U.S. Highlights

- A potential trade war between U.S. and Mexico was averted, but global trade uncertainty remains.

- Despite markets pricing in rate cuts, domestic indicators suggest that the U.S. economy is on decent footing. Inflation remains stubbornly low, however.

- The Fed rate decision next week is clouded by conflicting signals, but we believe it will likely feature an easing bias

Canadian Highlights

- Housing data for May suggests that residential investment is set to grow for the first time in five quarters.

- At least two rate cuts are priced in for the U.S. Federal Reserve, the bar remains high for a rate cut in Canada. Absent a realization of downside risks, don’t bet on a rate cut by the Bank of Canada this year.

U.S. – Conflicting Signals Cloud Fed Rate Decision

The U.S. economy is taking us on a bit of a rollercoaster ride. Some signals suggest that the downside risks to growth are rising, necessitating further support by the Federal Reserve. Others indicate that the economy is doing just fine, and stepping on the gas might not be warranted. One thing’s for sure, the Fed has a tricky path to navigate as it seeks to sustain the economic expansion.

This week was a perfect example of the conflicting signals faced by the economy. We began the week with a quick extinguishing of a possible trade war with Mexico, but trade uncertainty still looms large. Indeed, the trade conflict between the U.S. and China is not subsiding. Earlier this week, President Trump warned that if President Xi did not meet with him at the upcoming G20 summit, he would immediately slap 25% tariffs on the remaining un-tariffed $300 billion of Chinese imports.

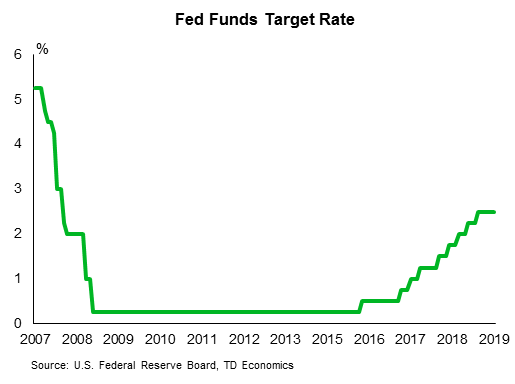

Markets are pricing in the risks emanating from the trade conflicts, resulting in a continued inversion of the yield curve (3-month to 10-year), and an expectation of at least two Fed rate cuts by the end of the year.

However, trade uncertainty does not yet seem to be weighing on business optimism. The NFIB small businesses optimism index improved for the fourth consecutive month as businesses anticipated an improvement in economic conditions and more capital expenditure in months to come.

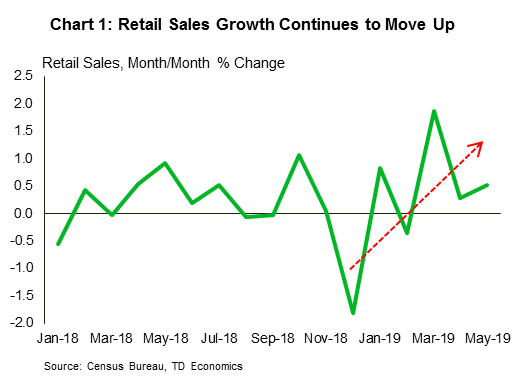

Moreover, U.S. consumers displayed their strength again, with solid retail sales growth in May alongside a significant upward revision to April data (Chart 1). Consumption growth may now exceed the 3% (annualized) mark in Q2.

Despite the strength in consumption, CPI inflation weakened in May. The weakness in inflation in Q1 appears now to be less transitory. Core inflation declined for a range of products including used cars and trucks, apparel, and motor vehicle insurance. While inflation may pick-up going forward, given the increased tariffs on Chinese imports, underlying price pressures in the economy seem to be limited.

The Fed will no doubt take notice of the weakness in inflation in the FOMC meeting next week. But they will also have to consider all other developments as well. Despite rising downside risks, the domestic economy appears to be chugging along. All told, we expect the Fed to convey an easing bias, but not move on rates at next week’s meeting.

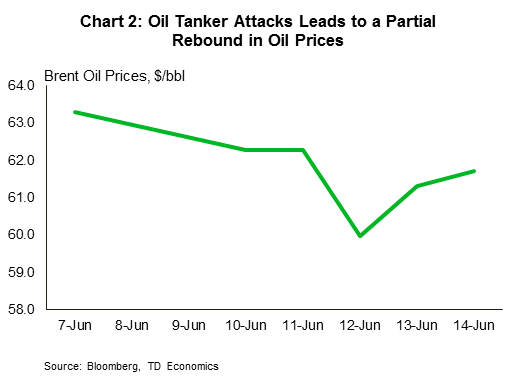

We also saw a rise in global political risks rise this week as two oil tankers were attacked in the Gulf of Oman. After falling through much of the week on the back of concerns about global growth, Brent oil prices jumped by around 5% on Thursday (with a similar move in the WTI contract), not quite enough to offset losses earlier in the week (Chart 2). With the relationship between the U.S. and Iran increasingly strained, oil markets may get caught in the middle.

Canada – A High Bar for Rate Cuts in Canada

As global growth concerns linger, waning demand and ample supplies has resulted in a softening of commodity prices. Oil prices lost more ground this week despite oil tanker sabotage, with WTI briefly hitting US$50 a barrel – the lowest level since January.

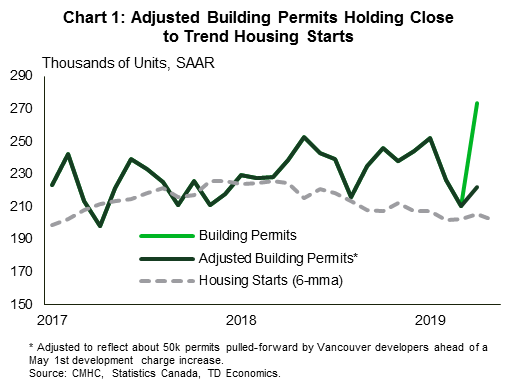

On the domestic front, the little economic news we got this week remained consistent with an economy set to accelerate in the second quarter. Housing starts for May came back to earth after shooting higher in April, disappointing expectations a bit. While the signal from April’s permit surge to 273k units appeared to suggest booming supply on the horizon, the strength instead reflected Vancouver developers pulling-forward permits to avoid a rise in development charges as of May 1st. Removing this impact leaves permits more in line with recent trend in housing starts (Chart 1). Despite the pullback in May starts, new construction is averaging a healthy 217.9k units this quarter through May, and should contribute positively to GDP for the first time in four quarters.

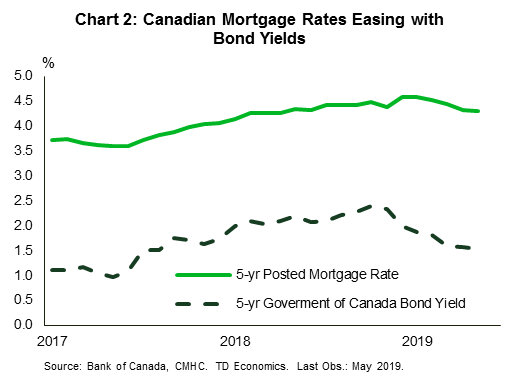

Residential investment has contracted for the past five quarters, but both monthly existing home sales and new construction indicators imply that this negative streak is set to come to an end this quarter. Strong population growth and declining mortgage rates are factors supporting housing demand. Interest rates for fixed-term mortgages are typically priced off of 5-yr Government of Canada bonds (Chart 2). Intensifying global growth concerns and trade war risks in recent weeks have helped to tilt investment flows into safe haven assets such as government bonds. Investors are also betting on a slowdown in the U.S. economy that may require the Fed to take out insurance and cut its policy rate by at least 50 basis points before the end of the year.

Although the Fed has not been shy about its willingness to respond with rate cuts to support growth in the wake of intensifying downside risks, the same cannot be said about the Bank of Canada. Governor Poloz has always emphasized the need for a risk management strategy when setting interest rates, which in practice involves putting a higher weight on financial stability risks posed by the high level of household debt in Canada than usual.

Canadian household finances are gradually improving, but household debt remains at very high levels. Historically, two consecutive quarters of well below trend economic growth would have triggered a response by the Bank of Canada. But, in this era of high debt, the Bank has been reluctant to cut rates unless there were clear signs of excess capacity, like in aftermath of the oil price crash of 2014/15. This time around, labour market strength and inflation holding near target suggest only modest economic slack. Nevertheless, financial markets have priced in one rate cut by the Bank of Canada before the end of this year. A rate cut may be necessary if downside risks are realized. However, until then, don’t bet on one.

U.S.: Upcoming Key Economic Releases

U.S. FOMC Rate Decision

Release Date: June 19, 2019

Previous: 2.50%

TD Forecast: 2.50%

Consensus: 2.50%

We expect the Fed to signal readiness to ease policy but stop short of committing to a near term cut. Chair Powell will likely look to put markets more at ease by reiterating his comments a few weeks ago that the Fed is ready to act if conditions warrant it. The Fed will likely stress that they are monitoring risks on the economy and taking appropriate action to sustain the expansion. In terms of projections, we expect the Fed to deliver only modest downgrades to growth and inflation forecasts despite some recent weakness in data. We expect the median 2019 dot to remain unchanged (reflecting a Fed on-hold) and the median 2020 dot to decline.

Canada: Upcoming Key Economic Releases

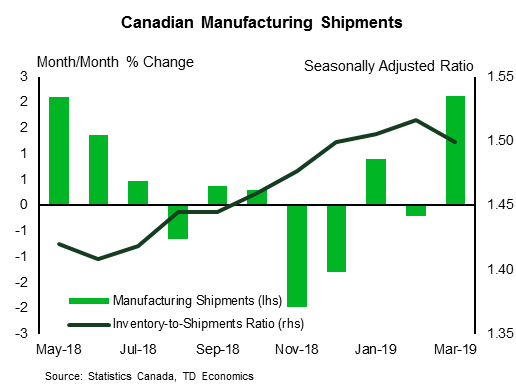

Canadian Manufacturing Sales – April

Release Date: June 18, 2019

Previous: 2.1%

TD Forecast: -0.8%

Consensus: 0.6%

TD looks for manufacturing sales to fall by 0.8% in April, giving back a portion of the prior month’s gain. Weaker motor vehicle shipments are the main culprit after a major automaker idled assembly lines for two weeks, which fits with a large drop in auto exports. Elsewhere, the sharp increase in gasoline prices will provide a tailwind to nominal refinery sales, although we see limited scope for increased refinery output which has risen by 12% over the last three months. Outside of these two industries, higher factory prices should provide a modest lift to nominal sales. Volumes should see a larger decline than the headline series, suggesting a drag on industry-level GDP.

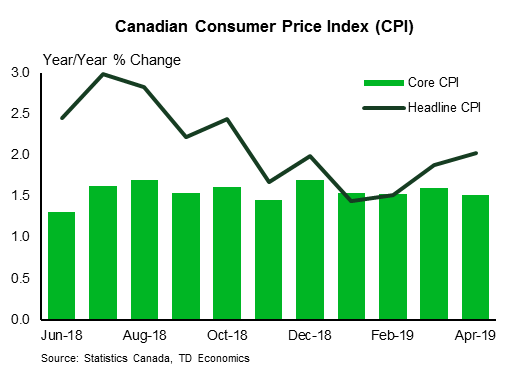

Canadian Consumer Price Index – May

Release Date: June 19, 2019

Previous: 0.4% m/m, 2.0% y/y

TD Forecast: 0.2% m/m, 2.2% y/y

Consensus: 0.2% m/m, 2.2% y/y

CPI is projected to firm to 2.2% y/y in May, with prices up 0.2% on the month. Energy will make a muted contribution after a stabilization in gasoline prices, which are coming off consecutive 10% m/m gains, leaving core goods and services to drive the headline print. Elsewhere, a rebound in rental prices following their first pullback in several decades should make a positive contribution to shelter cost inflation.

Core inflation should hold at 1.9% on average although we should see some divergence across the individual measures. CPI-trim is poised to push above 2.0% y/y due to base-effects but we do not expect this to be replicated across CPI-median or CPI-common, with downside risks to the latter on the heels of two consecutive quarters of <0.5% GDP growth.

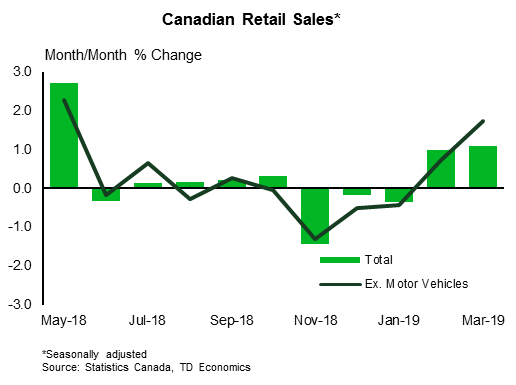

Canadian Retail Sales – May

Release Date: June 19, 2019

Previous: 0.4% m/m, 2.0% y/y

TD Forecast: 0.2% m/m, 2.2% y/y

Consensus: 0.2% m/m, 2.2% y/y

TD looks for retail sales to remain unchanged in April following the broad increase observed in March. Auto sales should make a negative contribution, leaving ex-auto sales up 0.2% m/m, while higher gasoline prices should provide a tailwind to nominal sales at the pump. The latter should serve as the main source of strength in April, overshadowing a pullback in the ex. autos and gasoline measure which drove last month’s increase. Higher consumer prices point towards a decline in real retail sales for April, which will weigh on industry-level GDP and Q2 consumption.