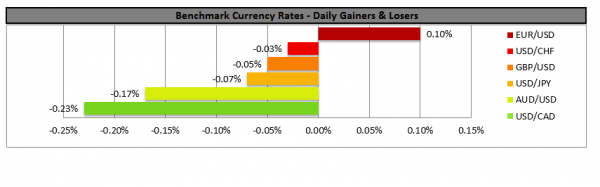

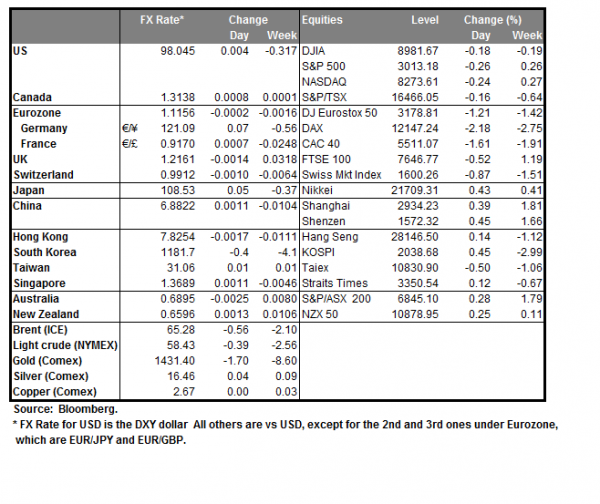

All eyes are on the FED, as today at 18:00 (GMT) the FOMC is to release its interest rate decision, and is expected to cut rates for the first time in 8 years. Fed Fund Futures imply a probability for the bank to cut rates by 25 basis points, of 82%, lowering the target rate to 2.00%-2.25% from current 2.50%. With the market already expecting that scenario, as well as one more cut of 25 basis points (bp) in the September meeting, the attention turns also to the accompanying statement. Should the accompanying statement imply that there may be another cut coming, we could see the USD weakening further, other wise the USD may get a lift. The USD was rather steady yesterday against a number of its counterparts, as the market seems to be maintaining a wait and see position. Should the bank have a more aggressive stance towards a policy easing bias, or should Jerome Powell in his press conference sound more dovish than market expects (18:30, GMT) we could see the USD weakening substantially. EUR/USD stabilized above the 1.1140 (S1) support line yesterday. Currently the pair maintains a sideways motion, however volatility could be expected as the Fed’s interest rate decision is looming and to a lesser degree Eurozone’s financial releases could have a substantial effect on the common currency. Should the bulls take over, we could see the pair breaking the 1.1180 (R1) resistance line and aiming for the 1.1220 (R2) resistance hurdle. Should the bears take over, we could see the pair breaking the 1.1140 (S1) support line and aim for the 1.1100 (S2) support barrier.

Oil prices on the rise

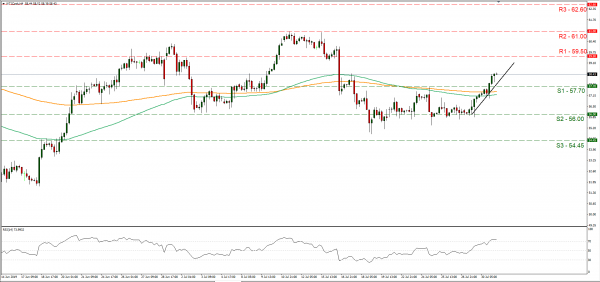

Oil prices have been on the rise yesterday, as Iranian exports in July were reportedly reduced by US sanctions. Media reported that Iranian oil exports were at 100 k barrels per day, if compared to June’s exports figure of 300k-500k. It should be noted that the API crude oil inventories yesterday confirmed the tightness of the US oil market as it reported another drawdown (-6 million barrels). We expect the oil market to be watching out, also for today’s EIA crude oil inventories figure, which could provide further volatility for oil prices. WTI prices had a remarkable bullish run yesterday as the commodity’s prices broke the 57.70 (S1) resistance line, now turned to support. Despite the WTI prices showing some stabilization during today’s Asian session, we maintain a bullish bias for the pair. For our bullish outlook for the commodity to change we would require WTI’s prices to break the upward trendline incepted since the 29th of July. Also it should be noted that the RSI indicator in the 4 hour chart has broken above the reading of 70, implying a rather overcrowded long position. Should WTI find fresh buying orders along its path, we could see it breaking the 59.50 (R1) resistance line and aim for the 61.00 (R2) resistance level. Should it come under the selling interest of the market we could see it breaking the 57.70 (S1) support line and aim for the 56.00 (S2) support level.

Other economic highlights, today and early tomorrow

There is a heavy load on the calendar today. Starting with the European session, we get Germany’s retail sales for June, UK’s nationwide for July, France’s preliminary CPI (EU Normalised) rate for July, Germany’s unemployment data for July, Eurozone’s preliminary CPI rate for July, Eurozone’s preliminary GDP rate for Q2, Eurozone’s unemployment rate for June and from Turkey, CBRT’s inflation report as well as the minutes of the bank’s last meeting, were it had decided a substantial rate cut. In the American session, we get the US ADP employment figure for July, Canada’s GDP rate for May and the EIA crude oil inventories figure. Last in the American session comes the FOMC’s interest rate decision as well as Jerome Powell’s (Fed Chairman) following press conference. During tomorrow’s Asian session, we get the China’s Caixin manufacturing PMI for July and BoJ’s Deputy Governor Amamiya is scheduled to speak.

Support: 57.70 (S1), 56.00 (S2), 54.45 (S3)

Resistance: 59.50 (R1), 61.00 (R2), 62.60 (R3)

Support: 1.1140 (S1), 1.1100 (S2), 1.1050 (S3)

Resistance: 1.1180 (R1), 1.1220 (R2), 1.1260 (R3)