The pound is expected to have a busy start to next week as the latest update on UK GDP growth and industrial production will hit the markets on Monday at 0830 GMT, while on Tuesday at the same time employment data will provide another insight into the British economy. The stats however may not be as promising as in the previous release.

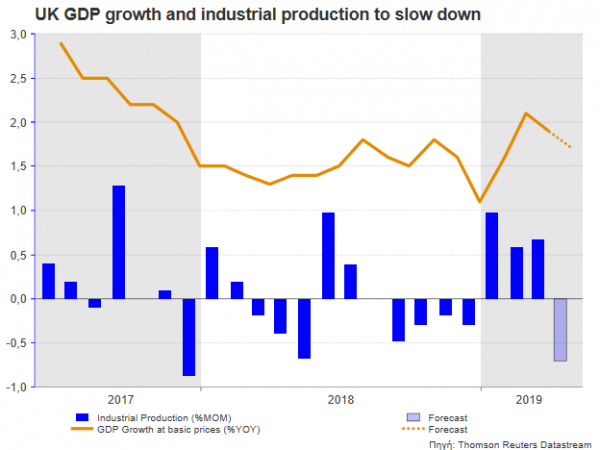

In the first quarter, the fear of a disorderly Brexit at the end of March forced companies to bring purchases forward to avoid any supply disruption in the months ahead. Consequently, industrial production more than doubled on an annual basis, with both services and manufacturing sectors contributing strongly positively to Q1 GDP growth that clocked in higher than expected at 1.9% y/y and 0.5% q/q.

On Monday, markets will likely realize that the above Brexit stockpiling effect was rather temporary as forecasts see industrial output contracting by 0.7% m/m in April after rising by an equivalent percentage in March, squeezing the annual gauge to 1.0% y/y. Of more importance, the monthly GDP growth is projected to have declined by 0.1%, the same rate as in the preceding month, sending the yearly measure lower to 1.7%.

Honestly, such an outcome would not be a big surprise following the deep fall in manufacturing and construction PMI readings earlier this week. Despite the modest increase, the services PMI did not excite either as the indicator remained close to the 50 mark that separates expansion, barely offsetting the loss in other sectors. Indeed, with uncertainty currently growing over whether the Brexit contribution of the new Conservative leader will be positive or negative before the October deadline, companies could reasonably remain cautious on spending and investing, shaving growth in upcoming quarters.

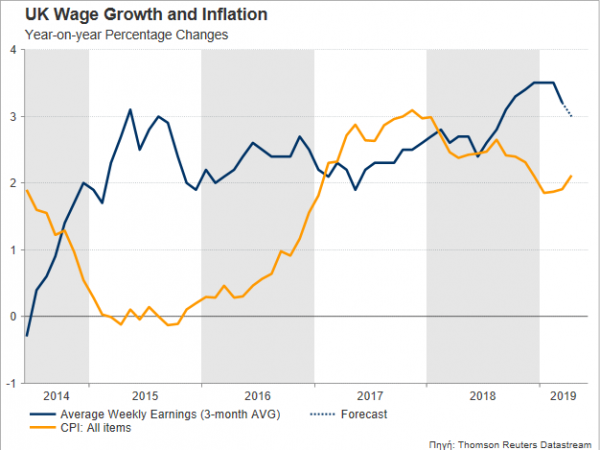

The employment report could demonstrate the bleak business sentiment on Tuesday if April’s data indicate a softer rise in new job positions and wage growth. Particularly, analysts believe that job creation slowed even dramatically in April, recording a marginal rise of 13k compared to 99k in March and 179k in February. Average hourly earnings including bonuses are also predicted to have softened from 3.2% to 3.0% despite the unemployment rate steadying at 3.8%, the lowest level since 1974.

While a wage growth of 3.0% is still supportive to consumption – as long as it holds well above the current inflation rate of 2.1% – another consecutive slowdown could upset the Bank of England governor. According to the central bank’s annual report written on May 21, Mark Carney is positive that upward pressure on prices is likely to build and hence interest rates should be raised, gradually and to a limited extend though, to keep inflation at the target (2.0%). Sure, the Brexit drama together with a tougher US trade policy could keep the pound under pressure, making imports more expensive. But with businesses struggling to boost sales and consumers facing slowing wages, a hike in interest rates would be premature.

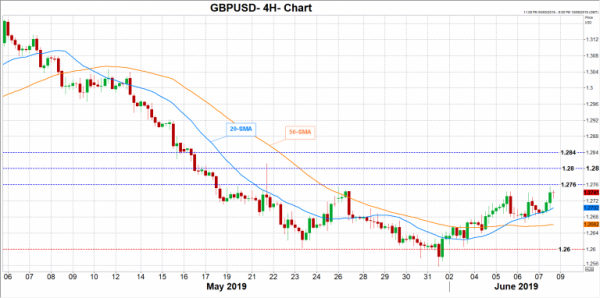

All in all, a negative surprise in next week’s data would further undermine the outlook for the British economy and put Carney’s rate hike hopes into question. The pound could feel the pain in the aftermath, with GBPUSD probably meeting the 20-period simple moving average (SMA) in the four-hour chart, around 1.2700. The 50-SMA currently at 1.2662 could also halt downside corrections ahead of the 1.2600 mark.

In the alternative scenario, better-than-expected figures may show that conditions are not so stormy as markets think, increasing chances for a rate hike if Brexit happens smoothly. In this case, GBPUSD could break resistance around 1.2760 and run towards the 1.28-1.2840 zone.

Its also worth noting that the first round of the Conservative ballot gets underway on June 13, with the results expected to be announced at the same day.