Global equities are sharply lower as risk off hit all asset classes after President Trump stunned markets with his announcement of tariffs on Mexican imports, an unexpected escalation in the trade war with Mexico. Trump’s move will derail recent progress that was made with the USMCA negotiations and adds concerns trade wars will become the new norm. More importantly, China also announced they will be releasing a blacklist of companies to target that cut supplies and violated their market rules, heightening the economic pain that will hit multi-nationals. Today’s headlines highlight an intensification of trade spats between the US and their first and third largest trading partners. Dow Futures will open sharply lower, breaking below the $25,000 handle, while the Nasdaq continues to lead the way down with a 1.3% decline. Global bond yields are plummeting across the board, while the curve steepens in America. Risk-off flows supported the Japanese yen, Swiss franc and gold prices.

- Trade – Risk off on Trump Mexico tariff and China blacklist

- Bunds – Falls to Record Low

- Turkey – Exits First Recession in a Decade

- Oil – Collapsing on trade worries

- Gold – Struggles despite rate cut bets

Trade

President Trump surprised markets after announcing Thursday night that the US would impose escalating tariffs on all Mexican goods beginning on June 10th, aiming at containing the rise in central American migrants coming to the border. Mexico is America’s third largest trading partner is expected to see a 5% tariff on imports that could grow up to 25% on October 1st. Trump’s decision likely puts a confusing twist to efforts to win congressional support in ratifying the United States- Mexico- Canada agreement. While the sudden aim at Mexico stunned markets, the demands are not as complicated as the ask list for China, so we could see a relatively quicker resolution here. Mexico could easily deliver improved security at the Mexico/Guatemala border, targeting criminal organizations that aid migrants, but may have trouble agreeing on acknowledging Central Americans entering Mexico are not able to ask for asylum with the US.

China’s retaliatory tariffs begin tonight and it seems the next round of wave of risk-off trade could get even uglier. China will establish a list of unreliable entities that will take aim at foreign firms that cut supplies to China. The curbing of exports of rare earth to US manufacturers is likely to become a reality too.

Trade tensions were supposed to be entering a state of calm and not flare up. Fear is that once these tariffs are implemented, economic activity and sentiment will see markets price in further economic weakness, that will have lasting impact and will not go away easily even if we do see trade deals in near future.

Bunds

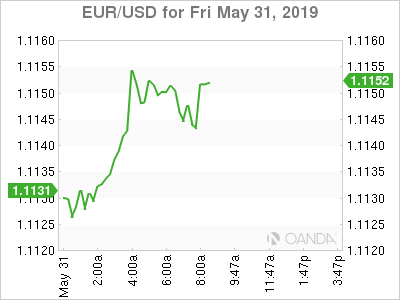

German yields are plummeting as risk aversion sees investors fleeing to German bonds. The yield on 10-year German bund fell to a record low, surpassing the one made back when Brexit happened. Many analysts are wondering if the entire German curve will go negative, a blow to German banks. The ECB is likely going to need to step up QE and deliver further rate cuts. The euro is still holding onto the 1.11 level.

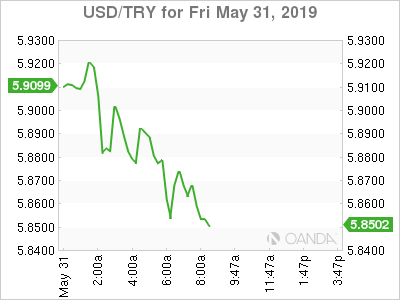

Lira

The Turkish lira rallied after the country officially exited a recession, however it was mainly driven by surge in lending by state banks. The 1.3% expansion in Q1 was expected and the lira rallied 0.3% to the dollar. Turkey remains a political mess and the longer-term bearish outlook for the economy remains in place. The lira is down roughly 5% this quarter and with consumer confidence at record lows, prospects for further Turkish growth are slim.

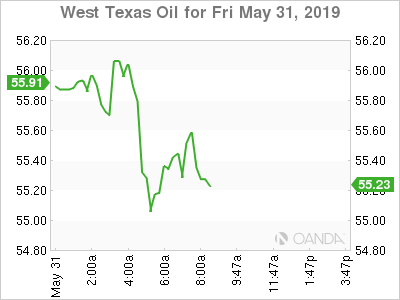

Oil

Oil bearish momentum remains on overdrive as trade fears have dealt a strong blow to demand expectations. President Trump’s latest tariffs on Mexico will also punish US gulf refiners, adding a few dollars to Maya crude, the only type of oil Pemex has been selling. West Texas Intermediate crude is down over 2% and back to the mid-50s. Glut concerns will also grow as stockpiles are growing as we enter the summer driving season. Oil could see a run for the $50 a barrel level as global growth concerns increase and are combined with a recent run of bearish EIA weekly crude and gasoline inventory reports.

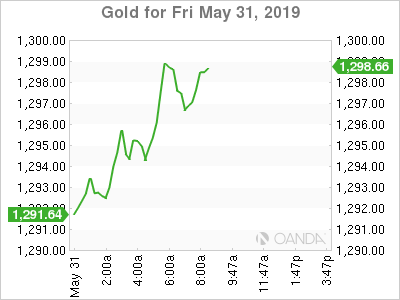

Gold

Gold is back above $1,300 an ounce on Trump’s latest tariff theatrics. The yellow metal has underperformed as a safe-haven but could see further gains as technical traders appreciate the breakout from a recent tight range.