First, a review of last week’s events:

EUR/USD. Recall that 60% of experts named the zone 1.1100-1.1185 as a local bottom. As for the remaining 40%, in their opinion, support 1.1185 should have become an insurmountable obstacle, after which analysts had expected the pair to return to {1level 1.1275-1.1320. That’s exactly what happened: the bottom was fixed at 1.1190, after which the pair turned around and went up, reaching the height of 1.1285 at the maximum. Then there was a bounce, and the pair completed the five-day week at the Pivot Point level of the first half of summer,1.1270;

GBP/USD. The line graph of the pair on D1 resembles a parabola, which, in general, reflects the two main forecasts of experts. 40% of them expected the pair to fall to the lows of December 2018 – January 2019, and it dropped to 1.2438. And then, as other analysts expected, the pair headed north, where it was stopped by resistance 1.2575;

USD/JPY. 40% of analysts hoped that the pair would be able to overcome the resistance of 108.80 and rise to the level 109.00-109.60. It seemed that this forecast was about to come true. However, the pair did not manage to touch the horizon of 109.00: not gaining just a couple of points, it collapsed down and returned to the strong support of June-July 2019 in the zone 107.85;

Cryptocurrencies. Bitcoin’s extremely high volatility continues to keep investors and traders in constant tension, since fluctuations of 10-15-20% can not only enrich, but also ruin anyone in a short time. The reason, first of all, is the thin market. It is so thin that any fixation of profits by a major player, any more or less loud news, causes serious jumps in the rate.

For example, the statement by Fed Chairman Jerome Powell that Facebook should not be allow ed to launch its Libra cryptocurrency until the company settles all issues with regulatory authorities, turned the BTC/USD quotes down by 15% on Wednesday. Although it would seem, bitcoin should only be better in the absence of such a powerful competitor as Libra. As a result, the upward trend of the beginning of the week was interrupted and the pair returned to July 7 values in the $11,000-11,850 zone.

The stress tolerance of altcoins was significantly lower than that of the basic cryptocurrency. So, Ethereum (ETH/USD) lost 7% in seven days, Ripple (XRP/USD) lost 11%, and Litecoin (LTC/USD) lost 13%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. The markets continue to be ruled by expectations of a coming decline in interest rates by the US Federal Reserve and easing of the ECB’s monetary policy. In whose direction, the euro or the dollar, will the scale swing?

There is a high risk of slowing economic growth noted in the latest protocol of the European regulator. And if the situation does not improve in the near future (and why should it improve?), The ECB is ready to lower interest rates and increase bond purchases under the QE program. It is not necessary that this will be announced on July 25, however, the ECB meeting scheduled for this day should nevertheless bring some clarity.

It is possible that the issue of monetary policy easing, but this time in the United States, will also be addressed by Fed Chairman Jerome Powell, who will speak on Tuesday, July 16 at a conference in Paris. He will read a report on the features of monetary policy in the post-crisis era there, and the tonality of this report can have a strong influence on the dollar rate.

Another important event that could affect the dollar pairs will be the publication of data on the growth rate of China’s GDP for the 2nd quarter of 2019. This will take place on Monday, July 15, and many experts expect a rather strong slowdown in the economic growth of the Middle Kingdom, which can provide serious support to the US currency.

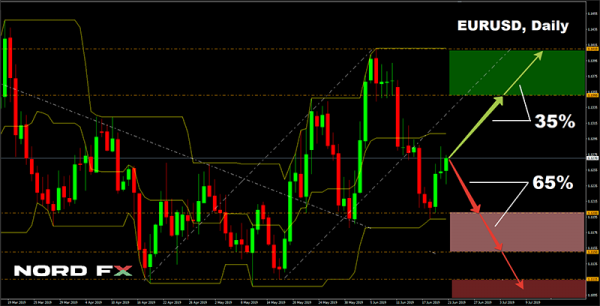

As for trend indicators and oscillators, they are in antiphase on H4 and D1: if most of them are green in H4, the picture is the opposite on the day time frame.

The forecasts of the majority (65%) of experts are also painted red, they expect further strengthening of the dollar and the slide of the pair to the zone of 1.1150-1.1200. The next target of the bears is the zone 1.1100-1.1115. As for the bulls, they see their goal in raising the pair to tier 1.1350-1.1410;

GBP/USD. Statistics on the labor market, wage growth rates and unemployment rates in the UK will be published on Tuesday, July 16. And on Wednesday, July 17, we will know the data on inflation. But experts expect no surprises from either of them.

At the moment, 60% of analysts, supported by graphical analysis and most of the indicators on D1, expect the pound to test support 1.2440 again and, if successful, drop to the low of January 3, 2019 at the level of 1.2405.

The remaining 40% of experts advise to open positions on the buy. There are two main arguments: the increase in the spread of government bonds profitability in the UK and the USA, and the rising oil prices. Both of these factors should push the pound up.The nearest resistance is 1.2755, the next is 1.2825;

USD / JPY. It is known that this pair has a strong correlation with the US stock market, and on the eve of the Dow Jones Industrial Average – for the first time in history! – Overcame the mark of 27.000 and reached last Friday the mark of 27.330. The pair may show growth to the 108.50-109.00 zone against this background. The next target is 109.65. However, only 30% of analysts voted for such a scenario. The majority of experts (70%), with the support of 90% of trend indicators on D1, expect the pair to decline to June lows around 106.75-107.00.

As for the graphical analysis on D1, it draws the lateral movement of the pair in the channel 107.70-109.00 with the predominance of bullish moods;

Cryptocurrencies. If on H4 and D1 time frames we observe lateral movement of the BTC/USD pair with gradual consolidation around $ 11,500-12,000 for the third week, the picture looks much more optimistic on W1 and MN: the uptrend is in full swing.

Positive predictions are made by many experts. For example, it was for the first time that the American rating agency Weiss Ratings assigned A-grade to Bitcoin, stressing that at the moment the potential benefits of investing in the first cryptocurrency exceed the risks. And Morgan Creek Capital Management CEO Mark Yusko suggested that the current market cycle could raise the price of Bitcoin to a new historical high of $30,000. Bitcoin mining is also growing. Researchers at Cambridge University have shown that today this process consumes more electricity than such countries as Switzerland or Kuwait. However, no one can predict yet at what point a new jump will occur, and experts’ forecasts for the upcoming week do not go beyond the range of $9,725-13,765.