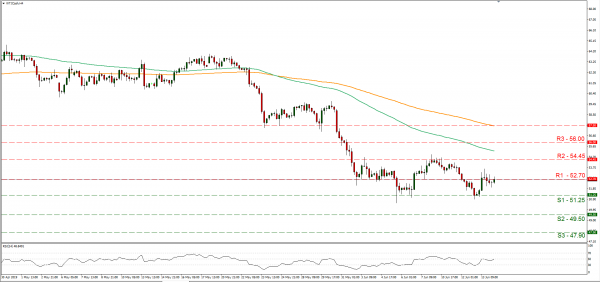

WTI prices marked some substantial gains yesterday as there were explosions on two tankers near the straits of Hormuz, according to media. The US was quick to accuse Iran of attacking the two vessels, while at the same time Iran denies the accusations. Whatever the case, the explosions add further tension to the region, which could threaten the normal supply chain for oil, hence increase the commodity’s prices. It should be noted that yesterday also the OPEC report was released and the organization states that ongoing global tensions have resulted in weaker growth in global oil demand. The organization also stated that the slowdown in the global economy of 1H is expected to be further challenged in 2H of 2019. The developments could force the organization to announce that its members will cut production levels even further in its meeting end of the month. We expect rising tensions and uncertainty providing bullish tendencies for the commodity’s prices. WTI prices rose yesterday, testing the 52.70 (R1) resistance line. Should there be further tensions or headlines implying further production cuts, we could see oil prices rising even further. Should the commodity’s long positions be favored again today, we expect them, to clearly break the 52.70 (R1) resistance line and aim for the 54.45 (R2) resistance level. Should the commodity come under the selling interest of the market, we could see it aiming if not breaking the 51.25 (S1) support line.

USD stabilizes ahead of Fed meeting

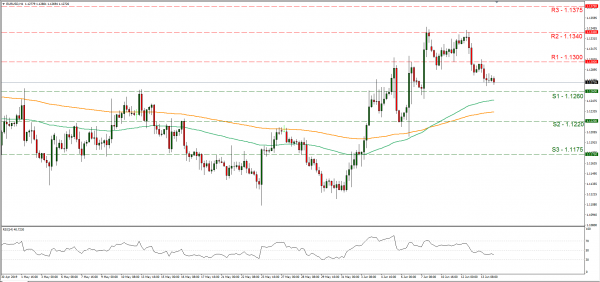

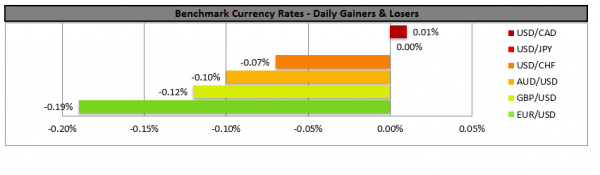

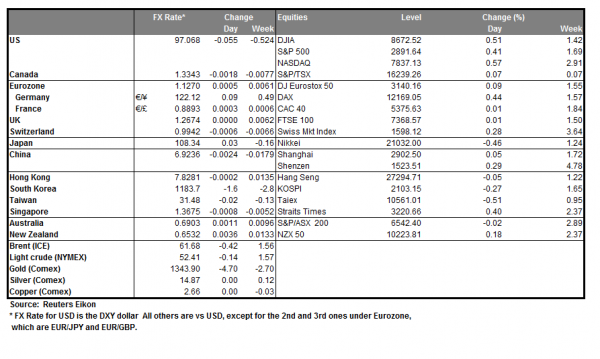

The USD seems to stabilize ahead of the Feds’ meeting next week, yet the week may be ending quit favorably for the greenback. Investors are expected to turn their attention towards the Fed’s meeting next week, for any hints about a possible rate cut. Analysts tend to point out that the market may be expecting dovish comments ahead of the meeting from Fed officials, which could subdue the USD. It should be noted though, that the poor performance of other currencies seems to keep the USD afloat for the time being. Also further tensions in the US-Sino relationships remain possible, especially ahead of the G20 meeting in Osaka, near the end of the month. We could see the USD be somewhat data driven today and new fundamental headlines could also influence its direction. EUR/USD dropped yesterday, aiming for the 1.1260 (S1) support line. We could see the pair dropping even further today, should today’s financial releases favor the USD. Should the bears take control over the pair’s prices, we could see them braking the 1.1260 (S1) support line and aim for the 1.1220 (S2) support level. If the bulls take over, we could see the pair’s price action, breaking the 1.1300 (R1) resistance line and aim for the 1.1340 (R2) resistance barrier.

Other economic highlights, today and early tomorrow

Today during the European session, we get from France the final HICP rate for May, from China the industrial production growth rate for May and Sweden’s CPI rate also for May. In the American session we get from the US the retail sales growth rates for May, the industrial production growth rate for May, the preliminary university of Michigan consumer sentiment for June and the Baker Hughes oilrig count. We do not expect any significant financial releases for Monday’s Asian session. As for speakers, please note that BoE Governor Carney and ECB’s Lautenschlaeger speak.

Support: 51.25 (S1), 49.50 (S2), 47.90 (S3)

Resistance: 52.70 (R1), 54.45 (R2), 56.00 (R3)

Support: 1.1260 (S1), 1.1220 (S2), 1.1175 (S3)

Resistance: 1.1300 (R1), 1.1340 (R2), 1.1375 (R3)