Asian markets were generally lower in early trading as investors continued to worry about the deteriorating trade ties between the United States and China. Last week, the US implemented additional tariffs on Chinese goods worth more than $200 billion. Today, the country is set to announce a further list of goods worth $300 billion that it will add tariffs on. As a result, China’s A50 index and Japan’s Nikkei declined by 1.30% and 0.40% respectively. The US futures too pointed to a lower open, with the Dow and S&P declining by 245 and 40 points respectively.

The Canadian dollar rose sharply against the USD on Friday after Canada released strong jobs numbers. The USD/CAD pair then rose slightly a few minutes before the markets closed for the weekend. Today, the pair was relatively unmoved. Friday’s data showed that the unemployment rate dropped to 5.7% from the previous 5.8%. The participation rate increased to 65.9% while the employment change rose to 106.5K.

The price of crude oil was relatively unmoved after a calm weekend for the oil market. On Friday, Baker Hughes reported that oil rigs in the US declined to 805 from the previous 807. The total oil rigs declined from 990 to 988. In addition to the weekly inventory data, investors will receive the EIA monthly report this week. The report will provide details about both supply and demand around the world.

XTI/USD

The XTI/USD pair was relatively unmoved in the Asian session. It is now trading at 61.68, which is along the narrow channel that has been forming for the past few days. On the hourly chart, this price is along the 23.6% Fibonacci Retracement level. The price is along the 25-day and 50-day moving averages. At this point, the pair could break-out in either direction.

EUR/USD

The EUR/USD pair was relatively unchanged in the Asian session. The pair is trading at the 1.1230 level. On the hourly chart, the pair is along the 25-day moving averages and slightly higher than the 50-day moving averages. The accumulation/distribution indicator has eased a bit while the volumes too have eased. With no major economic data expected today, the pair could remain along these levels.

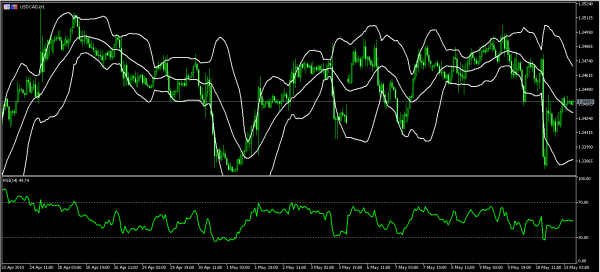

USD/CAD

The USD/CAD pair declined sharply on Friday after impressive jobs numbers from Canada. The pair then pared those losses. Today, the pair was relatively unmoved as traders continued to reflect on the jobs numbers. It is now trading at 1.3440, which is higher than Friday’s low of 1.3380. On the hourly chart below, this price is slightly above the middle line of the Bollinger Bands while the RSI has been relatively unmoved. The pair could continue moving higher, to test the upper line of the Bollinger Bands at 1.3470.