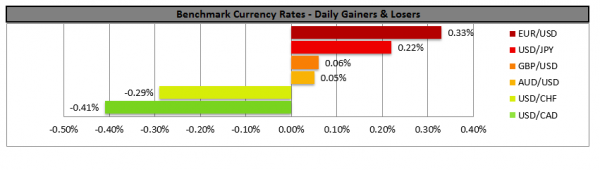

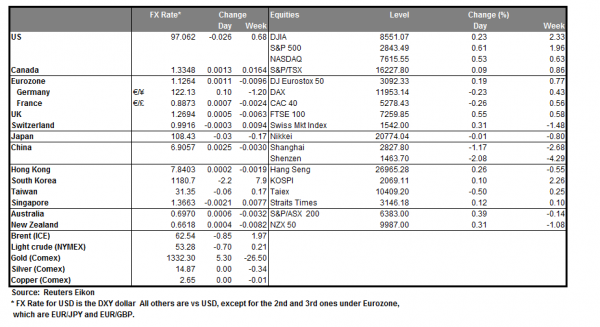

The ECB released its interest rate decision yesterday and decided to remain on hold at 0.0% as was widely expected. In the accompanying statement, the bank acted proactively once again, yet sounded less dovish than what the market may have been expected. TLTRO’s were priced at deposit rate +10 bps providing banks with a margin of 30 bps from the marginal lending rate of the bank to benefit. Rate guidance also altered maintaining the current rate levels throughout the first half of 2020. ECB president Draghi in his press conference repeatedly stated that the ECB had discussed “at a granular” level easing if contingencies unfold. Also on the positive side, GDP forecasts for 2019 are a bit higher, yet drop for 2020 and 2021. We could see the EUR remaining data driven and should there be some negative releases could start weakening once again. EUR/USD showed rose yesterday, breaking the 1.1260 (S1) resistance line (now turned to support) and then testing but failing to clearly break the 1.1300 (R1) resistance line. The pair could be influenced by today’s financial releases, especially the US employment report during today’s American session. Should the pair be under the selling interest of the market, we could see it breaking the 1.1260 (S1) support line and aim for the 1.1220 (S2) support level. Should the pair’s long positions be favored by the market, we could see it aiming If not breaking the 1.1300 (R1) resistance level.

USD steadies before US employment report is out

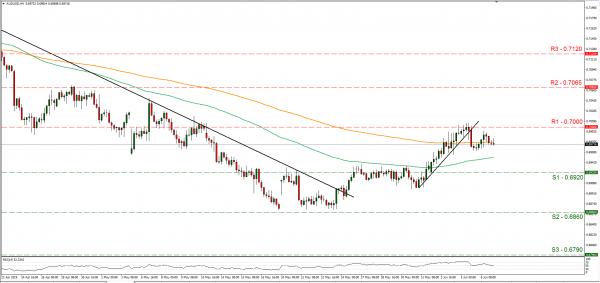

The USD steadied before the release of the US employment report for May at 12:30, GMT today. The Non-Farm Payrolls figure is expected to drop reaching 185k if compared to the previous release, yet the unemployment rate and the average earnings growth rate toe remain unchanged at 3.6% and +3.2% yoy respectively. On the one hand, the greenback could be getting some support as the unemployment rate is expected to remain at the lowest level for decades. On the other hand, the unchanged average earnings growth rate and a possible drop of the NFP figure could enhance arguments for a monetary easing by the Fed and hence weaken the USD. Should the release disappoint the markets we could see the USD weakening. AUD/USD maintained a sideways motion since breaking its upward trendline on Wednesday, below the 0.7000 (R1) resistance line. We maintain our bias towards a sideways motion, yet could see the pair being affected by the US employment report release during today’s American session, as well as the Chinese trading data, due out on Monday’s Asian session. Should the bears dictate the pair’s direction we could see it breaking the 0.6920 (S1) support line, while if the bulls take over, we could see the pair breaking the 0.7000 (R1) resistance line and aim for the 0.7065 (R2) resistance level.

Other economic highlights, today and early tomorrow

Today during the European session, we get Germany’s factory output growth rate and trade balance figure, both for April. In the American session, besides the US employment report for May, we get Canada employment data for May and the Baker Hughes active oilrig count. During Monday’s Asian session, we get from Japan, the current account balance for April and the final reading of the GDP growth rate for Q1. Also we get China’s trade data for May and the expected slowdown of the Chinese imports growth rate could weaken the Aussie and the Kiwi.

Support: 0.6920 (S1), 0.6860 (S2), 0.6790 (S3)

Resistance: 0.7000 (R1), 0.7065 (R2), 0.7120 (R3)

Support: 1.1260 (S1), 1.1220 (S2), 1.1175 (S3)

Resistance: 1.1300 (R1), 1.1340 (R2), 1.1375 (R3)