For the 24 hours to 23:00 GMT, the GBP declined 0.18% against the USD and closed at 1.2704, after Chancellor, Philip Hammond, warned over the potential impact of no-deal Brexit on the economy.

The OECD increased UK’s economic growth forecast to 1.2% from 0.8% in 2019, amid delay in Brexit. Additionally, the agency expects Britain’s GDP to rise 1.0% in 2020.

In the Asian session, at GMT0300, the pair is trading at 1.2715, with the GBP trading 0.09% higher against the USD from yesterday’s close.

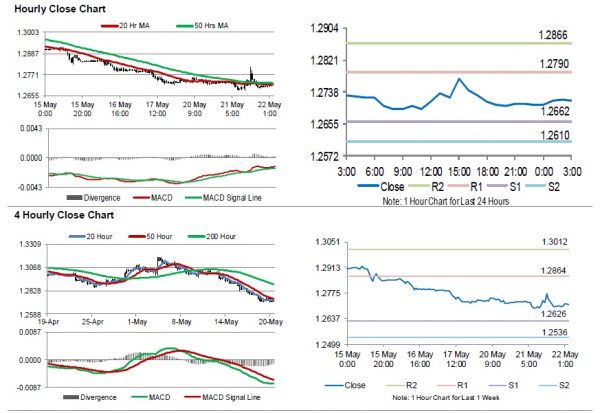

The pair is expected to find support at 1.2662, and a fall through could take it to the next support level of 1.2610. The pair is expected to find its first resistance at 1.2790, and a rise through could take it to the next resistance level of 1.2866.

Moving ahead, traders would keep an eye on UK’s consumer price index, producer price index, public sector net borrowing and the retail price index, all for April, along with the house price index for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages