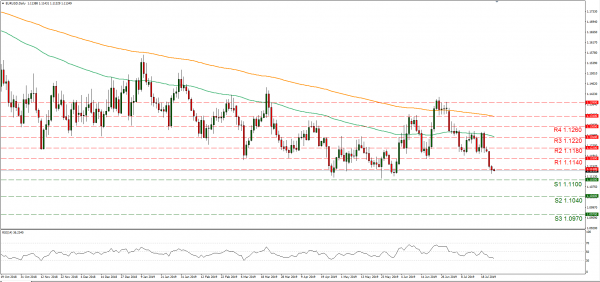

The ECB is to release its interest rate decision today and is expected to remain on hold at 0.0%.EUR OIS imply a probability of 52.15% for the bank to remain on hold at the current stage. However there is also another 47.85% probability to cut rates by 10 basis points. However, we believe that if the bank does not cut rates today, it would probably prepare the ground to do so in its September meeting. Traders are expected to be influenced by the accompanying statement and the following press conference of ECB President Mario Draghi. Market participants could be interested to see how ECB plans to take action to improve the economic condition of Europe. Even though the Unemployment rate has remained rather stable, Retail Sales y/y have dropped to 1.3% and the HICP final figure being at 1.3% far from the 2% target, are questionable. The overall expectation of the market is that the bank is expected to have a dovish outlook based the recent soft economic data. Should the bank sound dovish as expected, we could see the common currency weakening.

CBRT interest rate decision

During the late European session, we get CBRT’s interest rate decision. The bank is expected to cut the 1 week repo rate to 21.50%. Other reports state the rate cut could be larger or smaller. In any case CBRT could be forced to take action as Turkish businesses have been in a difficult situation while the country’s inflation has been dropping both monthly and yearly. The event could be a test of the central banks independence as many believe it follows Turkish President Tayyip Erdogan’s views. In the past, reports claimed Erdogan dismissed the previous CBRT governor due to a disagreement they had on the actions that should be taken. TRY could come under strong volatility at the time of the event

Support: 1.0970 (S1), 1.1040 (S2), 1.1100 (S3)

Resistance: 1.1140 (R1), 1.1180 (R2), 1.1220 (R3)

Support: 5.7090 (S1), 5.6450 (S2), 5.5745 (S3)

Resistance: 5.8120 (R1), 5.9280 (R2), 6.0175 (R3)