The Australian dollar declined sharply after the RBA released minutes of the past meeting during which the central bank reduced interest rates by 25 basis points. Members observed the sustained period of low interest rates supporting the Australian economy. There has been a growth of disposable income, continued investments in infrastructure and continued growth in the natural resources sector. On rates, members noted that:

Given these considerations, members considered the case for a reduction in the cash rate at the current meeting. A lower level of interest rates would support growth in the economy, thereby reducing unemployment and contributing to inflation rising to a level consistent with the target.

The euro was relatively unchanged ahead of inflation numbers from Europe. Data is expected to show that the headline and core CPI remained unchanged at 1.2% and 0.8% respectively. On a MoM basis, the headline CPI is expected to decline from 0.7% to 0.2% while the core CPI is expected to remain unchanged at 0.9%. In the region, the trade surplus is expected to decline from 22.5 billion euros to 8.8 billion euros in April. ECB governor, Mario Draghi will also speak today.

The US dollar index was relatively unmoved ahead of the building permits data. The data is expected to show that the building permits in May increased slightly from 1.290M to 1.296M. The housing starts are expected to decline by -0.4% from 1.235M to 1.239M. These numbers come ahead of the Fed interest rates decision, which is expected to be released tomorrow. Investors expect officials to leave rates unchanged.

AUD/USD

The AUD/USD pair declined sharply to a low of 0.6835, which is the lowest level since January 20. On the daily chart, this price is below the 50-day and 100-day moving averages. The RSI has dropped from a high of 56 to the current 30 while the accumulation/distribution indicator has continued to move lower. The pair could continue to decline to test the important support of 0.6800.

EUR/USD

The EUR/USD pair was unchanged in the Asian session and is trading at the 1.1230 level, which is along the 50% Fibonacci Retracement level on the hourly chart. The RSI has moved from the oversold level of 19 to the current level of 53. The pair will likely react slightly to the EU inflation data before making big moves tomorrow after the Fed makes its decision.

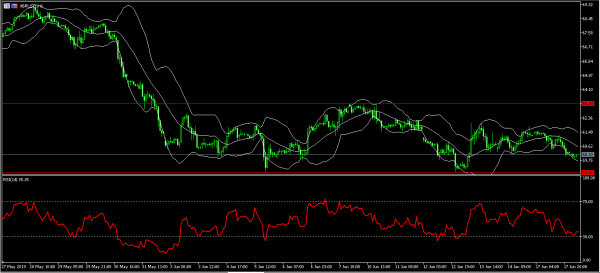

XBR/USD

The XBR/USD pair moved slightly lower today and is currently trading at the 60 level. The pair is between the 59 and 63 channel that has formed in the past few days. It is also along the lower line of the Bollinger Bands and along the oversold level of 30. The pair will likely continue consolidating ahead of tomorrow’s EIA inventories data.