Criticism will run wild today for Jerome Powell, as yesterday’s Fed meeting poured a bucket of ice water on dovish bets. The Fed Chair believes that the record long US expansion will continue with just a small amount of rate cuts just like Greenspan did in the mid 90s. The first rate cut in over decade did little to support US equities as Powell noted yesterday’s cut was not the start of an extended easing cycle.

Some economists will argue that it was not necessary for him to blatantly say this is not an easing cycle as it very well could end up being when you look at how little inflation has been created throughout the record long economic expansion. With debt constantly growing, we will see interest rates have a lower base in each cycle and we should not be surprised if the mid-cycle adjustment to policy delivers over a full percentage point cut over the next 12 months.

Powell policy communication mistake will likely be corrected over the next couple of weeks, but the damage has been done to sentiment and we could see king dollar reign last a little while longer and equities struggle their record run in the short-term.

BOE

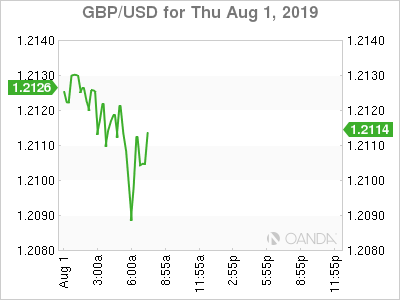

Today’s BOE rate decision will likely get little attention. Cable hardly moved as policymakers unanimously voted to keep rates unchanged as Brexit will ultimately dictate the next policy move. The latest projections do not include the possibility that the UK leaves the EU without a deal which means the BOE will be busy the next couple months. Weaker economic growth forecasts will likely continue to raise rate cut expectations to happen at the end of the year.

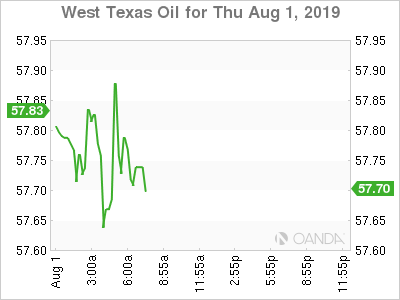

Oil

Numerous signs of slowing global economy and a rising dollar have put a damper in the short-term crude rally. Stimulus is coming globally, but at a slower pace and possibly lesser magnitude. The ECB punted their cut to September and the Fed may only see a modest amount reduction in rates, providing a little fuel to the fire in the dollar rally which will weigh on crude prices.

The decline with oil prices may see an acceleration if we have the dollar breakout against the euro. The macro environment for crude remains bullish as geopolitical tensions have not eased and as US crude inventories fell for a seventh straight week. Oil prices need to survive the surging dollar, but even if we do see it crude prices slide, WTI should see support around the $52.00 a barrel level.

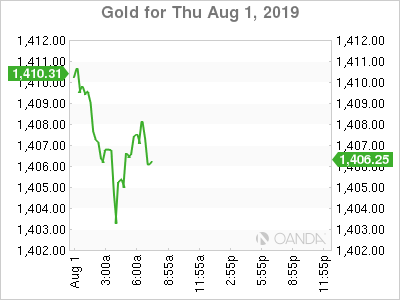

Gold

Gold bugs were not happy with yesterday’s FOMC meeting. The key takeaways are markets may have gotten a little too optimistic that the Fed was going to go full dove and we could see a stronger dollar weigh on gold in the short-term. Gold remains vulnerable on a break of the $1,400 an ounce level. The potential ascending triangle pattern is about to be invalidated and we could see a strong pullback, but not necessarily a beginning of a bearish trend.