UK data will dominate Wednesday’s economic releases as the latest indicators on GDP growth, industrial output and trade are due to be published. The numbers, out at 08:30 GMT, will be watched for a possible rebound in growth during May following a dismal April. But even if economic output did bounce back in May, the latest PMI data suggest more pain is on the way for the British economy, casting a shadow over the pound’s near-term outlook.

UK output expected to recover in May

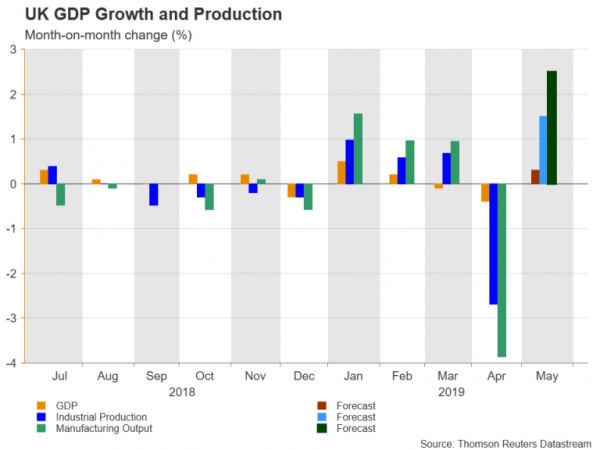

Britain’s gross domestic product (GDP) contracted by 0.4% month-on-month in April as industrial output slumped in a reversal of the temporary boost enjoyed in March when firms stockpiled in preparation of a possible no-deal Brexit on the UK’s original departure date from the EU. But industrial production and broader output probably returned to growth in May, along with an expected improvement in the euro area – Britain’s largest trading partner.

GDP is forecast to have expanded by 0.3% m/m in May, with the annual rate holding steady at 1.3%. Industrial production is expected to have recovered by 1.5% m/m, led by an anticipated 2.1% rebound in the manufacturing sub-sector, after tumbling by 2.7% in April. On a yearly basis, industrial and manufacturing output are forecast to have risen by 1.1% and 1.0%, respectively.

Positive data could temporarily support pound

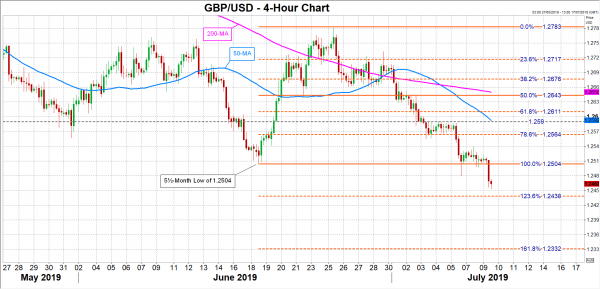

Other releases on Wednesday will include the May trade balance. If the figures are broadly positive, they could help put a floor under sterling’s recent slide, which would probably form around the January low of $1.2436. But with mounting worries about the global growth outlook from what is increasingly looking like a long-term trade war, and the ongoing Brexit uncertainty, any rebound is likely to be short-lived.

The pound could advance towards the $1.25 handle, near the June swing low, if the data ease fears about a sharp slowdown in British growth, before eying the $1.2590 resistance. An upside correction is probable if a positive set of figures coincide with a dollar sell-off as a number Fed officials will be speaking in the coming days and could signal a rate cut.

Downside risks are rising for pound

But given the growing worries recently that the UK economy could be headed for a technical recession if there is a contraction in the second quarter, the risks to the downside are currently greater for sterling. UK PMI numbers for June were far weaker than estimates and the only bright spot in the outlook for the global economy at the moment is the expectations of policy easing by major central banks.

Hence, worse-than-expected numbers on Wednesday would only deepen the bearish bets against the pound and could prompt the Bank of England to abandon its tightening bias and join its global peers by switching to a dovish stance. Under such circumstances, the pound could breach the nearest support at the 123.6% Fibonacci extension of the June upleg at $1.2438, opening the way for the 161.8% Fibonacci at $1.2332.