First, a review of last week’s events:

EUR/USD. Recall that the majority (65%) of experts expected further strengthening of the dollar and the slide of the pair to the 1.1150-1.1200 zone. And the pair went down, reaching the level of 1.1200 on the night of July 16-17. However, the strength of the bears dried up there and, two days later, the bulls returned the pair to where it started on Monday July 15, to the level of 1.1285. Thus, for the second week in a row, the pair is in a fairly narrow side channel, limiting its fluctuations to the boundaries of 1.1190 and 1.1285. The reason for such a lull (perhaps before the storm) is not the summer holidays of investors, but their expectation of the ECB meeting on Thursday July 25, at which the European regulator may decide to lower the interest rate;

GBP/USD. If you look at the D1 chart, you can say that the pound experienced another technical correction last week. The reason for this was strong data on wages and retail sales in the UK. But on the whole, everything was developing exactly as the majority (60%) of the experts had supposed. Being in a downtrend since mid-March, the pair first tested the support in the 1.2440 zone again, then, breaking through it, reached the January 3, 2019.low, 1.2405, after which it dropped another 25 points and, groping the bottom at the level of 1.2380, turned up. As part of the correction, the pair rose by almost 180 points, and ended the week in the 1.2500 zone;

USD/JPY. In general, the dynamics of the pair corresponded to analysts’ forecasts. However, volatility was slightly lower than expected. So, against the background of the strong growth of the Dow Jones Industrial Average index, a third of the experts waited from the pair to rise to the zone 108.50-109.00 at the beginning of the week. However, the bulls managed to raise it only to the height of 108.37. After that, the initiative went to the bears and, as predicted by 70% of analysts, the pair went south – to the lows of June around of 106.75-107.00. But here it missed the target by some 20 points as well. The fall stopped at 107.20. This was followed by another trend reversal, and the pair met the end of the week at around 107.70;

Cryptocurrencies. US authorities have literally turned against Facebook’s intentions to launch its cryptocurrency Libra. Moreover, the Financial Services Committee of the House of Representatives has prepared a bill to ban the release of cryptocurrencies not only by Facebook, but also by any other large companies with annual profits above $25 billion (for example, Google). If Trump signs this law, violators will pay a fine of $1 million per day. And although Facebook’s profit from Libra may be higher than this amount, the company may refuse this project, not wanting to aggravate relations with the authorities.

Against this background, Bitcoin continued to fall, reaching a four-week low at around $9.080. True, then there was a rebound upwards, as a result of which the losses of the BTC/USD pair decreased and amounted to about 11% in seven days.

Ethereum (ETH/USD) and Ripple (XRP/USD) went down as well. But Litecoin (LTC/USD) was able to return to its original values in the second half of the week: on the eve of the halving in August, investors found this altcoin undervalued and began buying it.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. The markets continue to be ruled by the expectations of a quick decline in interest rates by the US Federal Reserve and the ECB. As was said, the market does not exclude that the European regulator will announce this already next Thursday, on July 25th. Although many experts believe that until the end of September the rate will remain at the same level, that is, zero. In the first case, the pair can go down sharply. In the second case, sharp fluctuations in the rate are not likely to be expected. Moreover, despite the slowdown in economic growth, the situation in the Eurozone is not so bad: manufacturers’ prices are still growing, and the current operations surplus in June was almost €30 billion (compared with €22.5 billion in April). And this despite the trade wars!

It is interesting to see what the US will do in this situation? President Trump was outraged in his Twitter saying that the quantitative easing policy by the ECB and the depreciation of the euro against the dollar will allow the EU to ‘unfairly easier compete with the United States.’ ‘Europe is getting away with it for years – along with China and others!’, Trump wrote, which strengthened investors’ expectations regarding the devaluation of the dollar and the rate cut by the Fed.

In whose direction, the euro or the dollar, will the scales swing? There are more questions than answers. Moreover, the statements of US Treasury Secretary Stephen Mnuchin are directly opposed to what Trump says and writes. So, recently, after the meeting of G7 finance ministers in France, Mnuchin assured journalists that there was no change in the policy of a strong dollar at the moment.

In the meantime, the absolute majority of experts – 75%! – expect the pair to rise to the height of 1.1350-1.1415. The nearest resistance is 1.1285.

The remaining 25% of analysts and 90% of oscillators and 100% of trend indicators on D1 strongly disagree with them. They all expect the pair to decline to the spring lows in the area of 1.1100-1.1115.

As for the events that may affect the formation of short-term trends, this week we can note the release of the following data: July 23 – results of a study of bank lending in the Eurozone, July 24 – indicators of Markit business index in Germany and the Eurozone, and annual data on US GDP, which will see the light on Friday July 26th.

GBP/USD. On Tuesday, the minutes of the UK Financial Policy Committee meeting will be published. However, this rather important document is unlikely to be noticed by the market against the background of another event that will also happen on this day. On July 23, the British Conservative Party, after the counting of votes, will announce the name of the new prime minister. Recall that there are two candidates for this position: the former mayor of London and the former foreign minister, Boris Johnson, and the current foreign minister, Jeremy Hunt. And the fate of Brexit depends on who of them will occupy this post – how will the process of leaving the EU go, whether it will be completed and under what conditions.

Most analysts (65%) expect the pound to strengthen and the pair to grow to the zone of 1.2650-1.2750. The nearest resistance is 1.2575. The remaining 35% of experts believe that before it goes up, the pair should still return to the zone 1.2380-1.2405. Graphic analysis on D1 takes an even more radical position. According to his forecast, the pair can break through support in the 1.2400 zone and drop another 200 points within two weeks;

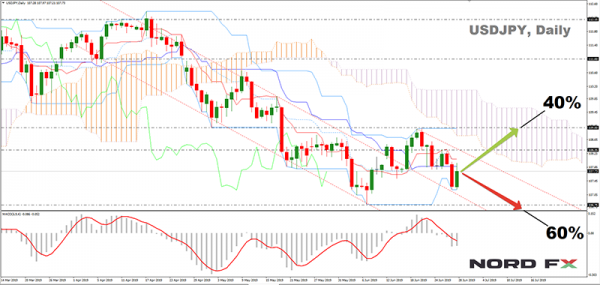

USD/JPY. For this pair, graphical analysis on D1 draws first a movement in the range of 106.75-108.35, and then rising to the height of 109.00. However, only 40% of experts agree with this forecast, their opinion is based on recently published macroeconomic statistics.

Recall that the purpose of the Bank of Japan is the inflation rate of 2%. However, its achievement can only be dreamed of. The inflation in June 2019 turned out to be exactly the same as a year ago and was only 0.7%. In such a situation, the Japanese regulator may start thinking about lowering the interest rate, as their colleagues in the Asia-Pacific region have already done – Australia, India, Indonesia and South Korea.

The remaining 60% of analysts believe such a move by the Bank of Japan is unlikely. In their opinion, the probability of a decrease in the dollar rate at the US Federal Reserve meeting on July 31 is significantly higher. In this case, the pair can not only descend to the horizon of 106.75, but also, breaking through it, rush to the January 2019 low in the zone 105.00. 90% of the oscillators and 100% of the indicators on D1 are siding with the bears;

Cryptocurrencies. At the end of Friday, July 19, the BTC/USD pair was in the area of a strong four-week support level (and now resistance level already) $10,500. And although it is impossible at the moment to formulate any kind of definite opinion, in the transition to the medium-term forecast, the overwhelming majority of experts (65%) vote for the growth of the pair.

In this case, problems of Facebook, Google and other large companies with the release of their own altcoins can play into the hands of bitcoin. Unlike Libra, bitcoin is a decentralized cryptocurrency, and therefore the US government will not be able to blame anyone about its release and regulation anyone.

Moreover, the conspiracy theorism has again surfaced that the patronage of bitcoin is none other than the US Treasury, which will do everything possible to eliminate the competitors of this reference digital asset.