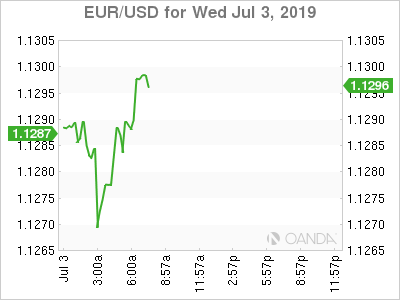

European equities are rallying on better than expected service PMI readings and as markets anticipate Christine Lagarde will likely replace ECB Chief Draghi. Lagarde is seen as maintaining an expansive approach to both conventional and unconventional monetary policies that will support the 19-member eurozone. Lagarde is not an economist, but she is a respected policymaker that has led the IMF through the aftermath of the financial crisis. She is considered an uber-dove, so it is very hard to imagine when interest rate hikes will be delivered by the ECB.

Germany continues to sell bonds at record lows, with today’s 5-year debt coming with a record low yield of -0.66%.

President Trump has also selected two Fed nominees that completely agree with his stance that lower interest rates are needed. Christopher Waller, director of research at the St. Louis Fed, also Trump’s informal adviser has been vocal that central bank needs to lower rates. Judy Shelton is a controversial nominee as she has spent much of her time away from mainstream economics. Trump has seen his past four nominees fail to fill the remaining two seats on the board of governors.

With dovish nominations coming out of the US and Europe along with light volumes as US investors prepare their barbecue grills for the US holiday, global bond yields are resuming their slide. Ten-year Treasury yields fell 2.1 basis points to 1.953%, the lowest since November 2016. Slower economic growth concerns was the overall theme of global PMI releases for June, showing that the trade war is having stronger than expected impacts to the data.

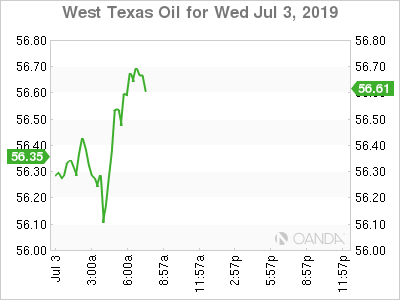

Oil

OPEC was disappointed with the price action that followed its two-days of meetings that saw the 24-country alliance agree on a 9-month extension of production cuts. Crude prices had its worst fall in over four years following an OPEC meeting. Oil prices are higher today after weekly API oil inventories reported crude stockpiles fell 4.97 million barrels last week, its second consecutive large drop.

Today’s release of the EIA crude oil inventory report is expected to see a draw of 2.8 million barrels. Unless we see stockpiles decline over 8 million barrels, oil will likely struggle to erase yesterday’s decline. The key for higher oil prices could come from Friday’s non-farm payroll report, which could signal the US labor market is weakening and that could give the Fed extra ammunition to go full dove at the end of July FOMC meeting. If markets begin to fully price in three Fed rate cuts by the end of the year, we could see the dollar deliver a major reversal which could help commodity prices.

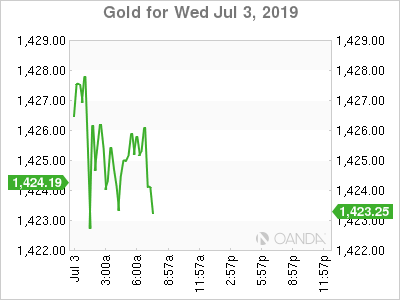

Gold

Gold prices are higher as dovish central bank bets got bolstered by a bunch of nominations from Europe and the US that will likely help bring forward the timelines on when to expect further stimulus. They yellow metal appears to have a firm bottom in place as the data has been deteriorating faster than expected in Europe and Asia and the US is only showing signs of only meager growth.

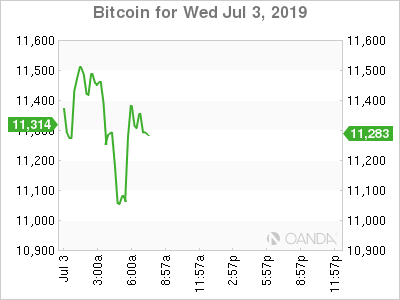

Bitcoin

Bitcoin is higher once again as the fundamental backdrop appears to firmly in place. The cryptocurrency should be supported as mainstream commerce is still moving forward with the adoption of accepting digital coins, regulation has cleaned up a lot of the chop shops, and institutional interests remains strong.

Volatility is both Bitcoin’s best friend and worst enemy, but it seems that the $10,000 level is proving to be key support here. If see this level hold for the rest of the week, bullish momentum could see price finally retake the $14,000 level.