Global stocks declined sharply as traders worried about an escalating trade war. In the United States, the Dow lost 620 points while Nasdaq lost 269 points. In Asia, the Shanghai and Nikkei declined by 10 points and 108 points respectively. These losses came after China announced that it would retaliate against the tariffs levied by the United States. The new tariffs will go into effect on June 1. Amidst all the turmoil, there is hope that things could change in June after Trump meets with China’s Xi Jinping in Japan during the G20 summit.

Sterling continued to decline after opinion polls showed that Theresa May could be at risk. Recent polls show that Nigel Farage’s Brexit Party has continued to gain in popularity ahead of the European elections that will happen later this month. If May’s party loses, it will be unlikely for her to remain as Prime Minister. Today, traders will focus on UK jobs numbers. The unemployment rate is expected to remain at 3.9% while average earnings with bonus are expected to rise by 3.4%, down from the previous 3.5%.

The euro rose slightly against the USD in the Asian session ahead of key data from the EU. In Germany, the CPI is expected to remain unchanged at 2.0%. The harmonized CPI is expected to remain unchanged at 2.1%. The ZEW economic sentiment for March is expected to increase to 5.1 from the previous 3.1. The current conditions are expected to increase to 6 from the previous 5.5. The industrial production is expected to decrease by -0.8% on an annual basis.

EUR/USD

The EUR/USD pair rose slightly to a high of 1.1240 from the previous low of 1.1219. On the hourly chart, this price is slightly above the 25-day and 50-day moving averages. The RSI has moved slightly higher to the current 55 while the volumes have remained subdued. Today, the pair could move in either direction as traders receive important data from the EU and as the trade war escalates.

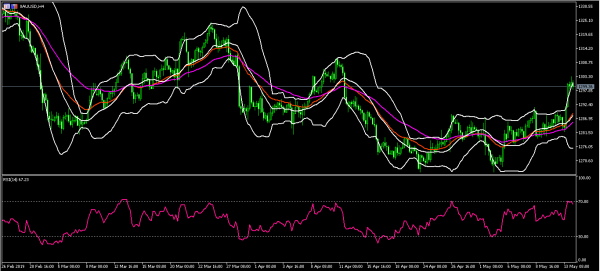

XAU/USD

The XAU/USD pair rose to a high of 1303. This was the highest level since April 15. The gains came as investors rushed to safe havens. On the four-hour chart, the pair is above the 25-day and 50-day moving averages. The price is along the upper line of the Bollinger Bands while the RSI has continued to rise to the overbought level. The pair could continue to rise, to test the 1350 level.

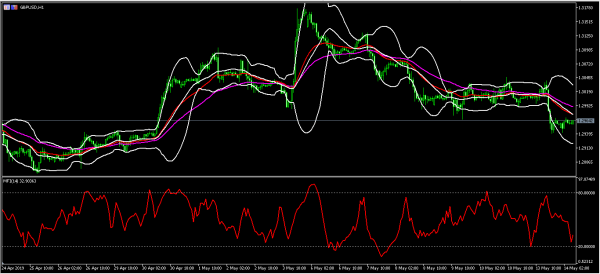

GBP/USD

The GBP/USD pair declined to a low of 1.2940. On the hourly chart, this price is below the 25-day and 50-day moving averages and between the middle and lower lines of the Bollinger Bands. The money flow index has declined to the current 32, which is close to the oversold level. The pair could continue to decline ahead of the European elections.