WPI +0.5%qtr vs 0.6%yr expected. The annual pace holds 2.3%yr and while Victoria wages are lifting as expected so far it is not enough to offset weakness elsewhere, particularly in NSW.

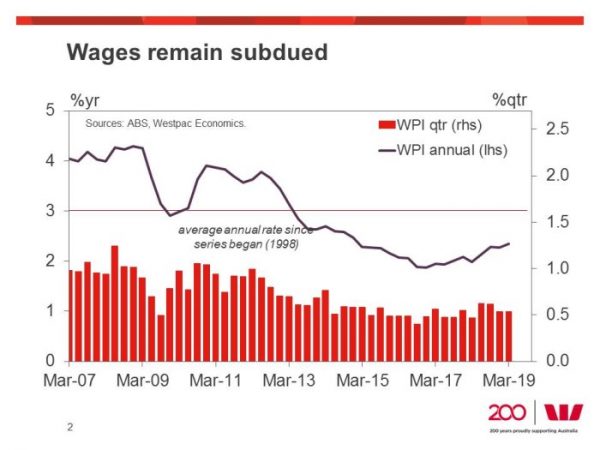

It is true that wage inflation has lifted off its record low of 1.9%yr in June 2017 but running at a 2.3%yr at March 2019 it can hardly be described as running at a breakneck pace. We expect wage inflation to drift higher from here – our forecasts have it peaking around 2¾ %yr in 2020 – but given how well contained the wage inflation is across the nation, and between sectors, even this modest increase looks optimistic with the risks to this forecast more to the downside than upside.

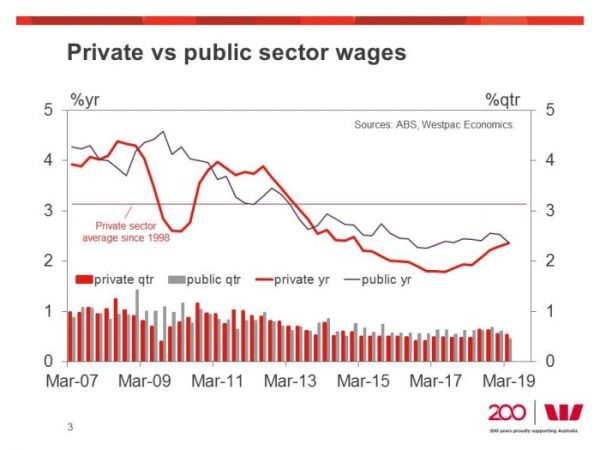

In the March quarter, total hourly wages ex bonuses rose 0.5% compared to a market median (and Westpac) expectation for 0.6%. The print was 0.54% at two decimal places with a 0.54% rise in private sectors wage rates and a smaller 0.45% rise in public wages – the smallest quarterly rise in public sector wages since March 2000. It appears that state governments, where revenues are under pressure from declining stamp duty collection, are pushing back against rising wage costs.

Private sector wages printed 0.54% in the last two quarters, but with base effects, the annual pace did drift a little higher to 2.4%yr – the fastest pace since December 2014 but still not exciting. Public sector wage inflation eased to 2.4%yr from a recent peak of 2.6%yr in September 2018, and on current trends, is likely to continue to moderate from here.

An annual pace of wages growth of 2.3%yr is a modest lift from the 2.1%yr pace it held from December 2017 to September 2018 which, in itself, was a very modest improvement from the record low of 1.9%yr in the four quarters before 2017 Q3. So while it is clear that wages have picked up a little and are off the record lows wage inflation is well contained and holding under the historical average.

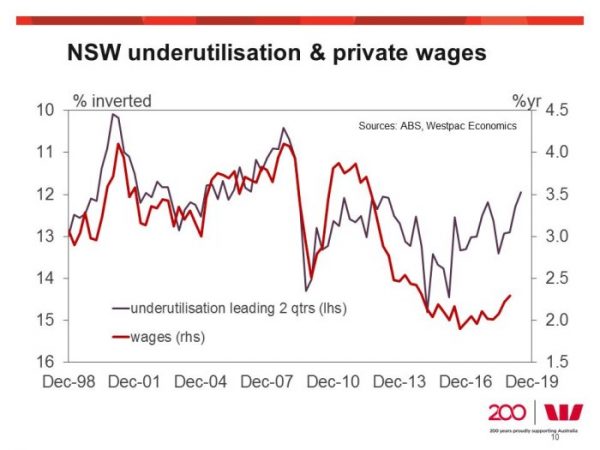

Since 2018, Westpac watched the rapid fall in the Victorian unemployment rate, and because of this, we are now looking for signs of an acceleration in wage inflation there. In the March quarter, Victorian wages lifted 0.5%qtr, a moderation from the 0.8% gain in Q4, but with base effects, the annual pace was flat at 2.7%yr – the fastest pace by any state and the fastest pace in that state since December 2014.

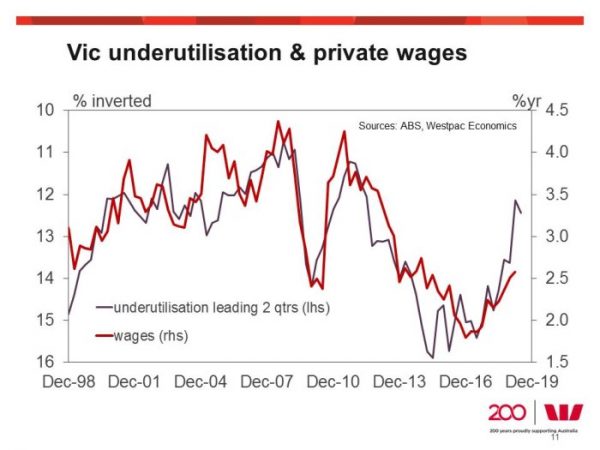

Contrast that with NSW, where wage inflation moderated to 2.3%yr from 2.4%yr. Tighter labour market conditions in Victoria appear to be generating some wage inflation unlike the state to its north. If this lift in Victorian wage inflation continues into 2020, we would expect this would lead to modest wages pressures in other states (particularly in NSW) as employers start competing for labour. But we would not overstate this as the overall impact is likely to be modest given that the improvement in the national labour market, as measured by the fall in underutilisation, has not been as significant as it is has been in Victoria.

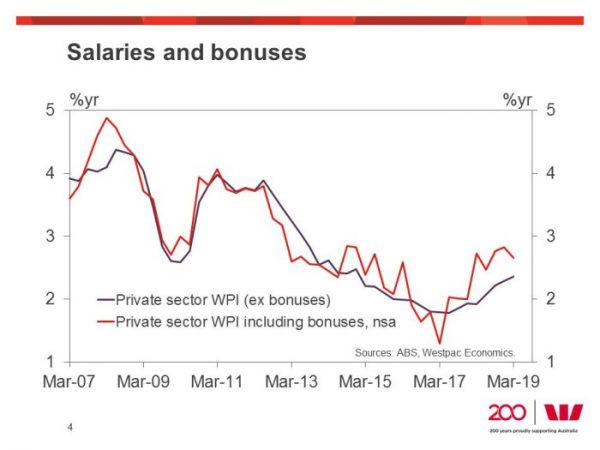

Private sector wages including bonuses continues to run at a faster pace than the measure excluding bonuses (2.7%yr vs 2.4%yr respectively). The faster pace growth of growth in variable compensation, which tends to be positively correlated with the economic cycle, suggests some upside risks for wages remains in place. However, the pace is slowing (from 2.8%yr in Q3 and Q4 of 2019) so this pressure is very modest and the increases in variable compensation may not be transferred to fixed compensation.

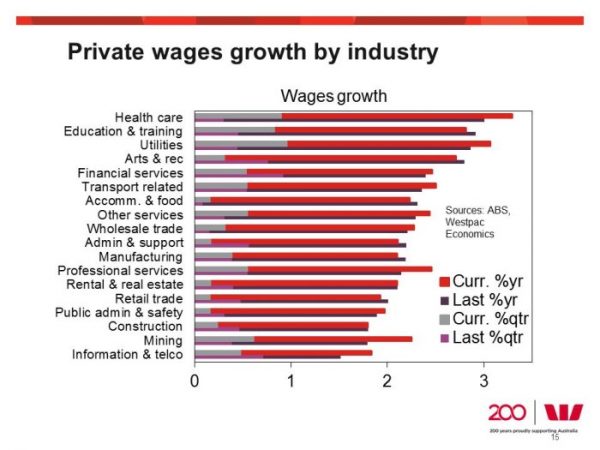

By industry the fastest gains in wages are still in the non-cyclical sectors, heath care, education & training and utilities, while mining has also seen a lift. Financial and professional services plus transport are starting to see some improvement but they remain at a very modest pace while retail, accommodation & food services, manufacturing and administration & support wages are slowing.

This is a disappointing update and one that will make us take a closer look at our forecast for wage inflation to get back to around 2¾%yr in 2020.