Investors will be glued to their screens next week, with a plethora of central bank meetings and an avalanche of data releases set to provide ample excitement. The Fed is certain to slash rates, though probably only by a quarter-point, which may briefly lift the dollar given expectations for even more aggressive action. The BoJ and BoE are both likely to soften their tones, while in the euro area, growth and inflation data may decide how forcefully the ECB acts in September.

Fed decision & nonfarm payrolls to decide the dollar’s fortunes

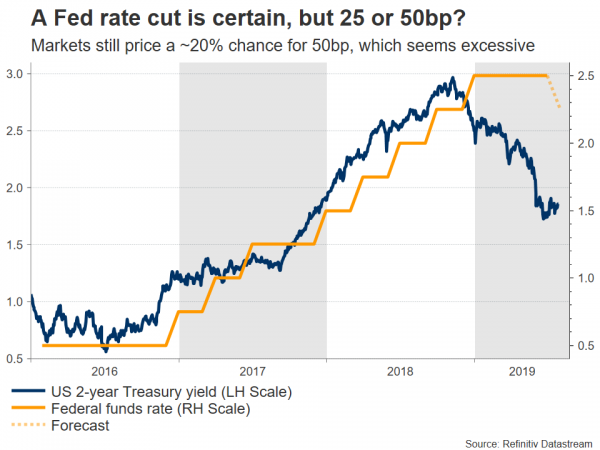

The moment of truth for the dollar is here, as the upcoming events will likely determine the currency’s direction over the remaining summer. The Fed is certain to slash rates on Wednesday. The question is whether it will cut by a typical 25 basis points (bp) or by a more aggressive 50bp. Markets still assign a ~20% chance for the latter, which seems extreme.

Even the most dovish FOMC official, James Bullard – who voted for a cut in June and opposed the hikes last year – recently said a 50bp move would be excessive. The point is that if a dove like Bullard is against such an aggressive cut, there’s almost no scope of it happening. Therefore, since more easing is priced in than the Fed is likely to deliver, the knee-jerk reaction in the dollar may be higher.

Whether that surge is sustained though, will depend on the signals policymakers send about the pace and depth of future cuts. In other words, if they indicate this is a ‘one-off’ move, and not the beginning of an easing cycle, the dollar could soar as market pricing points to several more cuts in the coming months. However, that’s unlikely. The Fed will probably keep the door wide open for more action, so any positive reaction in the dollar may be relatively short lived.

As for the data, the core PCE price index for June is due on Tuesday, ahead of the ISM manufacturing PMI for July on Thursday. Yet most of the focus will fall on Friday’s nonfarm payrolls, which are expected to clock in at 160k in July, lower than June’s 224k – but still a solid print. The unemployment rate is projected to drop back to 3.6%, while average hourly earnings are forecast to rise at the same pace as in June.

Bank of Japan unlikely to offer much

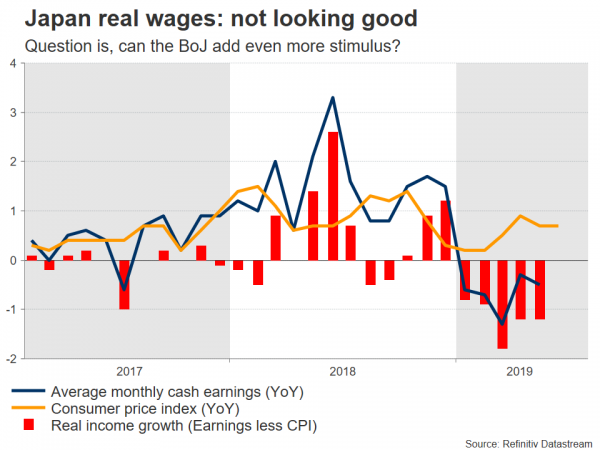

Before the Fed, the Bank of Japan (BoJ) will be the first to announce its decision on Tuesday. The Bank is expected to keep policy unchanged this month as officials are reportedly split on the need for further easing.

However, with the ECB having already signalled it will consider all options and the Fed expected to cut rates, the BoJ could feel impelled to at least update its forward guidance on interest rates to align it more closely with its global peers. Such a move would also alleviate some of the upside pressure on the yen, which policymakers are likely keeping a close eye on.

Bank of England: preparing to turn neutral

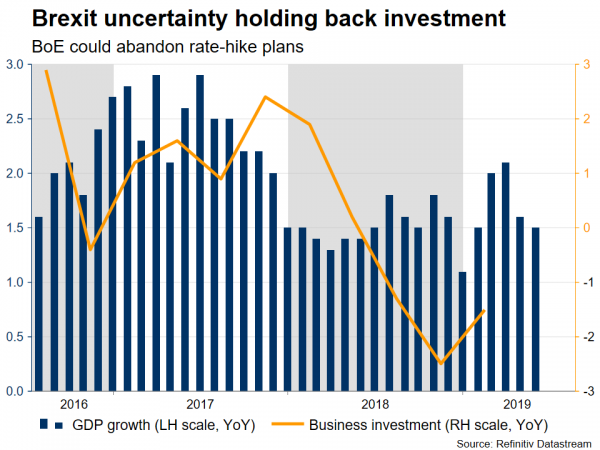

In the UK, Brexit news will continue to be the overarching driver of sterling, though investors could briefly turn their attention back to economics on Thursday, when the Bank of England (BoE) announces its policy decision. Until now, the BoE had maintained a soft tightening bias, indicating that rates would need to rise slightly over time.

Yet, the case for rate hikes has become dubious lately. Brexit uncertainty has taken a heavy toll on the economy, with the forward-looking PMI surveys pointing to a mild contraction of GDP in Q2. Hence, this may be the moment when the BoE officially abandons its tightening bias, and turns neutral. While that may weigh on sterling, any downside is unlikely to be huge as this won’t be a surprise for markets, which currently price in a ~65% chance for a rate cut this year.

Eurozone GDP & inflation data due as markets eye ECB stimulus

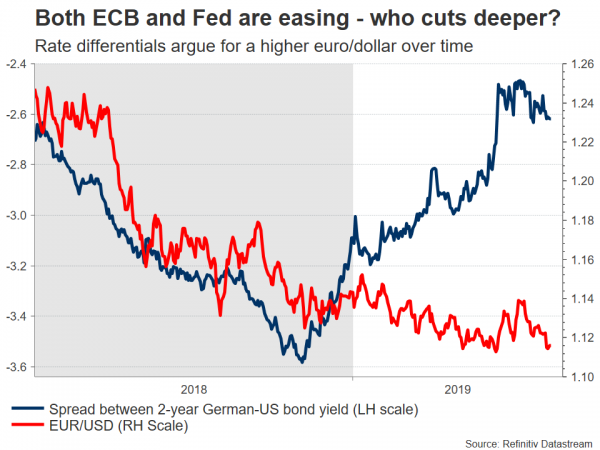

ECB President Mario Draghi did not mince words at this week’s ECB meeting, making it clear that his central bank stands ready to add more stimulus to boost the struggling euro area. His remarks suggest the ECB will probably cut rates and perhaps even restart its QE program as soon as in September. As such, incoming data between now and the September meeting will likely shape expectations on the size and scope of this stimulus package.

On Wednesday, the first estimate of GDP for Q2 is expected to show that growth decelerated to 0.2% in quarterly terms, from 0.4% earlier. Likewise, the preliminary CPI rate for July is forecast to decline to 1.2% on a yearly basis, from 1.3% in June.

In the FX market, more QE by the ECB implies a weaker euro. However, that may only transpire against currencies like the yen and Swiss franc – not necessarily against the dollar, given that the Fed may deliver more powerful easing than the ECB overall. Put differently, while both the euro and the dollar seem set to weaken in general as their central banks ease, the dollar may weaken more than the euro given how much more ‘rate ammunition’ the Fed has, which argues for a higher euro/dollar over time.

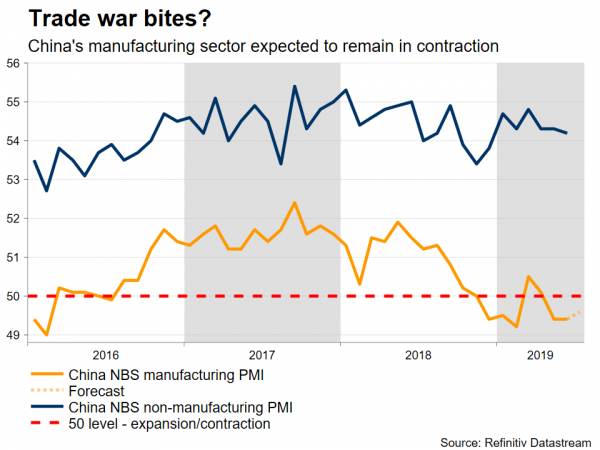

China’s official PMIs on tap as trade talks resume

The world’s second-largest economy will see the release of its official PMIs for July on Wednesday, which are often crucial for global risk sentiment, influencing assets like stocks in particular. What may be even more important for risk appetite though, is what signals come out of the US-China trade talks, the next round of which will be held in Shanghai on Monday.

While the fact that the two sides are meeting face to face again is a positive sign, the likelihood of any major breakthrough appears low. The differences on key issues like intellectual property protection and an enforcement mechanism for any deal seem too big to bridge, and perhaps the best that investors can hope for are signs of progress on some of the ‘easier’ questions, like how to treat Huawei.

Australia’s inflation and retail sales prints crucial for RBA

Quarterly inflation figures on Wednesday and monthly retail sales stats on Friday will steal the show in Australia, with traders looking for clues on when the RBA will cut rates again – having done so at both of its last two meetings. Markets currently assign only a ~30% probability for another cut at the August 6 meeting, though that could change quickly depending on the quality of these data.

Beyond monetary policy, the other key variable for the aussie will be how the US-China trade talks unfold.

Elsewhere, Canada’s monthly GDP data for May could attract some attention on Wednesday.