Global equities are sharply higher after a wrath of European services PMI data showed most of the region remained in growth territory and continued momentum that the Fed will join the rest of the advanced economies’ central banks in delivering rate cuts. It appears markets are convinced the Fed will cut rates after yesterday’s stock rally saw the S&P 500 post its best gain in 5 months. On the trade front, no major developments occurred and that was good enough to keep a positive risk-on session overnight. Still in the UK, President Trump also delivered harsh tones towards Iran, noting military action is possible if Iran takes steps to get nuclear weapons. Trump has maintained a hard stance with Iran and his comments did not yield any major moves. Just before the open, Fed’s Kaplan delivered a wide range of comments on Bloomberg TV, that support the rate cut argument that June will be a hold, but July is live.

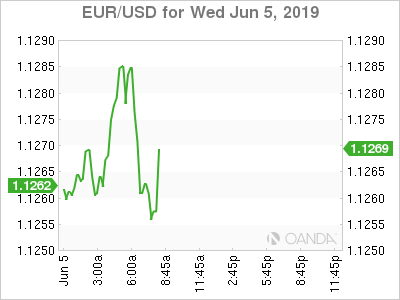

The Dow Jones Industrial Average is poised to open 0.6% higher, while the S&P 500 continues to advance from the pivotal 2,800 level, and the Nasdaq exits bear market territory with a 0.7% gain. The euro gave up all its gains and turned slightly negative to the dollar after the EU Commission recommended excessive deficit procedure against Italy. The rest of the high-betas have modest gains to the greenback.

- Italy – EU Triggers Disciplinary Process over Public Debt

- AUD – Annual Growth at Weakest Levels since Financial Crisis

- Oil – Lower on higher American stockpiles and trade worries

- Gold – Bullish Sentiment in place; rising along stocks

Italy

The European Commission began debt procedures against Italy, in what confirms the start of very lengthy battle between Brussels and Rome. The Commission’s report sees Italy’s debt ratio surging both this year and next to over 135%, mainly due to a snowball effect with current debt, falling primary surplus, and weak privatization proceeds.

The EU report also highlighted that France does not warrant disciplinary action as their deficit and debt are compliant. Greece was warned that they could fail to reach the post-bailout budget target this year, but their respective yields saw little reaction.

The market reaction to the European Commission Report saw Italian stocks fall and yield surge, with the 10-year yield rising 8.2 basis points to 2.594%. The euro also came off its highs, dropping around 30 pips to 1.1257.

AUD

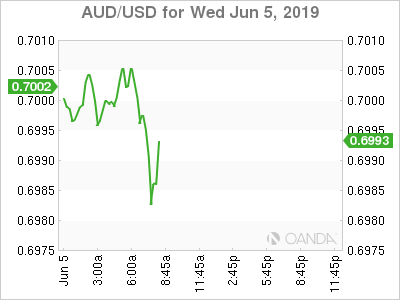

The Reserve Bank of Australia (RBA) was correct in cutting rates earlier this week after dismal GDP data showed the slowest annual growth since the financial crisis. The Australian economy grew at 1.8% from a year earlier, in-line with analysts’ expectations, but at the weakest level in almost 10-years. It appears the housing slump has Aussies focused on saving money reducing their expenses.

Expectations for further rate cuts remain likely as weak income growth and falling house prices confirm the economy is losing its sound footing. The next couple of RBA meetings are live ones and we should probably expect another rate cut. The current implied probabilities show a 29.5% chance for the RBA to cut at the July 2nd meeting and a 61.6% chance at the August 6th policy decision.

Despite all the concerns for a soft start in 2019 for the Australian economy, the currency is rallying mainly on expectations we are on the verge of seeing a softer dollar, as expectations surge the Fed will cut their own respective rates.

Oil

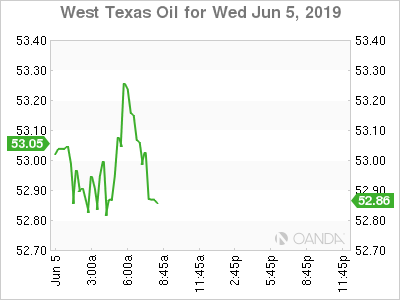

Crude prices continue to fall after the API weekly report showed inventories rose 3.55 million barrels, adding fuel to the fire of the bearish supply argument. Expectations are for the EIA crude inventory report to post a decline of 1.6 million barrels. If we see the EIA report surprisingly deliver a strong build like the API, crude could see another sharp selloff.

While trade and recession worries have played a major contributing factor to the recent slide, we are seeing some optimism that progress could emerge between the Chinese and Americans at the G20, which is at the end of the month. Combined with high expectations the Fed will cut rates and deliver soft landing for the US economy, we could see oil prices stabilize if we don’t see swelling inventory supplies of crude.

Gold

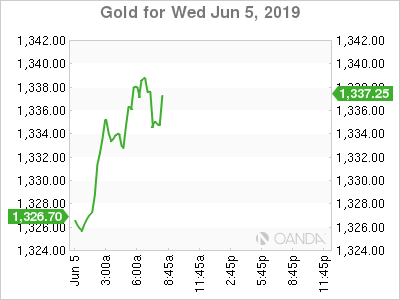

Gold prices rose 1.0%, despite a broad equity rally as investors pile on safe-haven bets in the event trade talks take a turn for the worst. The bullion rally is also firmly being supported by the Fed’s focus on whether and when to cut interest rates, which has the beginnings for a major dollar reversal.