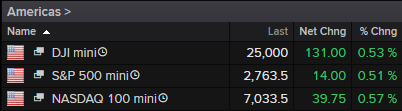

Central banks provide reprieve for stock markets

Stock markets are rebounding again on Tuesday, an encouraging sign at a time when sentiment has appeared to have been significantly harmed by tariffs

Perhaps we have central banks to thank for the bounce over the last couple of days, with the RBA cutting interest rates to record lows – in line with expectations – overnight and a Fed official suggesting a cut may be warranted soon. James Bullard is one of the most dovish members of the Federal Reserve, so his comments should perhaps not come as too great a surprise, but he is a voter this year so maybe carry a little more weight.

It may just also be an overreaction at a time when the market seemed to only be headed in one direction. At times, it seems traders are looking for any reason to take a little profit off the table and maybe this is the reason to do so. The important thing though is that we have seen a clear shift from the Fed over the course of this year and talk of a rate cut is in line with what markets were already factoring in.

While the risks are building and sentiment becoming increasingly fragile, I still feel the markets are getting a little ahead of themselves. Markets are now pricing in more than an 80% chance of two rate cuts this year and have a third as a coin toss. That strikes me as being quite extreme even given expectations for the economy for the rest of the year and risks that exist. Could be a rough few months if markets are correct.