Yesterday, US stocks made a comeback after seeing large losses earlier in the day. The Dow ended the day down by 67 points, which was better than the 500-point loss earlier on. The recovery came as investors concluded that a US trade deal with China was still on the table. This is because Donald Trump has used threats before in trade negotiations. Still, traders will continue to pay close attention to the ongoing happenings on trade. In Asia, stocks remained lower. The Japanese Nikkei lost 1.1%, taking a delayed hit after the country’s market opened following a 10-day break as the new Emperor took the throne.

The price of crude oil was mixed in early trading as investors waited for more data. Yesterday, prices declined sharply after the Trump announcement of US tariffs. Prices made a recovery and ended the day above the open. Today, the price of Brent declined while that of WTI rose slightly. Today, investors will receive US inventory data from the American Petroleum Institute (API). Last week, data showed an increase in inventories of more than 6.81 million barrels. Tomorrow investors expect the inventories to show an increase of more than 744K barrels.

The Australian dollar rose sharply after the RBA delivered its interest rates decision. The pair rose to an intraday high of 0.7045. The bank sounded more hawkish than most investors were expecting explaining how inflation had risen by 1.3% and in underlying terms, was at 1.6%. For the year, the bank expects it to rise by 1.75% and 2% in 2020. In an official statement, the bank said that:

The Board judged that it was appropriate to hold the stance of policy unchanged at this meeting. In doing so, it recognized that there was still spare capacity in the economy and that a further improvement in the labor market was likely to be needed for inflation to be consistent with the target. Given this assessment, the Board will be paying close attention to developments in the labor market at its upcoming meetings.

Before the rate decision, the country reported that retail sales declined by -0.1% in the first quarter. This was worse than the expected gain of 0.3%. This was the lowest growth rate in seven years. On trade, the country’s trade surplus rose to $4.94 billion, which was higher than the expected $4.49 billion.

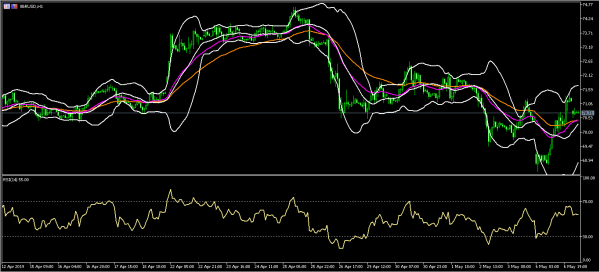

XBR/USD

The XBR/USD pair declined to an intraday low of $70.53, which was the lowest level since yesterday. On the hourly chart, this price is slightly higher than the 50-day and 25-day moving averages. The 14-day RSI has remained unmoved at the 50 level, while the price remains between the upper and middle line of the Bollinger Bands. It is also along the 38.2% Fibonacci Retracement level. Today, the pair could retest the 50% Fibonacci level of 71.60.

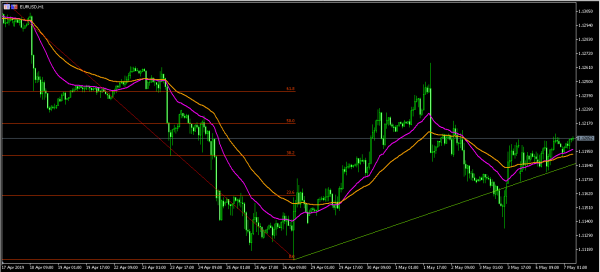

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1205 in the Asian session. The pair is slightly above the 25-day and 50-day moving averages. The price is slightly below the 50% Fibonacci retracement level and is above the important support shown below. There is a possibility that the pair will continue to move higher to test the 50% Fibonacci level of 1.1220.

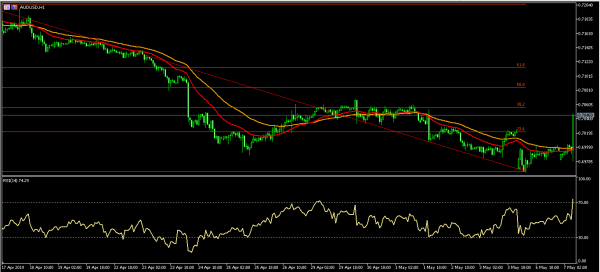

AUD/USD

The AUD/USD pair rose sharply after the RBA decision. It reached a high of 0.7045. This was the highest level since May 1. On the hourly chart, the pair is much higher than the 25-day and 50-day moving averages while the RSI has shot up above the overbought level of 70. The volumes indicator has risen too. There is a likelihood that the pair will test the 50% Fibonacci level of 0.7085.