The euro rose as investors received the results of Sunday’s European elections. The results showed that the turnout increased for the first time in 40 years. They also showed that voters returned a more fragmented pro-EU majority. The traditional center-right and center-left parties lost ground. Parties against the EU made less gains than earlier expected. In France, Marine Le Pen’s National Rally defeated Emmanuel Macron’s En Marche. In the UK, Brexit party also defeated the traditional Labor and Tory parties. Other countries where anti-establishment parties won were in Poland, Italy and Hungary.

Sterling rose slightly as debate in the UK shifted to the next Prime Minister. This follows Theresa May’s resignation announcement which will see her officially step down on June 7. Investors hope that the next Prime Minister can help lead the UK past Brexit. However, the top contenders have argued that the country will be fine even with a no-deal Brexit. They include Boris Johnson, who is the former Foreign Secretary, Dominic Raab, the former Brexit Secretary, and Michael Gove – Secretary of State for Environment, Food and Rural Affairs. Others include Jeremy Hunt, Sajid Javid and Penny Mordaunt. The UK markets will remain closed today for the Spring Bank Holiday.

The price of crude oil declined today as traders weigh up their next options. On Friday, data from Baker Hughes showed that oil rigs declined from 802 to 797 in the previous week. In total, the number of rigs decreased from 987 to 983. Investors will focus on the US inventory data expected tomorrow and on Wednesday. Over the past few weeks, data has shown inventories increasing. Investors will also focus on the developments on trade and on the upcoming OPEC leaders meeting.

EUR/USD

The EUR/USD rose slightly as the European election results were announced. Since Thursday, the pair has risen from a low of 1.1106 to today’s high of 1.1215. On the hourly chart, this price was above the 61.8% Fibonacci Retracement level. It was also above the 25-day and 50-day moving averages. It is also slightly lower than the upper line of the Bollinger Bands. The RSI has moved close to the overbought level of 70. The pair looks set to continue the upward momentum although the volumes will be slightly lower because the US markets will be closed for the memorial weekend.

GBP/USD

The GBP/USD pair moved up slightly to a high of 1.2735. This was higher than Friday’s low of 1.2602. On the four-hour chart, the price is moving closer to the 23.6% Fibonacci Retracement level. The price is slightly above the 25-day moving average and slightly lower than the 50-day moving average. The accumulation/distribution indicator has started an upward momentum. The pair will likely continue moving higher to the 23.6% Fibonacci level of 1.2788.

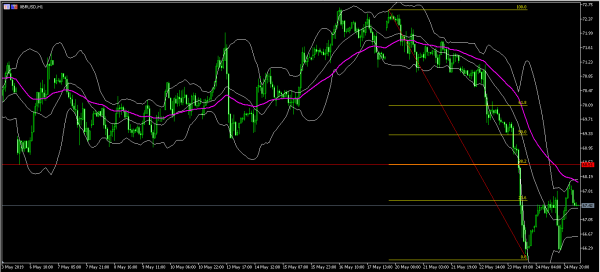

XBR/USD

Last week, the price of Brent crude oil declined to a low of 65.98. This was the lowest level since early May. On Friday, the price rose to a high of 68.05. Today, the pair moved slightly lower to 67.42. On the hourly chart, this price is along the 23.6% Fibonacci Retracement level and along the middle line of the Bollinger Bands. It is also below the 50-day moving average, which is along the upper Bollinger Band. Today, the pair will either move higher to the 38.2% Fibonacci level of 68.5 or move lower to Friday’s low of 66.20.