The Euro declined to a two-month low as investors await the European Central Bank’s (ECB) decision tomorrow. While the bank is expected to leave rates unchanged, investors will want to know the planned timeline of a rate hike. In recent statements, ECB officials like Mario Draghi have signaled that a rate hike will be delayed until the first half of the year. Officials have also signaled that the quantitative easing that ended last December could be restarted. Today, investors will receive the PMI data from the region. In Germany, the manufacturing PMI is expected to rise slightly from 45.0 to 45.1.

The New Zealand dollar declined today after the country released weak trade numbers. In June, the country exported goods worth more than N$5.01 billion, which was lower than the previous N$5.74 billion. Investors were expecting the exports to be at $5.29 billion. During the month, the country exported goods worth more than $4.65 billion, which was lower than the previous $5.57 billion. As a result of increased exports rather than imports, the trade surplus increased to more than $365 million.

In the United States, the earnings season will continue. This is after hundreds of companies like Chipotle Mexican Grill and Snap reported better-than-expected earnings. Today, companies like Boeing, Caterpillar, Dassault, Facebook, Wix, and Northrup Grumman will report. Meanwhile, investors will receive the manufacturing PMI and home sales from the US. The Markit PMI data for the month of July is expected to rise slightly to 50.9 from the previous 50.8. New home sales for June are expected to rise by 659k.

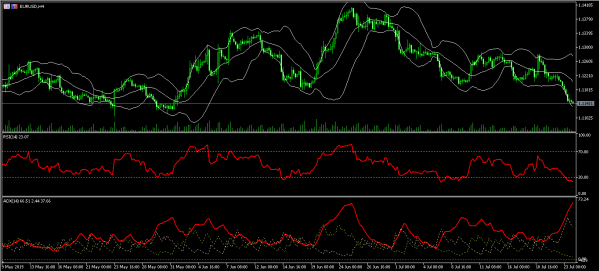

EUR/USD

The EUR/USD pair declined to a low of 1.1140, which was the lowest level in two months. The current price is along the lower line of the Bollinger Bands and below the 25-day and 14-day moving averages. The RSI has moved to the oversold level of 23 while the ADX indicator has moved to the extreme level of 66. The pair will likely continue moving lower to test the important support of 1.1100.

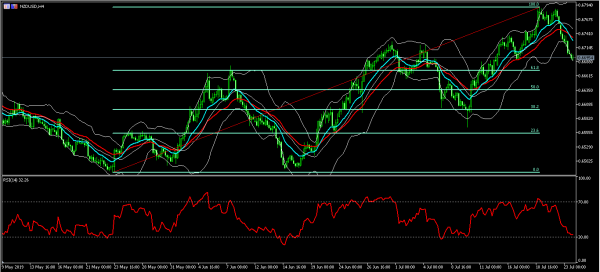

NZD/USD

The NZD/USD pair declined after the weak import and export data. It is now trading at 0.6690, which is below the 14-day and 28-day moving averages. The price is along the lower line of the Bollinger Bands. The RSI has moved close to the oversold level of 30. The pair will likely continue moving lower to test the important support of 0.6670, which is the 61.8% Fibonacci Retracement level.

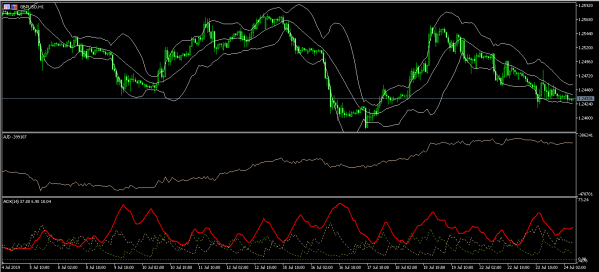

GBP/USD

The GBP/USD pair declined to a low of 1.2430, a day after Boris Johnson won the vote to become the next UK Prime Minister. On the hourly chart, the price is between the lower and middle moving averages. The accumulation/distribution continued the upward momentum while the average directional index has remained unchanged. The pair will move in either direction as Boris Johnson sets his agenda.