Trumps eases fears with an eye on Wall Street

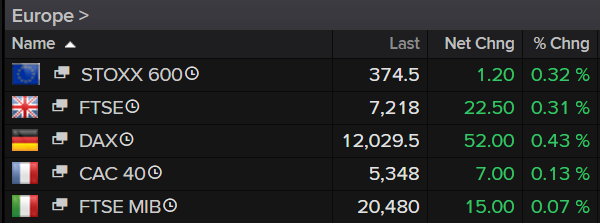

The panic at the start of the week looks to have passed for now, with equity markets facing a second day in the green on an apparent softening in tone from US President Donald Trump.

In the last 24 hours, Trump has been as vocal as ever and has sought to play down the breakdown in trade talks, instead referring to it as a “little squabble” and claiming they have not collapsed at all. This seems very at odds with the remarks he was making previously and suggests he may have been doing so with one eye on Wall Street.

Trump will have seen the response in the markets to the new tariffs and harsh rhetoric that has accompanied them and having satisfied a supporter base that wants to see a hardline with China, may have been looking to repair some of the damage suffered on Wall Street. We know he pays close attention to the markets and he won’t want a repeat of the fourth quarter.

Trump also once again took aim at the Fed, claiming if they cut rates the US would win the trade war, “it would be game over”. It’s highly unlikely the Fed will oblige in assisting with political matters but clearly the days of the central bank coming under pressure from the White House are not behind us.

Weaker Chinese data gets overlooked

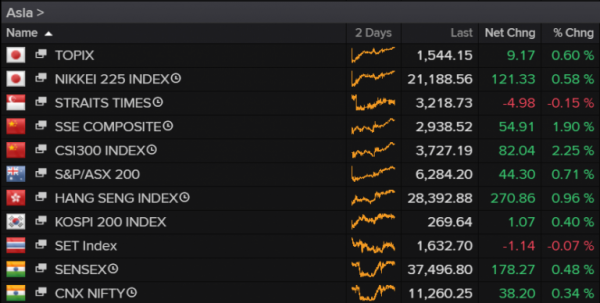

Interestingly, the weaker Chinese data overnight has not really dampened the bounce we’re seeing in the markets. Considerably weaker numbers across the board – retail sales, industrial production and fixed asset investment – may have come as a greater concern at the start of the week but it appears the softer rhetoric from Trump is more meaningful to investors.