Inflation and retail sales numbers for April will be reported out of the United Kingdom this week, but with political uncertainty running high, the focal point for traders will likely be the outcome of the European Parliament elections. The CPI and retail sales data are due on Wednesday and Friday, respectively, at 08:30 GMT, while UK voters will be going to the polls on Thursday to take part in European elections that the UK was not supposed to participate in.

BoE to keep close watch on uptick in inflation

Under more ordinary circumstances, UK inflation data would have been a closely watched indicator for investors as it often dictated the Bank of England’s next move in the past. But despite BoE Governor Mark Carney warning markets at the last policy meeting that the Bank’s expected rate path is steeper than what has been priced in by investors, the consensus view remains that until there is clarity on the Brexit front, the probability of a rate hike over the next year is very low.

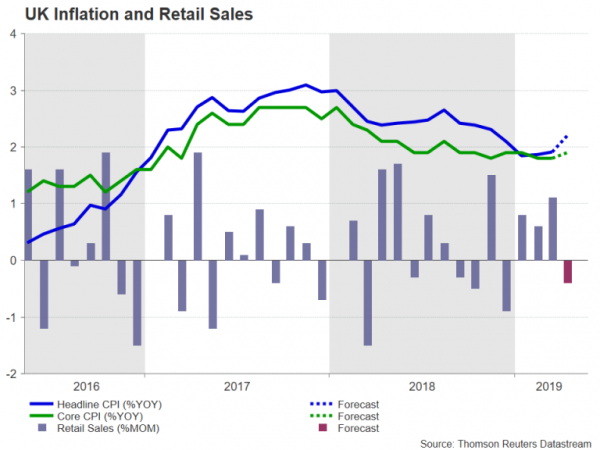

That’s not to say traders should be completely ignoring incoming UK data, particularly the CPI figures, as the longer the Brexit stalemate drags on, the more likely the Bank will have little option but to carry on with business as usual and raise rates if necessary. Wednesday’s inflation numbers are expected to highlight the upside risks to prices as the headline rate of CPI is forecast to jump from 1.9% to 2.2% year-on-year in April. The core rate, which excludes volatile items, is expected to edge up from 1.8% to 1.9% y/y.

Retail sales and Euro elections pose downside risks for pound

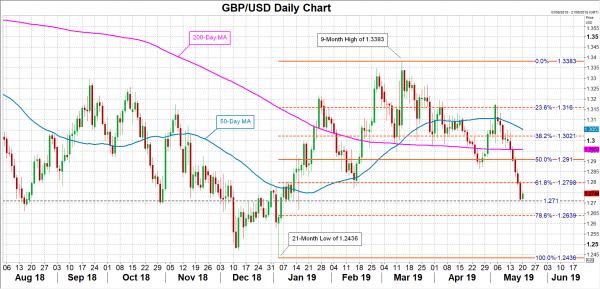

After a bruising week for the pound, strong inflation data could help cable reclaim the 1.28 handle, which is close to the 61.8% Fibonacci retracement of the upleg from 1.2436 to 1.3383. But there could be some downside for the currency from Friday’s retail sales release where a pullback is being anticipated. After three months of solid gains that drove annual sales to an impressive 6.7% in March, retail sales are forecast to have dropped by 0.4% month-on-month in April. Such a figure would leave the annual rate at 4.5%.

A soft retail sales report could push pound/dollar below immediate support in the 1.2710 area, opening the way for the 78.6% Fibonacci at the 1.2640 level. A bigger risk for sterling, however, is the European Parliament election on Thursday (most other EU states will hold their votes on Sunday).

Main parties expected to get hammering at European vote

The latest poll of polls has the newly founded Brexit party – led by former UKIP leader, Nigel Farage – in the top spot, with Labour a distant second and the Conservatives being relegated to fourth place. Prime Minister May is hoping that a disastrous performance by the main parties in the elections would cause MPs to feel more compelled to deliver Brexit to the British public and vote in favour of her deal.

May promises “bold offer” on Brexit deal

May is promising a “new, bold offer” when she reintroduces her Withdrawal Agreement Bill to Parliament in the first week of June. However, with any new offer likely to address only ‘minor’ concerns such as workers’ rights and environmental standards, these are unlikely to be enough to win sufficient Tory and Labour votes to get the deal through as the most opposed aspect of the deal – the Irish backstop – is not changing.

Whether the deal passes or not, May has indicated she will set her departure date after the last-ditch vote in June, raising the prospect of a hardliner such as Boris Johnson taking over as prime minister. Such a development has the capacity to put the pound on a new downward path as a no-deal Brexit would once again become a realistic prospect.