Trumpflation becomes Slumpflation as political uncertainty sees oil come to its senses and follow gold higher.

CRUDE OIL

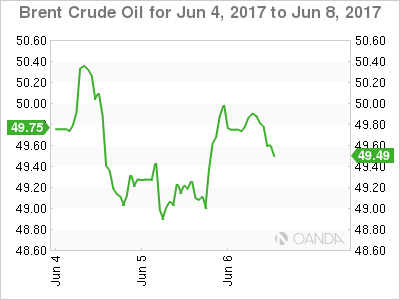

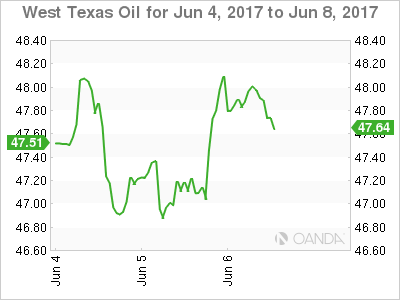

Crude oil prices rose overnight with Brent and WTI finishing some 70 cents higher, offsetting the declines of the previous day. A sagging U.S. Dollar, in general, has played it part, but the primary driver appears to be Qatar’s standoff with the rest of the Arab world. It is now becoming clear that port restrictions on Qatari flagged vessels are going to cause loading disruptions around the region for shipping moving gas and crude.

As mentioned yesterday, the threat of supply disruptions in the Middle East can never be construed as bearish for oil prices, and so it has come to pass. That said, the disruptions are seen as inconvenient rather than systematic and thus will maybe only put a floor on crude in the short term rather than starting a panic rally.

Attention now turns to this evenings U.S. Crude Inventory figures where the street is expecting a 3.5 million barrel draw down to follow last week’s monster 6.4 million barrel draw down. A number at or larger should give cheer to beleaguered oil bulls while a significant undershoot or a positive number will likely see crude coming under sustained short-term pressure again.

Brent spot trades at 49.75 this morning with resistance at 50.60 and then 51.50, the 200-day moving average. Support is delineated now at the 48.70 regions and then 48.00. A break of the latter suggesting a retest of the May lows around 46.30.

WTI spot trades at 47.90 this morning with resistance at 48.25 and then 49.35, the 200-day moving average. Support lies at 46.50 which is a must hold technical level. A break suggesting, like Brent, that more downside pain lies ahead.

GOLD

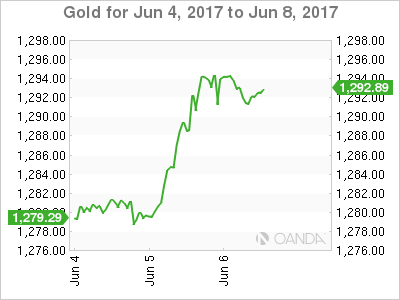

Gold continued its relentless march higher overnight, rising $17 to test the April high around 1296, before falling slightly to trade at 1292 in the early Asian session. A combination of geopolitical concerns from the Middle East, tomorrows U.K. elections and a wilting U.S. Dollar as the Street loses faith rapidly in the Trumpflation agenda, have played into gold’s hands.

Gold now has a double top at the 1296 area which will be initial resistance followed by the psychological 1300 level. A daily close and consolidation above the latter open up a lot of clear air from a technical perspective, with no resistance until the 1340 region. Technical support is at 1279 initially followed by 1270 and then 1260. The distance between the various technical levels giving plenty of room for intra-day volatility.

With Trumpflation rapidly becoming Slumpflation, and the degree of uncertainty around as we head into the latter half of the week, there would appear to be no reason for gold’s march higher to peter out. Therefore any dips should be well supported in Asia with a test of the highs possibly on the cards sooner rather than later.