Iranian military confronted and seized a British warship on Friday as Tehran said it was violating international maritime rules. UK officials were not clear on how they intent to reply to this action but they stated they are in talks with their international allies to make decisions. US officials have also stated they will be in talks with the British over the incident. This could be retaliation from Iran’s side as British forces had seized a ship thought to carry Iranian Oil earlier in July. We would not be surprised if the situation intensifies further this week while if so, safe haven instruments along with Oil prices could react significantly to the matter. Last week the US had claimed to drop and Iranian drone which Iranian officials later denied. Europeans, the UK and the US may have to try other ways to approach the Iranian matter as until now what we are seeing is retaliation persisting. If the Strait of Hormuz becomes inaccessible to Oil tankers even for a small period then Oil prices could be getting some support. Oil tankers are already undertaking increased expenses to enter the area as companies providing ship insurance are charging extra for sailing in war risk area. Today the U.K. government’s emergency committee will be having a meeting to discuss how to deal with the matter. According to Bloomberg UK officials said they aim to deescalate the matter.

Chinese companies turn to the US for farm products

According to China’s official Xinhua news agency, Chinese firms are reaching out to U.S. exporters to buy crops and agricultural products. This is an indication that the two sides are taking the initiative to strengthen their relationships and they are in goodwill. In the previous days, China has confirmed that Vice Premier Liu He and Commerce Minister Zhong Shan were in talks with Mnuchin and Trade Representative Robert Lighthizer on further steps to be taken so the two sides implement what exactly was agreed in Osaka during the G20 meeting. The progress is important as the two sides seem to be working according to plan and the reaction could be evident on the USD which could get some support.

Other economic highlights, today and early tomorrow

Today, we get Canada’s Wholesale Sales growth rates for May. Tomorrow in the early Asian session, from Australia, RBA Ass. Governor Kent speaks.

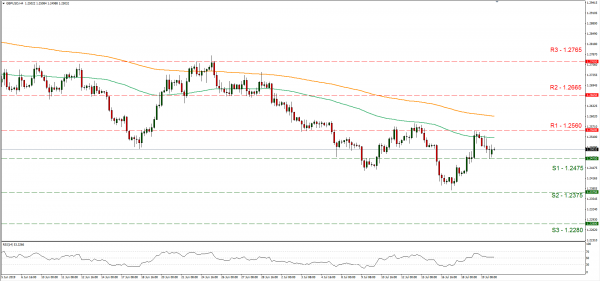

Support: 1.2475 (S1), 1.2375 (S2), 1.2280 (S3)

Resistance: 1.2560 (R1), 1.2665 (R2), 1.2765 (R3)

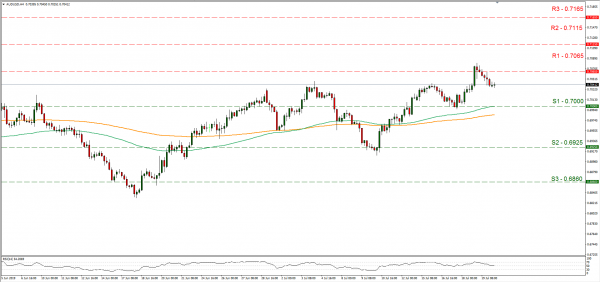

Support: 0.7000 (S1), 0.6925 (S2), 0.6860 (S3)

Resistance: 0.7065 (R1), 0.7115 (R2), 0.7165 (R3)