U.S. Highlights

- News of a trade truce between the U.S. and China buoyed equity markets at the start of the week. The ceasefire put additional tariffs on hold, and there were some modest concessions on both sides.

- On the economic front, messages were decidedly mixed this week. The ISM manufacturing and non-manufacturing indexes moved lower in June, while the payroll report showed a reacceleration in hiring with 224k jobs created last month.

- Given the balance of risks, there is still a solid case for a 25- basis point “insurance” cut when the Fed meets later this month. But, insurance is likely to mean one or two rate cuts this year and not four or five as markets are pricing.

Canadian Highlights

- Financial markets were relatively quiet this week. The S&P/TSX posted a modest gain, whereas OPEC+ announced an extension of the group’s oil supply cuts.

- Grabbing the bulk of the attention this week was a surprise trade surplus in May due to an impressive surge in exports.

- The shortened week also saw a decent Labour Force Survey for June, with the headline print remaining flat but the details of the report further supporting the narrative of healthy labour markets.

U.S. – Markets Celebrate The U.S.-China Trade Truce

News of a trade truce between the U.S. and China kicked off this holiday-shortened week. The ceasefire puts additional tariffs on hold. There were some modest concessions on both sides. The U.S. will allow American companies to continue selling equipment to Huawei (although specifics are still pending), while China will buy more American agricultural goods. The outcome was broadly in line with analyst expectations, but still positive enough to bouy equity markets, especially in sectors such as semiconductors hit by trade uncertainty. On Wednesday, the S&P 500 reached an all-time high.

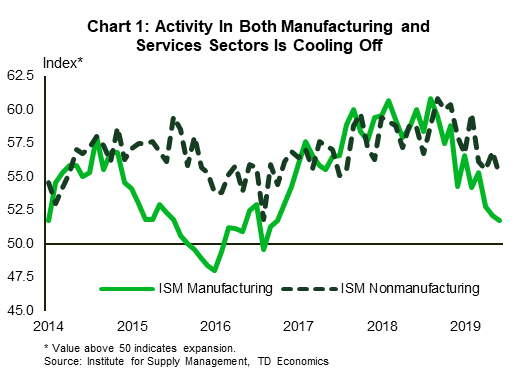

On the economic front, messages in this week’s data releases were decidedly mixed. The ISM manufacturing and non-manufacturing indexes moved lower in June and are significantly below year-ago levels. Still, both remain in expansionary territory, implying slower, but not negative economic growth (Chart 1). More concerning is that the greatest weakness was in the forward-looking indicators. The new orders subcomponent narrowly avoided contraction in June, while pending orders have already slipped below the 50-point threshold.

It is not surprising that activity is slowing from its 3%-plus, stimulus-fueled pace of a year ago, but it makes reading the economic tea leaves more difficult. It is hard to know in real time if the economy is returning to a healthy trend-like pace or pushing past it into a slump. Tariffs and trade uncertainty further cloud the mix, and signs globally point to a less benign slowdown.

America’s saving grace may be that a large share of its economy is relatively shielded from global events. Still, while its service sector is less impacted by trade, it has not been spared entirely. Indeed, comments from non-manufacturing survey respondents highlighted concerns about tariffs in several industries, including construction, retail trade, health care & social assistance and professional and technical services.

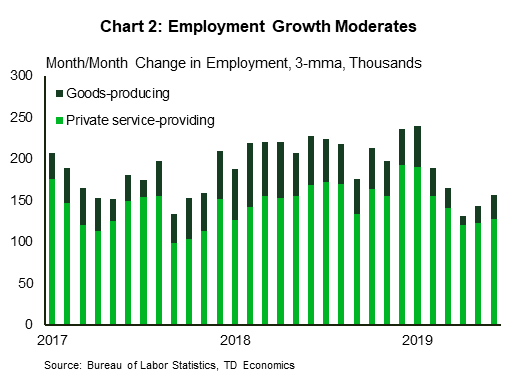

The best evidence that the American economy is headed for a soft landing is the continued resilience in the labor market. That had been brought into question with the May payroll report (job growth slowed to just 72k), but doubts were assuaged with this week’s report showing a reacceleration to 224k in June. The only fly in the ointment was that there were no signs of faster wage growth. Instead average hourly wage growth remained unchanged at 3.1% for the third consecutive month.

Given the balance of risks, there is still a solid case for a 25- basis point “insurance” cut when the Fed meets later this month. But, as long as signs point to continued, albeit slower, economic growth, insurance is likely to mean one or two rate cuts and not four or five as financial markets are currently pricing. Fed speeches over the next two weeks will be key in communicating this to the public and financial market participants.

Canada – Canada’s Q2 Defying Global Headwinds

Financial markets were relatively quiet this week. The S&P/TSX Composite followed its global peers higher, recording a modest 0.7% gain (as of writing). Sentiment was lifted by a positive conclusion to the G20 meeting and expectations of more stimulus forthcoming by the ECB this September. Meanwhile, the decision by OPEC+ to extend supply cuts for nine months was met with a subdued market reaction. In fact, oil prices fell on the week, as markets weighed weak global manufacturing and PMI data that bodes poorly for oil demand growth against an OPEC+ decision that was largely priced in.

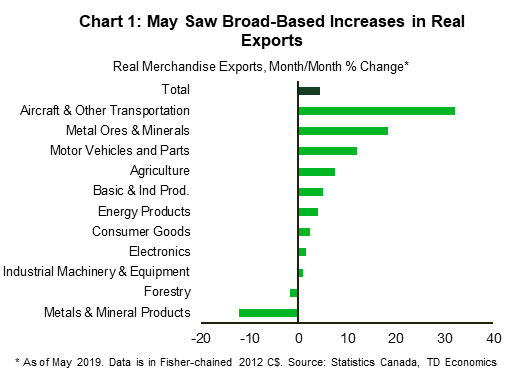

Kicking off the Canadian data release schedule was a surprise trade surplus for May, driven by a spike in exports. Part of the 4.6% surge in exports should be discounted given transitory factors. These include a resumption of activity following temporary disruptions in motor vehicle plants and a surge in the volatile aircraft category. Still, the details of the report were unambiguously positive, with 9 of the 11 product groups recording increases in both nominal and real terms (Chart 1).

The week also saw some regional housing data releases, which, while mixed, should not change the narrative of stabilizing housing markets. Preliminary data suggests that existing home sales advanced in Toronto for the fourth consecutive month. Pullbacks occurred in Vancouver and Calgary, but these followed outsized increases in the prior month.

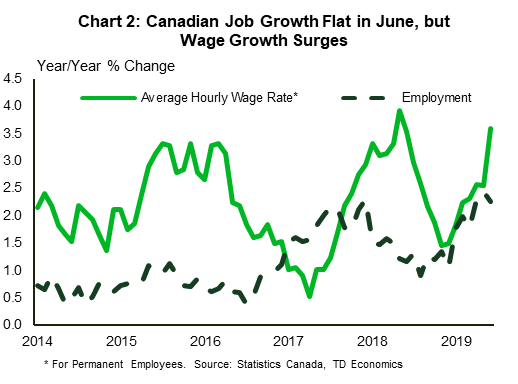

Capping this week’s data calendar was a decent labour force survey report for June. Net job gains were flat on the month, but the details of the report further confirm that the Canadian labour market has been firing on all cylinders. Full-time jobs advanced by a healthy 24k in June, but the highlights of the report were a 3.6% increase in year-over-year wage growth for permanent employees (Chart 2) and a surge in full-time hiring in Alberta (+37k).

This run of positive data surprises stands in contrast to ongoing deceleration in economic momentum abroad. Taken together, recent releases are pointing to some upside to our already-strong second quarter tracking and the Bank of Canada’s very cautious 1.3% forecast. And, with core and headline inflation measures also running slightly above target and wage growth finally picking up, this further justifies our expectation that the Bank of Canada is likely to leave its policy rate unchanged at 1.75% next week.

Of course, some moderation in growth is to be expected in the next few quarters as trade uncertainty and weaker foreign demand act as headwinds to export demand and manufacturing activity. Nevertheless, policy rates in Canada are likely to remain unchanged this year. Financial stability concerns related to elevated household debt levels temper the better-than-expected economic momentum. This sets up the case for divergence between the Federal Reserve’s and the Bank of Canada’s monetary policy paths as the most likely outcome later this year.

U.S.: Upcoming Key Economic Releases

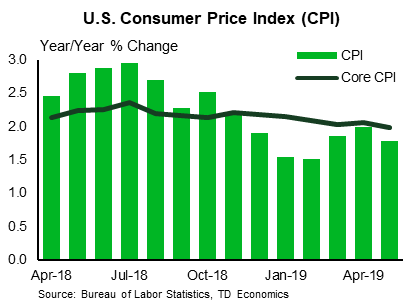

U.S. Consumer Price Index – June

Release Date: July 11, 2019

Previous Result: 0.1% m/m, core 0.1% m/m

TD Forecast: 0.0% m/m, core 0.2% m/m

Consensus: 0.1% m/m, core 0.2% m/m

We look for headline CPI to slow a further two tenths to 1.6% y/y in June on the back of a flat monthly print, as negative non-core inflation will be balanced by firm underlying price gains. We expect the former to be driven by price declines in the energy segment on the back of a 5% m/m drop in gasoline prices. Core inflation, on the other hand, should remain steady at 2.0% y/y, reflecting a firm 0.2% m/m advance. Core prices should be supported by a 0.2% m/m increase in core services inflation, which we expect to be also aided by a flat showing in core goods – it has declined in the prior four months. We anticipate OER to remain largely steady at 0.3% m/m and for the ex-shelter segment to slow marginally on a monthly basis.

Canada: Upcoming Key Economic Releases

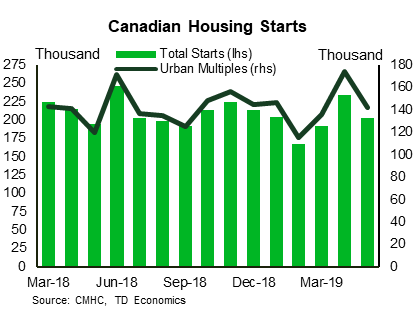

Canadian Housing Starts – June

Release Date: July 9, 2019

Previous Result: 202k

TD Forecast: 210k

Consensus: 209k

Housing starts are forecast to recover to an annualized 210k in June on a partial rebound in multi-unit construction. Apartments and other multi-unit projects were the main drivers behind the May slowdown and continued strength in permit issuance suggests this pullback will be short-lived. Permits for multi-dwelling buildings rose by 40% to a (non-annualized) 18.3k in April, the last month available, which stands as a new record for monthly issuance. While permits are just as volatile as starts, the trend still points continued sustained strength in residential construction despite moderating demand in certain regions.

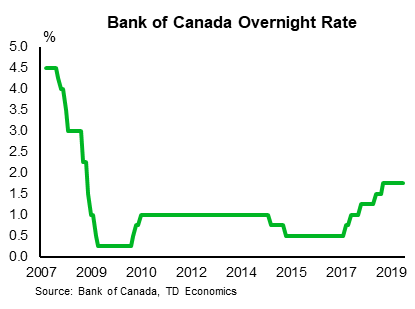

Bank of Canada Rate Decision

Release Date: July 10, 2019

Previous Result: 1.75%

TD Forecast: 1.75%

Consensus: 1.75%

TD looks for the Bank keep rates unchanged at 1.75% in July and provide limited guidance as it awaits more clarity surrounding the global outlook. Since December, the Bank has been primarily focused on housing, energy markets and global trade, and we have seen a number of conflicting developments to global trade tensions since the April MPR (US/China escalation vs steel/aluminum tariffs removal). The Bank has also signaled it is keenly focused on incoming data, which has surprised materially to the upside since April and pushed Q2 tracking towards 3%, well above official estimates. All this suggests the BoC is in no rush to follow G10 central banks lower, and will require more time to assess global trade conditions and their impact on growth before shifting from the current policy stance.